In part two of our BYOT series, we first explore the economic value of implementing a BYOT program from a utility perspective. Next we dive into the success measures of a DR program. Then we wrap up with the role of BYOT in both the short- and long-term utility planning cycles.

What is the Economic Value of BYOT?

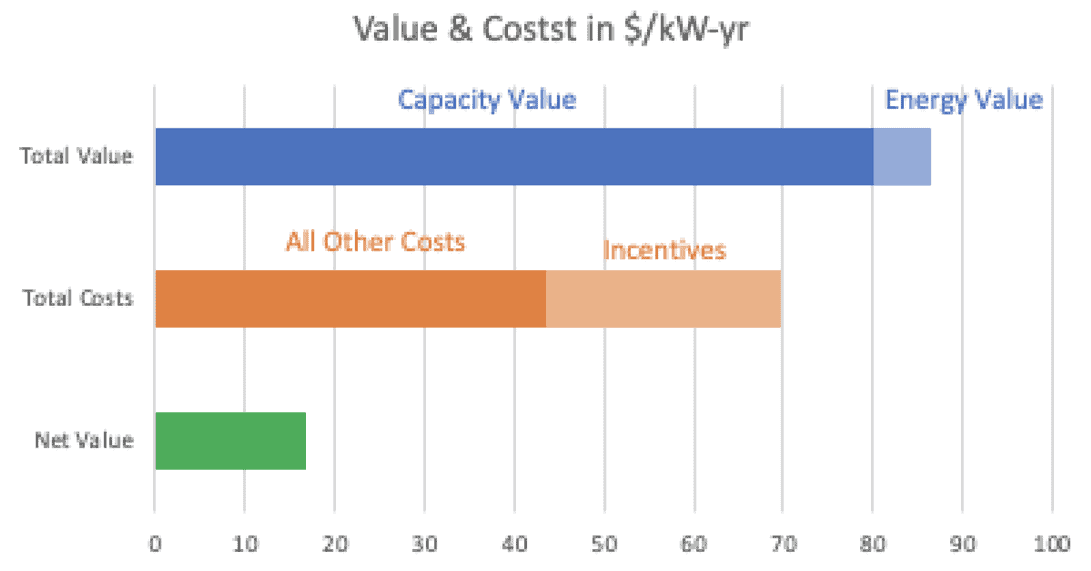

In order to analyze the economic value of BYOT to a utility, we consider a sample utility that realizes the value of demand response through capacity and energy payments. These can have a range of values depending on the market. Furthermore, there are other sources of value such as avoided costs of the use of transmission and distribution infrastructure and ancillary benefits that are not considered in this analysis. Even costs associated with running a DR program can differ across utilities depending on any prior experience running programs and their existing engagement levels with their consumer base. Therefore, we shall root the economic analysis in the following base case assumptions:

Sources of value to the grid

Capacity payments = $80/kW/yr

Energy Value = $100/MWh

Program & participants

Program evaluation timeline = 5 years

Customer base = 150,000 of new and existing thermostat users

Uptake = 3% of customer base per year

Churn = 3%

Load shed per consumer = 1 kW

Participation = 90%

DR Events

Number of events per year = 16

Event duration = 4 hours

Costs

Per consumer costs: Recruiting Costs, OEM Fees, Call-center Costs, and Field Services Costs

Other costs: Program management and Software Costs

Incentives: Hardware Rebate and Event Incentives

The gross and net value to the utility are shown in the blue and green bars in Figure 2 below. Please note that depending on the capabilities of the specific stakeholders involved in a BYOT program, the costs associated with the program may be split differently among stakeholders. The model used for program management will also determine the risks associated with the total costs. These figures are only indicative of a typical split.

What Are the Determinants of Success of BYOT?

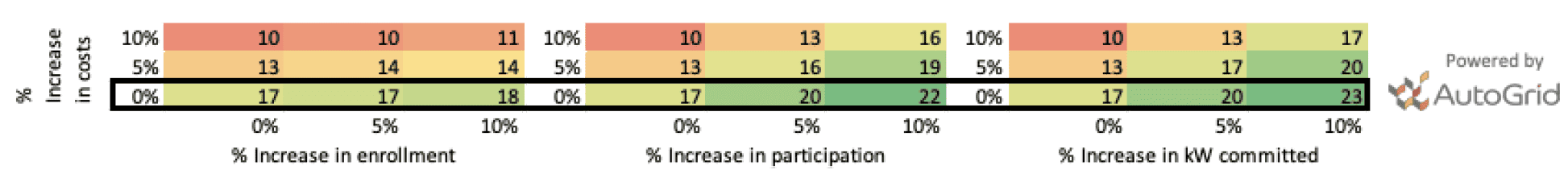

A short study of Figure 3 suggests the potential impact of reducing the total cost ($/kW-yr) to build the market, materialize, measure, and manage blocks — a direct increase in the net value to utilities. Considering that energy flexibility management is an evolving space, finding the right set of stakeholder partners who can deliver high levels of consumer enrollment and engagement is key.

# Enrolled = # Target End Consumers * % Uptake – Existing Enrollees * (1 – Churn Rate)

# Participants = # Enrolled * % Participation

MW Enrolled = #Participants * Load shed per consumer

As discussed previously, a software platform that is OEM-agnostic enables the utility to avoid OEM lock-in in the short term, and attendant technology obsolescence in the long term. Moreover, utilities will have a larger pool of target consumers, as users of different smart thermostats can enroll in the program. The percentage uptake is determined by both the amount of incentives and the ease of enrolling.

