🌍 Overheard at SFCW #195

Sunny techno-optimism in foggy San Francisco

It’s not so surprising that BYD could overtake Tesla in global EV sales this year

Happy Tuesday!

Hope fellow Northern Hemisphere readers are getting into the leaf-peeping spirit, despite our strange new normal for fall foliage.

Last week’s earnings updates put Tesla and BYD neck-and-neck in global EV sales. The electric competition is head and shoulders above the legacy automakers and scrappy startups racing to turn EV strategies into production and deliveries, and the trends of Tesla in the US and BYD in China illustrate some of the larger geopolitical tensions in the EV supply chain.

In other news, last month was officially the hottest September on record. Tensions are rising ahead of COP28, and the Pope has a message for climate investors.

In deals this week, green hydrogen electrolyzers attract a hot $380M, electric sea gliders raise $60M, and plant-based meat brings in $32M.

Thanks for reading!

Not a subscriber yet?

📩 Submit deals, announcements, events & opportunities, or general curiosities for the newsletter at [email protected]. 💼 Find or share roles on our job board here.

Less-than-stellar Q3 results from Tesla mean BYD is in a position to overtake the automaker as the world’s top seller of EVs.

Despite initially laughing off China’s BYD as a competitor to Tesla’s quality, CEO Elon Musk has had to acknowledge the Berkshire Hathaway-backed automaker as a real contender. While US auto giants are pouring billions into EV ramp-ups, it’s BYD that has long-dominated sales in foreign markets. Legacy automakers and the highly capitalized EV startups losing money on every vehicle may be competing with Tesla in their minds, but when it comes to real-world cost and delivery, the current competition is BYD.

This news may come as a surprise to those focused on the EV market in North America, but in many ways, Tesla is borrowing BYD’s playbook. In fact, Tesla buys batteries from BYD, which makes its own batteries and semiconductors.

