The Future of Digital Water Technologies

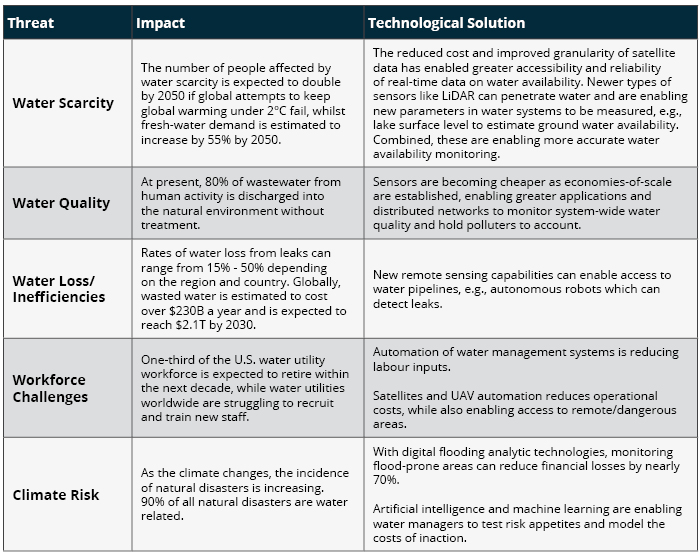

Water is becoming an increasing global threat to people, businesses and the economy due to compounding risks of water scarcity, declining water quality and climate change, together with water loss and a dwindling water utility workforce.

Digital Water to the Rescue

Digital water consists of sensors and analytics software to digitize and understand water use, quality and risks, for efficiency, leak prevention, and safety. The digital water innovation ecosystem is seeking to address these challenges with stacked sensors and analytical software to ultimately empower water operators’ knowledge.

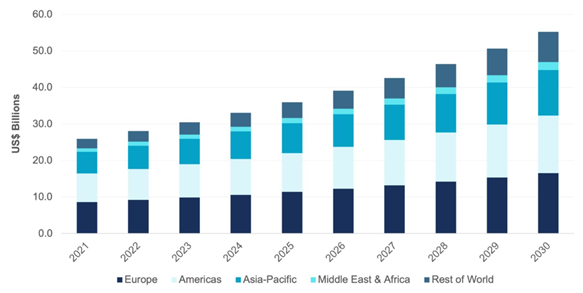

As these risks are predicted to increase, so is the digital water sector. Globally, the water and wastewater utility sector expenditure on digital solutions is forecasted to grow 8.8% annually, from $25.9B in 2021 to $55.2B in 2030 (Figure 1).

Figure 1

Global Digital Water Forecast by Region, 2021–2030

Global Digital Water Forecast by Region, 2021-2030, Bluefield Research

Over $425B of assets are at risk due to water scarcity, however, the CDP estimates that inaction to water risks is up to 5x the cost of taking action and smart water practices can reduce water use by 20% and reduce loss from leaks by up to 50%.

Digital Water Technologies are Addressing Challenges

Recent Water Innovator Deals

December 2022: Ketos, a provider of real-time analytics through direct water sensors with a corresponding platform for water management in industry, agriculture and municipal applications, raised its second growth equity round of the year from Accenture Ventures.

November 2022: Constellr, a provider of global water monitoring services via microsatellites and thermal infrared sensors, raised $11M in a seed round from investors Lake Star and VSquared Ventures.

September 2022: FIDO, a developer of image recognition software that detects water leaks from internal videos of pipes, raised $6.3M from frequent water investor Emerald Ventures, as well as Ireon Ventures and Greenhouse Capital Partners.

Although the water industry is to face significant and compounding challenges, it has been slow to digitize, compared to other sectors. The ADB found only 5% of ADB project approvals in the water sector were digitization projects.

The Climate Policy Initiative estimates that in 2019-2020, over 95% of adaptation spending was from public financing, whilst 37% ($17B) of all adaptation spending is in the water sector. Thus, public infrastructure is a key market for climate risk innovators.

Data on private spending is poor. As such, market fragmentation and localization of water regulations often limit innovators’ scaling potential. Water utilities also have few incentives for efficiencies. Due to these challenges, few innovators raise past Series B, and those who do reach later stages either raise PE funding, bootstrap, fail or are acquired by large incumbents or scale-ups.

The Future of Digital Water

Incumbent partnerships are a key route to market, due to the combined number of resources and contacts to overcome risk aversion to water technologies. Corporate partnerships with climate-conscious companies present a growing opportunity and have seen the realization of many pilots. As corporates realize the benefits of efficiencies brought about by digital water technologies, we expect pilots to scale to larger national and global installations.

As adaptation budgets increase to meet the challenges of climate change, expect public financing for water tech to rise in parallel.

As water scarcity and quality increases, also expect more regulations to restrict and meter use, as well as enforce stricter discharge rates and higher water quality standards.

There is a huge need for digital water and strong drivers which will only increase. As underlying technologies have benefitted from economies-of-scale, innovators are creating more complex stacked solutions for specialized applications.

Competitive advantage will soon require hyper-accuracy of risk prediction and action prescriptions – real-time modelling and dashboarding is now table stakes. We expect an uptick in both public and corporate funding for these technologies as they realize the benefits of efficiencies and garner the confidence to scale technologies across their operations.