At AutoGrid, we have spent years designing a product for utilities with the consumer experience at the forefront. The AutoGrid Demand Response Optimization and Management System (DROMS) helps end-users determine eligibility by answering a few questions on a utility-branded portal, enrolls their thermostat in a BYOT program in fewer than 10 clicks, and instantly delivers upfront incentives in the form of hardware rebates. Field services are provided as needed to ensure that smart thermostats enrolled in the program are ready to be dispatched when a DR event is called.

Consumer engagement is signaled by the participation rate in the short term and churn rate in the long term. To ensure high levels of participation, communication is key — both in how and how often the energy company communicates with consumers about when DR events occur and their performance during each event. Individual consumers have preferences on which channels they wish to receive notifications in. AutoGrid DROMS can accommodate email, text, and voice notifications using customizable templates for pre-, during-, and post-event notifications. Opt-out or opt-in options are also made easy for consumers.

Post-event, AutoGrid DROMS uses both the smart thermostat and advanced metering infrastructure (AMI) data for measurement and verification (M&V). This information may then be used by utilities to deliver event incentives to consumers in the form of savings on their utility bills. In the absence of AMI data, AutoGrid DROMS can use smart thermostat data alone and translate it into load shed against the baseline. This allows the utility to include consumers without AMI in the target group.

If consumers’ experience of participating in DR events is frictionless and if actionable information is delivered to their portal, churn rates are likely to be near the lower end of the three to five percent range typical in the industry. The impact of higher enrollment and engagement rates on the net economic value for utilities is shown in Figure 3 below. As is evident from the charts below, any increase in enrollment and engagement of end-consumers has a net positive impact on the value to utilities. Therefore, customer experience from the process of enrollment, to event dispatch, and post-event reporting is key. A robust software platform can help improve both enrollment and engagement metrics.

At AutoGrid, we have designed the consumer-facing portal with their experience in mind. The enrollment process can be completed in less than 10 clicks and the portal can be integrated into utility websites to deliver a seamless experience. Furthermore, post-participation in a DR event, end customers are able to view a detailed M&V report that shows them how they performed during an event. Delivery of this information and other customized insights in a timely manner is critical in continuing to engage customers who are already enrolled in the program, which, in turn, has a positive impact on their participation rates. And finally, as the utility allows consumers to participate in DR programs using more IoT devices such as smart water heaters, storage systems, and solar PV assets to name a few, the committed capacity per consumer increases. This enables the utility to realize more DR capacity from a given consumer base. As seen in the graphs above, an increase in the committed capacity has the highest impact on net value delivered to the utility. As the energy-IoT space continues to evolve, utilities stand to continue benefiting from aligning their goals with those of their consumers. AutoGrid’s software platform empowers utilities to operate at the bottom half of these graphs by delivering more value to end consumers, thereby increasing their enrollment, engagement, and participation levels.

How Does BYOT Align With Utilities’ Short-term and Long-term Goals?

In very tangible terms, an effective BYOT program maximizes the number of thermostats enrolled at the lowest per MW cost for the utility. From a program-execution standpoint, a BYOT program enables the utility to outsource recruiting and marketing to the energy service provider and device OEM, resulting in hassle-free maintenance for these thermostats at higher customer satisfaction levels.

Furthermore, the experience of program managers and system operators in using the software platform is critical. AutoGrid DROMS offers custom templates for different DR event types as well as dashboards for an aggregated view of thermostats ready for dispatch at any given point in time. This type of functionality has been integrated into the product to ensure that scheduling and dispatching DR events happens with the click of a button. Also, the platform becomes a single system of record for all dispatchable thermostats, customer types, and contract information, as well as for program, participant, and event constraints and similar parameters.

Long term, the software platform should accommodate different types of smart devices. At AutoGrid, we understand that distributed energy is an evolving and dynamic space within the energy industry and is catalyzed by innovation in technology. More devices are being made smarter to enable ease of use and greater control for consumers. Therefore, the choice of software provider should be driven by flexibility of the platform rather than by a custom solution for one OEM type. AutoGrid DROMS creates a pathway for scalability to all customer classes and device types in recognition that, as the space continues to evolve, BYOT will increasingly mean Bring Your Own Things™.

AutoGrid DROMS can also offer unique solutions to challenges that are specific to emerging markets as well. In this context, a successful BYOT program is also a tool for state-owned utilities to continue supporting critical sectors such as agriculture and industry at a lower cost. For many of these state-owned utilities, demand side management programs such as BYOT also create a path to profitability because electricity use is often subsidized by the utilities for these critical sectors. In the state of Andhra Pradesh in India, AutoGrid is working with the state-owned utility, Andhra Pradesh Southern Power Distribution Company (APSPDCL), to optimize energy use for agricultural, commercial & industrial, and residential customers. These consumers bring their own water pumps (agricultural consumers), air-conditioning units (residential and commercial consumers), and non-critical industrial loads (industrial consumers) that Autogrid helps manage for APSPDCL to deliver energy savings to the customer and thereby reduce APSPDCL’s cost of delivery.

As utilities continue to redefine ways in which to deliver value to their customers, AutoGrid brings that value and helps utilities to do so profitability. The AutoGrid BYOT solution delivers on utilities’ short- and long-term goals by aligning them with the consumer’s needs.

Guidehouse DERMS Leaderboard

AutoGrid ranked #1 in comparison to 12 other industry companies.