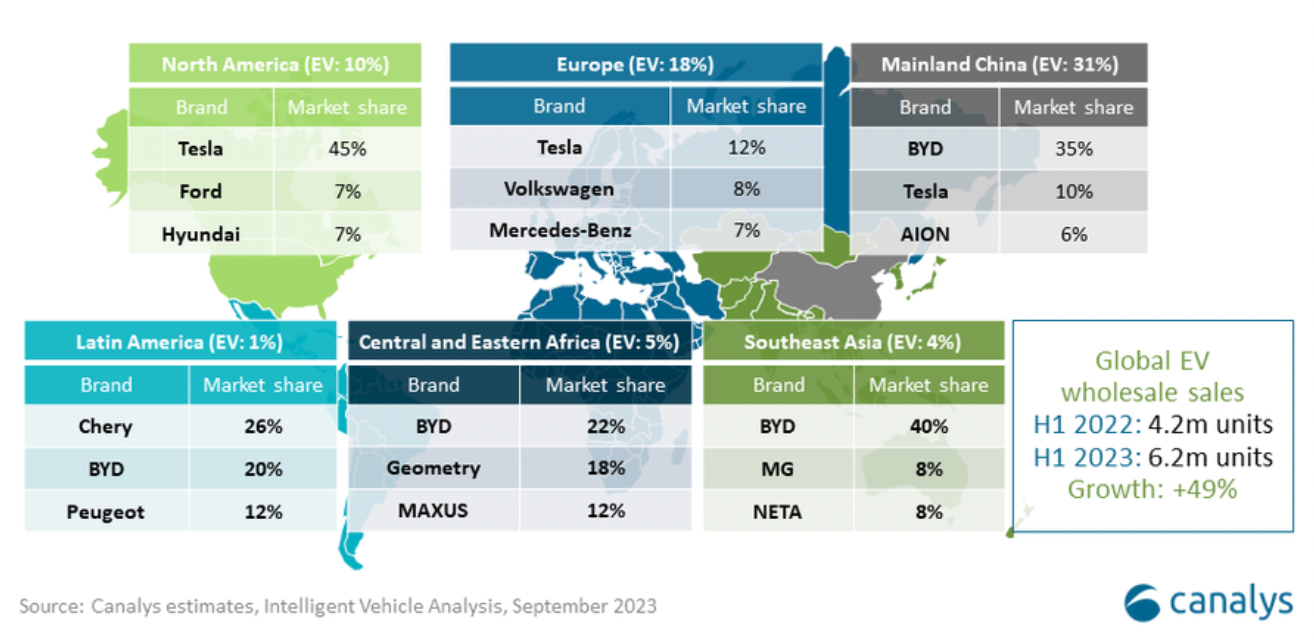

While the US just hit 1M EV sales in a single year for the first time, China makes up a majority of the global EV market, with 3.4M vehicles sold in the first six months of 2023, followed by 1.5M sold in Europe during the first half of the year. BYD has long dominated in developing markets and is the top seller in countries like Thailand, Israel, and Singapore, as well as commanding 35% market share in China.

BYD is China’s largest automaker and was the 10th largest automaker globally in H1’23. The company aims to sell at least 3M EVs this year, while Tesla is targeting 1.8M EV deliveries.

BYD is the fourth-largest battery producer in the world. It’s been making its own batteries since the days before US automakers were even thinking about lithium-ion supply chains.

Tesla generated plenty of hype around its 4680 batteries three years ago, but it remains unclear if much progress has been made toward the promised mass production and cost savings.

Tesla has its charging network, which has been one of the largest and the fastest growing charging networks in the US. Other automakers are increasingly adopting capabilities for Tesla charging ports. Tesla offers stationary storage and solar options as well, and Musk continues to bet big on autonomous driving, though the NHTSA is still wrapping up its investigation into safety issues.

BYD also has solar operations. The company was built on consumer electronics, starting out as a provider of electronic components. BYD makes its own chips and acquired US-based manufacturer Jabil Inc’s mobile electronics business in China for $2.2B in August to expand its operations.

The push for domestic battery manufacturing in the US has been a constant drumbeat from OEMs and policymakers alike. The combination of competition with China and downplaying climate change is also making EV-bashing a common refrain from Republican presidential candidates.

Tesla is the runaway leader for EV sales in North America, but the company's price cuts to meet IRA credit requirements in the US have also rippled through the competitive Chinese EV industry, which is more highly saturated and reaching a point of consolidation and reshuffling.

But for all the capital poured into startups hoping to follow in Tesla’s footsteps, EV companies are having a hard time delivering. Rivian is producing at greater volumes, but losing more than $30,000 on each vehicle it delivers—about 8x the losses Tesla experienced on each EV it sold in 2015. And electric mobility companies that went public via SPAC are filing for bankruptcy.

The EV sales battle between BYD and Tesla highlights the advantage of China’s EV supply chain dominance—BYD has been able to grow rapidly in the last few years due in part to its in-house chip manufacturing and battery production.

⚡ Electric Hydrogen, a Natick, MT-based building green hydrogen electrolyzers developer, raised $380M in Series C funding from Energy Impact Partners, Fifth Wall, Amazon Climate Pledge Fund, Breakthrough Energy Ventures, Equinor Ventures, and other investors.

✈️ Regent, a Boston, MT-based electric sea gliders developer, raised $60M in Series A funding from 8090 Industries and Founders Fund.

🚗 Harbinger, a Gardena, CA-based vertically-integrated EV platform, raised $60M in Series A funding from the Coca-Cola System Sustainability Fund, Riverstone Holdings, Ridgeline, Tiger Global, ArcTern, and other investors.

🥩 Umiami, a Paris, France-based plant-based meat developer, raised $32M in Series A funding from Bpifrance, Astanor Ventures, and VERSO Capital.

