ImpactAlpha, Jan. 4 – In one of the first deals of its kind, the government-backed Canada Growth Fund entered into a long-term offtake agreement for stored carbon alongside a $200 million equity investment in Calgary-based Entropy’s carbon capture and storage technology. CCS, which captures direct emissions from fossil fuel and other polluting plants and buries it underground, got a boost at last month’s COP28 climate summit in Dubai. Critics say investment in the technology will divert resources away from green projects and give cover to fossil fuel expansion.

Home grown

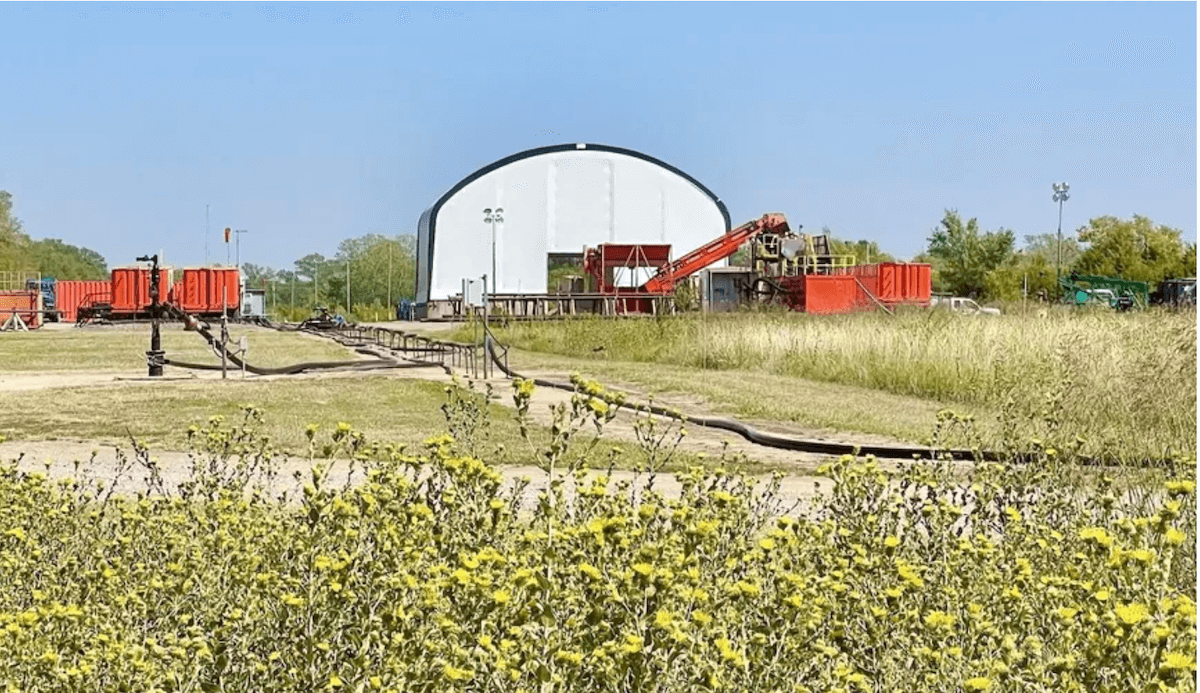

Entropy uses advanced CCS technology developed at the University of Regina in Saskatchewan. It’s first carbon capture project, Glacier Phase 1, has been capturing and sequestering carbon from a natural gas plant for more than a year. The investment by the Canada Growth Fund, a $15 billion investment vehicle of the Canadian government, will support the development of CCS projects in Canada.

“With its abundance of natural resources, access to high-quality geological storage, and sophisticated engineering know-how, Canada is the best place in the world to build a CCS industry,” said Canada Growth Fund’s Patrick Charbonneau.

The deal follows a $300 million infusion from Brookfield’s Global Transition Fund in 2022 to help Entropy expand globally.

Carbon offtakes

Canada Growth Fund will buy up an initial 2.8 million tons of carbon credits over 15 years at a fixed $86.50 per ton. Entropy’s Mike Belenkie said the large-scale carbon credit offtake agreement and long-term pricing gives the company’s Glacier Phase 2 natural gas CCS project “a clear path to accelerating growth and reducing emissions, right here at home.”