Understanding Operational Risks in Hydrogen Projects: Key Considerations for Developers and Investors

October 27, 2023Types of Operating Risks in Hydrogen Projects

The identification, documentation, allocation and ultimately mitigation of risk, including operational risk, is relevant for any project but particularly hydrogen projects which are, by their nature, large, complex and capital intensive projects. Risk mitigation is all the more important given the frequent need to develop projects quickly in order for developers and equity investors to make the most of any “first to market” advantage.

This article will seek to highlight and consider some of the key operational risks relevant to the development of hydrogen projects.

Site Selection

Site selection and in particular ensuring the suitability of the site on which a hydrogen project is to be located is key. Site selection is not simply a question of making sure the land area is sufficient to accommodate the plant and any associated infrastructure but it also goes to the ability to obtain necessary planning and building permits, consents and approvals in a speedy and efficient manner and with a minimum number of conditions needing to be satisfied.

It is also helpful if the site chosen is close to necessary infrastructure, which includes generation capacity/grid connection, water sources, port infrastructure and downstream markets or at least transportation to enable downstream markets to be readily accessed. Such proximity mitigates to some extent certain construction and operational risks.

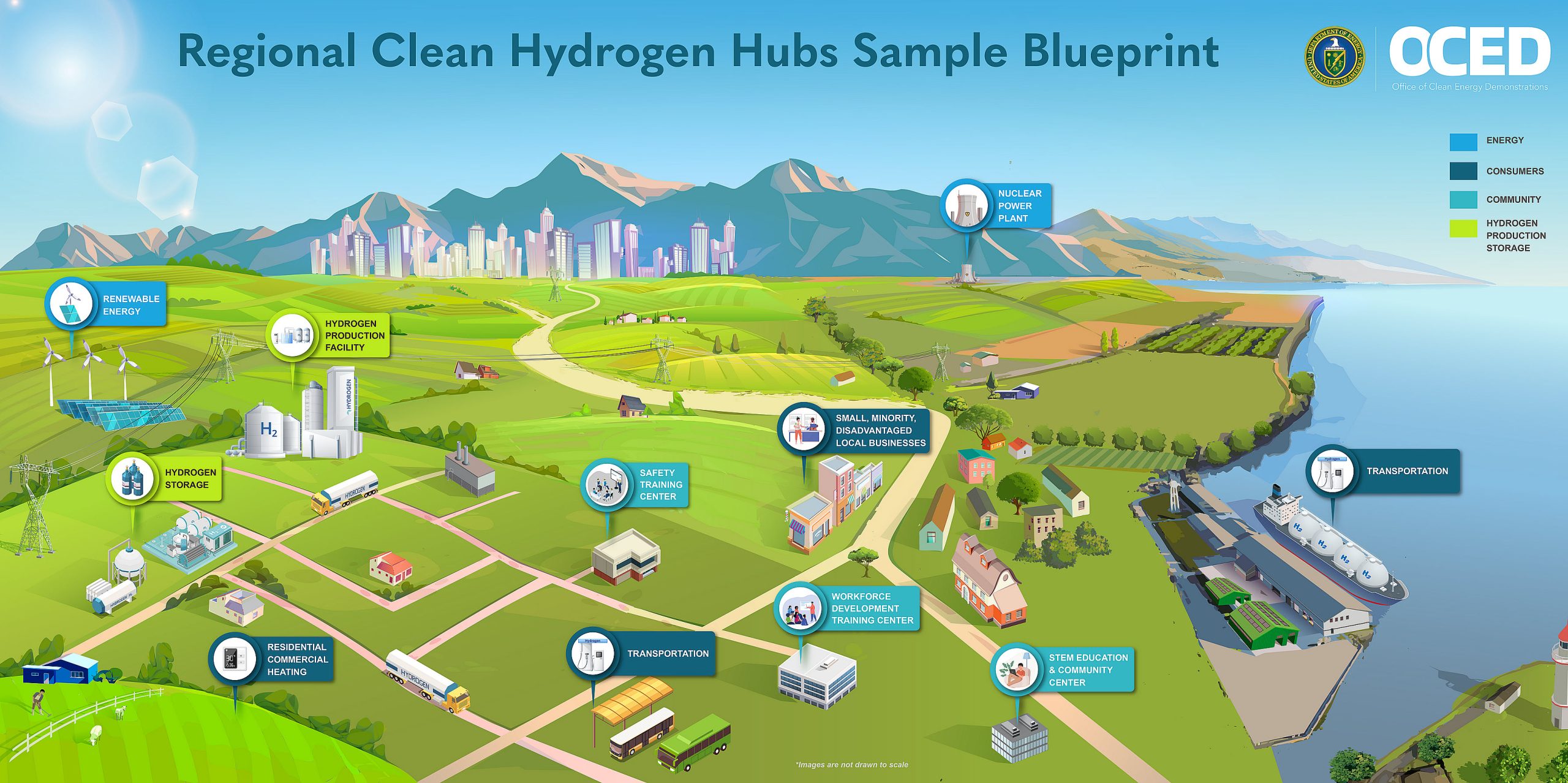

Image Credit: www.energy.gov

Hydrogen Hubs

A number of jurisdictions have sought to mitigate site issues through the creation of “hydrogen hubs” – these are areas that are close to infrastructure and also potential users of hydrogen. Certain consents and permits may already be in place and additional documentation can be obtained efficiently as such hubs often benefit from some sort of “fast track” consents and permitting regime.

It should be noted however, that an Environmental Impact Assessment will nevertheless be needed. This can add cost and potentially delay if the EIA is not factored in at the outset. Stakeholder engagement is also key. Adverse reaction from local communities and interested parties risks delay and may act as a distraction for developers as they divert resource to manage stakeholder concerns.

