By Victoria Cuming, Head of Global Policy, BloombergNEF

The annual United Nations climate summit is over for another year. Out of the 10 crucial areas where COP28 needed to make progress, a few – like fossil fuels – exceeded albeit low expectations. Others – like climate ambition and carbon markets – failed. Away from the wrangling in Dubai, some policymakers make some progress on implementing some of the programs needed to achieve the Paris goals.

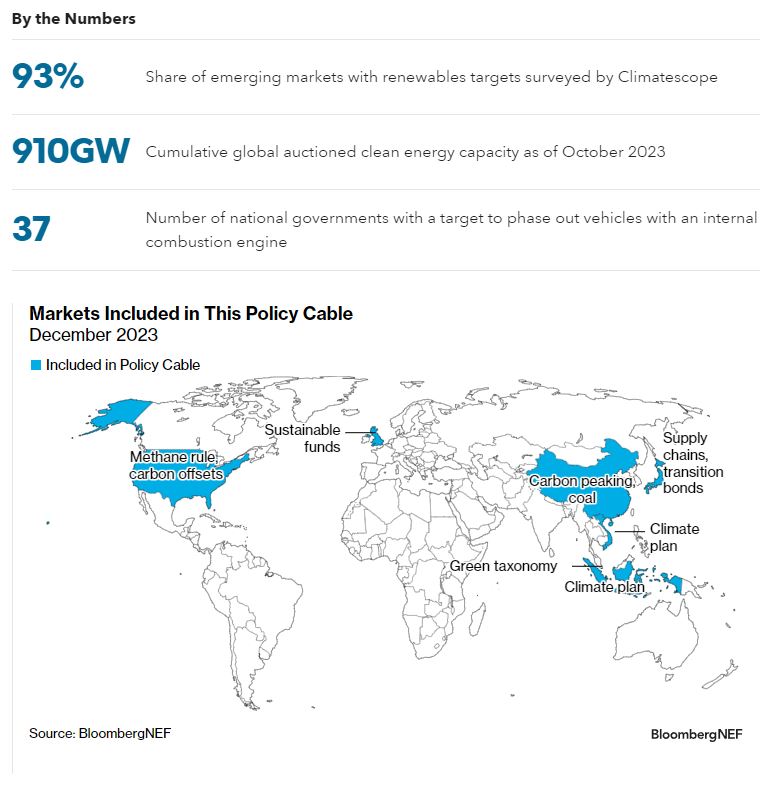

- In Japan, more government funding has been allocated to the energy transition, especially to bolster domestic supply chains, while China is employing local pilots to test pathways to peak carbon emissions this decade.

- The UK has unveiled a first-of-a-kind labeling system for sustainability-orientated investment funds, and Singapore’s new sustainable finance taxonomy includes stricter criteria for transitional activities than the standards set by policymakers in neighboring countries.

- Recent developments have mixed implications for the climate transition: governments only procured a further 11% (17 gigawatts) of clean energy capacity by auction in 3Q 2023, though a further 248GW is in the pipeline.

- Vietnam’s implementation roadmap for its $15.8 billion Just Energy Transition Partnership entails more renewables uptake as well as coal power. Similarly, China’s new coal capacity fees will benefit electricity generators using the fossil fuel but should also support further renewables deployment.

- Meanwhile, Japan is leading the way with its pioneering transition bond but it has failed to credibly define what ‘transition’ means.

- There is room for improvement elsewhere, too. While more emerging markets have imposed renewables goals, few have the concrete incentives to achieve them. The long-awaited blueprint for Indonesia’s $20 billion climate investment plan pulled its punches on coal.

- In the case of electric vehicles, ambition from both policymakers and automakers has stalled, with no new significant commitments made or targets set in 2023.

BNEF clients can access the full report here.