Greetings, Agents of Impact! And a happy short week to those celebrating Thanksgiving.

We kicked off ImpactAlpha Open, our free weekly newsletter, in July to bring more people the best of ImpactAlpha and impact investing news and trends from around the web. If you’ve enjoyed Open, we think you’ll love a full ImpactAlpha subscription, which includes our daily Brief, insider conference calls and full access to ImpactAlpha.com.

👏 To make subscribing even easier, we’re offering our best deal ever. Through Friday, grab 75% off an annual subscription. That’s right, one year of ImpactAlpha for just $99. Grab the deal.

In this week’s newsletter:

- Turning climate finance gaps into opportunities;

- Impact innovations in municipal bonds;

- Pay-for-nature schemes; and

- The climate impact of the Thanksgiving meal (it’s good news!).

Ok, let’s jump in. – Dennis Price

Must-reads on ImpactAlpha

- Impact management. Robert Eccles and Bhakti Mirchandani argue for assessing the negative impacts of all investments, including those that may advance one or more of the Sustainable Development Goals. (Open)

- Stanford’s Alicia Seiger and Marc Roston make the case for “emissions liability management” as a more straightforward and accountable approach to managing and reducing corporate carbon emissions. (Open)

- Muni impact. “In a market where there’s very little innovation, it’s exciting to see change,” said Public Finance Initiative’s Lourdes Germán on last week’s Agents of Impact Call on racial equity in municipal bonds. Watch The Call video and read the recap. (Open)

- Go deeper. Social risks and racial equity are increasingly central to investments, even in once-stodgy municipal bonds. (Open)

- Gender alpha. Investments in women-led agribusinesses seem to correlate with greater profits, faster growth and lower risk at Root Capital, as reported by Jessica Pothering.

- Turning climate finance gaps into opportunities. The Climate Finance Tracker on ImpactAlpha points to three gaps that need filing, in energy access, nature conservation and regenerative agriculture, as Vibrant Data Lab’s Eric Berlow explained to David Bank.

- COP27 Watch. As Amy Cortese reported as COP27 wrapped up, a new narrative of unstoppable progress and immense opportunity is taking hold. On deadline, negotiators wrangled with loss, damages and fossil fuels.

Now $99 for 1 year

⚡ Grab ImpactAlpha’s best deal ever. You’re breaking ground, launching products, hitting milestones – and driving impact. This holiday season, we’re grateful for YOUR impact. To show it, we’re offering you our best deal ever.

- THROUGH BLACK FRIDAY: Take 75% off an ImpactAlpha subscription – that’s $300 in savings.

