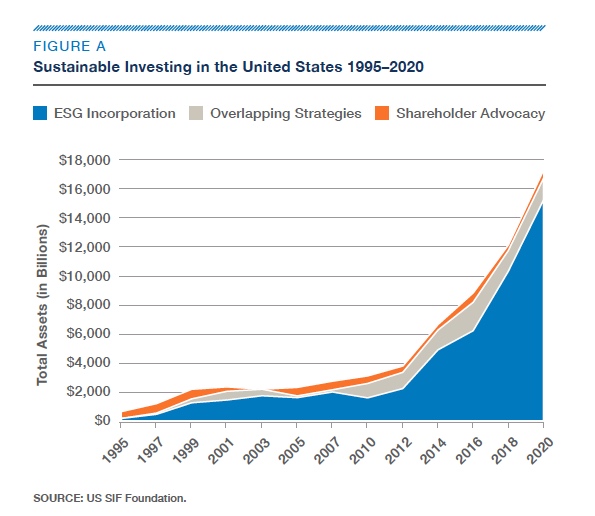

ImpactAlpha, Nov. 16 – U.S. investors added more than $5 trillion to environmental, social and governance, or ESG, strategies from the start of 2018 through the end of 2019. The 42% increase is more than quadruple the growth of assets under management overall, according to US SIF Foundation’s biennial survey of U.S.-based asset owners and managers, to be released today.

Sustainable investment, broadly defined, now accounts for one-third of the $51.4 trillion in total U.S. assets under management, up from just one-quarter two years ago. The momentum has accelerated further this year, as the COVID, climate and racial justice crises have brought ESG and sustainable investing to the fore. Investors poured $30.7 billion into sustainable funds through September, according to Morningstar, even as the Trump administration worked to turn back the tide (President-elect Biden is expected to take a more proactive stance).

“Perhaps more than any other year in recent memory, 2020 has exposed the urgent need to work towards a more just and sustainable society,” said US SIF’s Lisa Woll, who will launch the US Sustainable and Impact Investing Trends 2020 today at 1pm

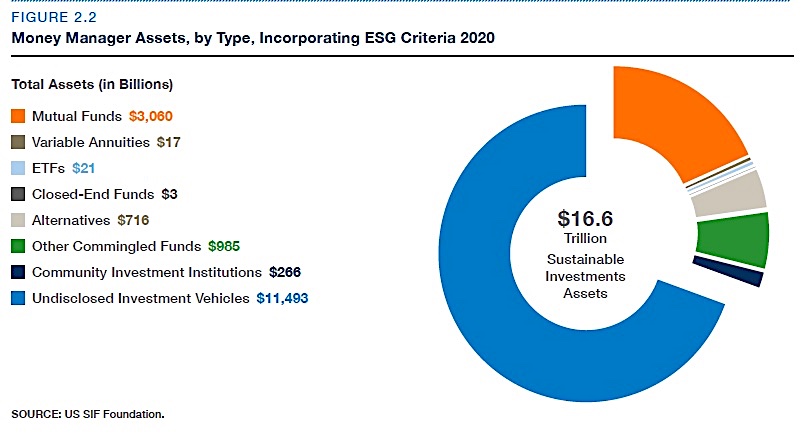

By the numbers. US SIF tallied $16.6 trillion in US-based assets incorporating ESG at the start of 2020. The assets were held by 530 institutional investors, 384 money managers and 1,204 community investing institutions. Another 205 institutional investors or money managers representing $2.0 trillion in US-domiciled assets filed or co-filed ESG-related shareholder resolutions (the overlap accounts for the $17.1 trillion total).

Sustainable investments have grown more than 25-fold since US SIF began tracking it in 2005. Red flag: Specific ESG investment vehicles and issues are only identified for about 30% of the assets. “We hope that there will be greater disclosure by asset managers,” says Woll.

Hot buttons. Climate change is the top ESG issue identified by money managers, accounting for $4.18 trillion in assets, an increase of 39% over 2018. Investing in sustainable agriculture and natural resources was top of mind for both asset owners and managers, nearly doubling to more than $2 trillion.

More than one-quarter of shareholder proposals targeting corporate behavior on environmental and social issues proposals received majority support in 2018 through 2020, compared with just three wins from 2012 to 2015. The No. 1 issue: corporate political spending and lobbying, including companies fighting greenhouse gas regulations. Also on the ballot: Fair labor and equal employment opportunity, and climate risk.

Alternative assets. Investment funds including venture capital, private equity and real estate increased their ESG assets by 22%, to $715 billion. The number of such funds rose 16% to 905.

Community-based financial institutions, meanwhile, increased their assets by 44% to $266 billion. Credit unions drove the growth. US SIF counted nearly 600 community loan funds with $27 billion in combined assets in 2020.

Retail rising: About 28%, or $4.6 trillion, of the $16.6 trillion is ESG-geared assets are managed for retail and high net worth investors, a 50 percent increase from 2018. The Morgan Stanley Institute for Sustainable Investing found in 2019 that individual investors enthusiasm for sustainable investing “is at an all-time high.”

US SIF this year began offering a free course for ‘unaccredited’ investors to learn more about sustainable and impact investing.