Power Supply

The firm supply of power in sufficient quantities is a key operational requirement for any hydrogen plant. If the output is to be marketed as “green hydrogen” then the power will, in addition, need to be generated from a renewable source.

Volume, Reliability and Renewable

It is oftentimes a challenge for hydrogen plant operators to obtain the volumes of power required – but it is not simply a question of volume – the power also needs to come from a reliable, firm source which, in turn, can raise particular challenges considering the power source needs to be renewable. Because renewable generation is typically intermittent in nature, any renewable power solution for a hydrogen plant is potentially complex and may require a multi-source approach. This makes it likely significant quantities of new additional renewable generation capacity may need to be constructed in some jurisdictions in order to satisfy the demands of hydrogen production plants.

“Green” Certificates

In addition to the contractual agreements for the supply of power, arrangements will also need to be in place to ensure that any “green certificates/ certificates of origin” associated with renewable generation are transferred, thereby helping the hydrogen producer to demonstrate that the end hydrogen product is “green” and enabling them to take advantage of the enhanced market opportunities that potentially exist for green hydrogen.

Power Price

The issue of a suitable power supply goes beyond volume and reliability – there is also the question of price and indeed stability of price over a long term. Power constitutes a significant operating cost for any hydrogen plant and therefore locking in a competitive price for a number of years is an important operational issue. It should be noted that the corollary of a long term fixed price is typically a higher price. Any hydrogen project will need to model power costs carefully to determine the optimal solution for any particular project.

Project Structures used to address Risk

Questions arise as to whether power supply risks can, to some extent be addressed through project structure – for example a fully integrated structure where the parties involved in the generation aspects of a project are also involved in the hydrogen production and downstream sales aspects. Such a structure may assist with ensuring commonality of interest throughout the project value chain and eliminating elements of “project on project” risk. A fully integrated structure, however, may not be appealing to all developers, particularly since entities with expertise and a track record in the successful development of renewable generation projects may lack expertise, interest and/or appetite for risks arising from other parts of the hydrogen value chain.

Water Supply and Availability

A similar analysis to that undertaken for power also needs to be undertaken for water. Water is a key feedstock for hydrogen projects where the electrolysis process splits the water molecule into its component parts of hydrogen and water. Its availability is often not the subject of particular focus in many parts of the world however water availability is an acute problem in certain jurisdictions, including a number of jurisdictions currently with a heavy focus on the development of green hydrogen. It also should be noted that water availability is likely to become an issue for an increasing number of countries given the impact of climate change.

Desalination Plant

Desalination Plants

In locations where significant volumes of fresh water are not readily available, consideration will need to be given to the construction and ongoing operation of desalination facilities. This, in turn, will add to the cost of a particular project as well as potentially increasing interface risk and “project on project” risk.

Supply Chain Risks

Supply chain issues are recognised as a risk for many projects currently. The same is true of hydrogen projects. Electrolysers are a particular pinch point of the supply chain with demand outstripping demand and with electrolyser manufacturers also facing issues in terms of scaling up both their operations and also the capacity of electrolysers.

Contracting for sufficient quantities of electrolysers at a fixed price is challenging particularly at a time when underlying commodity costs are volatile and transportation costs are also on the rise. There are a number of ways in which developers may seek to address this risk from taking an equity interest in an electrolyser supplier to entering into a framework agreement at an early stage. A framework agreement arrangement reserves manufacturing slots and minimum quantities of electrolysers over a period of years. Clearly the framework agreement approach results in certain upfront payments having to be made and the developer taking a risk on the development of its own future projects. Pricing provisions may also include complex indexation formulae as the parties seek to mitigate the risk of commodity price rises going forward.

One final key risk to be mentioned is the protection of intellectual property, not just in terms of equipment but also in terms of new processes which improve efficiency of operation and output. Equipment suppliers are keen to protect intellectual property rights in their equipment whilst at the same time ensuring that appropriate rights are granted to the project developer. A particular issue in the context of hydrogen projects is multi-contractor construction arrangements, which can present particular challenges in terms of protecting intellectual property rights.

Certain contractual structures can be developed to provide the equipment suppliers with the protection they require whilst at the same time ensuring developers get the rights they need to construct and operate facilities. Such structures can be quite complex and increase project documentation generally.

Whilst hydrogen projects do present a number of operating risks, provided such risks are identified and considered early on in a project’s development there are a variety of ways that parties can work together to mitigate them. Once again it is key for the parties to identify these and allocate them to the party best able to manage and mitigate them.

Author: Kirsti Massie, Partner and Co-Head of Projects and Infrastructure at Mayer Brown

HFN News is your leading source for fresh hydrogen and renewable energy updates. Amid the fast-paced growth of hydrogen companies, we provide top-notch news and insights about this exciting sector. Our coverage spans from hydrogen cars to global sustainable initiatives, and we highlight the latest in green jobs and developing hydrogen hubs. We invite you to share your local hydrogen news and explore today’s renewable energy job listings on our site. Thanks for choosing HFN News as your trusted guide to the hydrogen and renewable energy world!

HFN News is your leading source for fresh hydrogen and renewable energy updates. Amid the fast-paced growth of hydrogen companies, we provide top-notch news and insights about this exciting sector. Our coverage spans from hydrogen cars to global sustainable initiatives, and we highlight the latest in green jobs and developing hydrogen hubs. We invite you to share your local hydrogen news and explore today’s renewable energy job listings on our site. Thanks for choosing HFN News as your trusted guide to the hydrogen and renewable energy world!