Agents of Impact

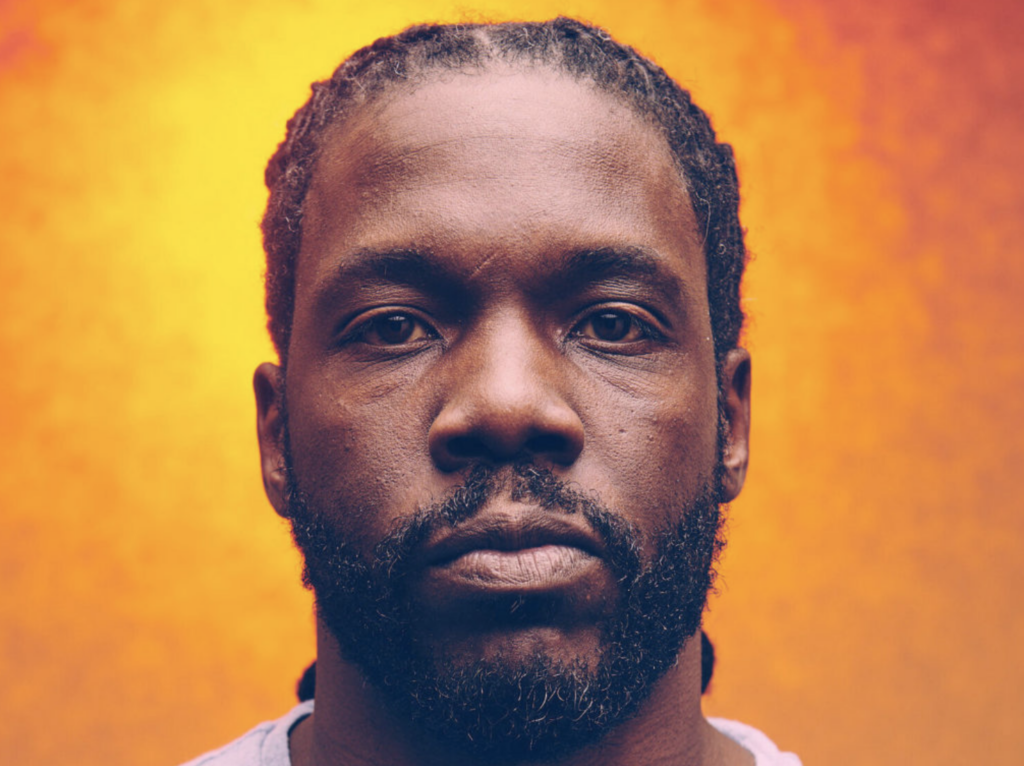

⚕️ Marcus Whitney, Jumpstart Nova: Investing in Black healthcare innovators

For years, Marcus Whitney has been the only Black healthcare venture capital partner in Nashville, a city awash in healthcare VC funds. His latest project, Jumpstart Nova, raised $55 million to invest exclusively in Black healthcare founders.

- Keep reading, “Marcus Whitney, Jumpstart Nova: Investing in Black healthcare innovators,” by Roodgally Senatus, and like the story on Instagram.

🏃🏿♀️ On the move

- Lucas Di Grassi, former Formula E world champion and U.N. environmental ambassador, joins Vidavo Ventures as venture partner.

- Participant Media promotes Danice Woodley to executive vice president of people and culture.

- Sheryl Kucer, ex- of Dyson Capital Advisors, joins Veris Wealth Partners as chief operating officer.

Impact Briefing

🎧 On this week’s podcast

Amy Cortese catches up with FullCycle’s Stephan Nicoleau, who was at COP27 in Sharm El Sheikh, Egypt, to talk methane, governance and catalytic capital. Host Monique Aiken has the headlines.

- Listen to this week’s episode, and follow all of ImpactAlpha’s podcasts on Apple, Spotify or wherever you listen.

Deal Spotlight

🌱 Empowering – and paying – communities to protect nature

A climate trend that’s gathering steam: pay-for-nature schemes, wherein governments, donors and private investors pay to protect and restore natural resources and biodiversity. Incoming Brazilian president Luiz Inácio Lula da Silva, for example,has promised to halt wide scale destruction of the Amazon rainforest, in part by subsidizing credit to farmers that adopt sustainable practices and even paying them to preserve forestland.

- Private-led models. U.K.-based Amazonia Impact Ventures has issued $5 million in impact-linked loans to rural businesses and cooperatives in Peru and Ecuador to protect forestland. Mexico’s Ejido Verde pays indigenous communities to plant trees for land restoration and sustainable agroforestry.

- Go deeper.

Six Signals

✊ Human rights starts at the top. Companies’ human rights performance is positively linked with assigning board responsibility for human rights, according to the Corporate Human Rights Benchmark. (World Benchmarking Alliance)

👩🏽🦱🧑🏼🦱👨🏾🦲👩🏻🦰 Returns on inclusion. Higher representation of Black, Indigenous, and people of color employees in management has a positive relationship to higher cash flow, net profit, revenues, five-year return on equity and stock performance. (As You Sow)

⚡ Energy access impact. Researchers using satellite imagery and machine learning found that grid and electricity-access investment in rural Uganda accelerated the growth of village-level asset wealth in rural Uganda. (Nature)

🐘 GOP at COP. The Republican governor of Indiana pitched corporate and government leaders on the renewable energy opportunities in the state at the U.N. climate conference in Egypt. (Chron

🥩 Cultivated milestone. The FDA has greenlit lab-grown-meat for the first time. (Wired)

🦃 Turkey tally. The climate impact of the Thanksgiving meal might surprise you (the news is good!). (The Washington Post)

Get in the Game

💼 Step up

- Apollo Global Management is recruiting a summer MBA associate for climate equity in New York.

- US Bank is recruiting a remote ESG risk professional.

- LISC is hiring a remote lending asset manager.

🎬 Take action

- Fifty Years launches “Repo Grants,” a fast-grants program that will award $25,000 to $100,000 for research projects focused on the female reproductive system.

- Tbli Group will accept votes until Wednesday, Nov. 30 for the “Better World” prize for ESG and impact measurement systems.

- ReFED is accepting applications until Nov. 30 for its catalytic grant fund from innovators with ideas for cutting consumer food waste.

🤝 Meet up

- The Future Leaders’ Climate Summit will take place March 3-6 in Miami Beach, Fla.

- Robert Ross, president and CEO of The California Endowment, will be speaking at Mission Investors Exchange’s 2022 national conference in Baltimore, December 5-7 (ImpactAlpha is a media partner). MIE members, foundations and other philanthropic asset owners can register here.

📬 Get ImpactAlpha Open in your inbox each Tuesday.

Sign up for FREE at ImpactAlpha.com.

Don’t be strangers. Connect with us. Tell us who you are and what you’re up to. Share your news, tips, data points, introductions and high-impact ideas, to [email protected].

See you back here next Tuesday!