⚡ Bolt.Earth, a Bengaluru, India-based EV charging infrastructure and software platform, raised $20M in Series B funding from Union Square Ventures, Prime Venture Partners and ITIGO Funds.

⚡ Amperon, a Houston, Texas-based electricity grid demand forecasting platform, raised $20M in Series B funding from Energize Capital, D.E. Shaw Group, Veriten and HSBC Asset Management.

✈️ Jetson, a Brooklyn, New York-based eVTOLs developer, raised $15M in Seed funding from various angel investors.

🥩 Eden Brew, a Sydney, Australia-based animal-free dairy products developers, raised $15M in Series A funding from Main Sequence Ventures and Possible Ventures.

🌳 Vibrant Planet, an Incline Village, NV-based forest planning and monitoring platform, raised $15M in Series A funding from Ecosystem Integrity Fund, Day One Ventures, and Microsoft Climate Innovation Fund.

⚡ Electric Era Technologies, a Seattle, WA-based EV charging provider, raised $12M in Series A funding from Chevron Technology Ventures.

🏭 Osmoses, a Cambridge, MT-based industrial chemical separations platform, raised $11M in Seed funding from Blindspot Ventures, Collaborative Fund, Fine Structure Ventures, and New Climate Ventures.

🚗 Kinetic Automation, an Orange, CA-based EV servicing centers, raised $10M in Series A funding from Construct Capital, Lux Capital, Automotive Ventures, and Haystack.

🔋 Peak Energy, a Denver, Colorado-based sodium-ion battery systems developer, raised $10M from Eclipse Ventures and TDK Ventures.

🥩 Pow.bio, a Berkeley, CA-based continuous precision fermentation platform, raised $10M in Series A funding from Thia Ventures, Better Ventures, Cantos, Climate Capital, Hitachi Ventures, and other investors.

🔋 Breathe Battery Technologies, a London, UK-based battery performance software provider, raised $10M in Series A funding from Lowercarbon and Speedinvest.

🌱 Granular Energy, a Paris, France-based clean energy certification platform, raised $8M in Seed funding from Norrsken VC, All Iron Ventures, BoxGroup, Powerhouse Ventures, Revent, and other investors.

🧪 Cove, a Los Angeles, CA-based biomaterials and packaging developer, raised $7M in Series A funding from Valor Siren Ventures.

🌾 Treetoscope, a Tel Aviv, Israel-based precision irrigation platform, raised $7M in Seed funding Champel Capital, GlenRock fund, SeedIL, YYM-Ventures, Agrovision, and other investors.

📦 FlexSea, a London, United Kingdom-based seaweed-derived biomaterial for packaging platform, raised $4M in Seed funding from Indico Capital Partners and Grant funding from Innovate UK.

🍎 Relocalize, a Montréal, Canada-based hyper-local food supply system developer, raised $4M in Seed funding from Waterpoint Lane and i4 Capital.

🏠 Purpose Green, a Berlin, Germany-based digital twin for building efficiency platform, raised $3M in Pre-Seed funding from Atlantic Labs and Speedinvest.

🌱 Muir AI, a Seattle, WA-based supply chain emissions monitoring platform, raised $3M in Seed funding from Base10 Partners, Madrona Venture Labs and Soma Capital.

🔋 Green Graphite Technologies, a Montréal, Canada-based lithium-ion battery grade graphite developer, raised $2M in Seed funding from BDC Capital’s Climate Tech Fund and the Sustainable Chemistry Alliance.

☔ Previsico, a Loughborough, UK-based flood risk management platform, raised $2M from 24Haymarket and Foresight Group.

🧱 C-Crete Technologies, a San Leandro, CA-based materials discovery for energy transition platform, raised $2M in Grant funding from US Department of Energy.

⚡ Qube Technologies, a Calgary, Canada-based continuous emissions monitoring platform, raised an undisclosed amount in Series B funding from Riverbend Energy Group.🏠

1KOMMA5°, a Hamburg, Germany-based smart energy solutions marketplace, raised an undisclosed amount from 2150.

💨 CarbonCycle, an Irving, TX-based CCS project developer, raised $100M in funding from Grey Rock Investments.

🚗 EV Life, a Folsom, CA-based EV financing marketplace, raised $8M in Debt funding from Trisolaris.

⚡ Electriq Global, a Tirat Karmel, Israel-based hydrogen powder for storage developer, raised $1M in Grant funding from Netherlands Enterprise Agency.

💨 Endolith, a Houston, TX-based microbes for sustainable mining platform, raised $1M in Grant funding from US Department of Energy.

Brookfield, a Toronto, Canada-based investment firm, raised $12B for its sixth private equity fund.

Paine Schwartz, a New York, NY-based investment firm, closed a $1.7B fund that invests in across food and agricultural companies.

At One Ventures, a San Francisco, CA-based investment firm, closed a $375M fund that invests in companies using deep tech to solve climate challenges.

HCVC, a Paris, France-based investment firm, raised $75M for their second fund that invests in deep tech companies.

Share new deals and announcements with us at [email protected]

Last month broke the record for hottest-ever September by a whopping 0.5°C, according to the EU’s Copernicus Climate Change Service. With the combined effects of climate change and El Niño, this is now expected to be the warmest year on record, reaching 1.4°C above pre-industrial levels and prompting “cascading impacts” on our environment and society, according to the World Meteorological Organization.

Sultan al-Jaber made remarks at the Abu Dhabi International Petroleum Exhibition that 20+ oil and gas companies had made 2050 net zero plans. Al-Jaber, who will be hosting COP28 later this month and offered to host it in the UAE again next year, drew criticism for espousing climate consciousness at a marquee oil industry event and as the leader of a petrostate. The Sultan is head of Abu Dhabi Oil Co., which pumps 4M barrels per day and plans to increase production.

In other updates on global climate talks, Russia will oppose a pre-COP 28 agreement to phase out fossil fuels. The UN’s main fund dedicated to assisting vulnerable countries with climate adaptation is still short of its $10B goal (just a fraction of the estimated $200-250B developing nations need each year through 2030), as the US and other wealthy countries have yet to pay their shares.

The IMF reports a gloomy global economic forecast means G20 is unlikely to meet their short-term international climate financing commitments. The group estimates private investors will need to fill the gap, supplying 80% of clean energy finance in developing markets. Reaching net-zero by 2050 will require $2T in investments per year by 2030—5x the current rate.

In his first exhortation addressing climate change in eight years, Pope Francis called on the rich world to do more to accelerate the rate of renewable deployment while avoiding carbon capture and storage. He wrote about the importance of COP28 as a turning point for global leadership, but remained optimistic about the planet’s future. The pontiff has been vocal about climate change throughout his tenure despite opposition from within the church.

Carbon removal startup Heirloom wrote an open letter asking the industry to conform to a set of quality and ethical standards. The company says it will not accept investments from oil and gas or allow its technology to be used for enhanced oil recovery. Heirloom recently received part of a $1.2B direct air capture federal grant and the largest carbon removal credit purchase agreement in history.

ERCOT is trying to head off winter meltdown fears with bids for additional capacity, soliciting an additional 3,000 MW of operating reserves through dispatchable generation (which includes nuclear, coal, gas, biomass, and energy storage, but not wind and solar) as well as demand response solutions to cover peaks periods from December 2023 through February 2024.

This year could mark a turning point for GHG emissions from the power sector, which rose just 0.2% during the first half of 2023, according to analysis from Ember. "[T]he world is nearing the point of falling power sector emissions," the NGO wrote.

US hedge fund Gramercy is providing a record-setting $552M loan to the UK law firm pursuing massive class-action environmental lawsuits in the UK against mining companies BHP and Vale as well as 14 global carmakers.

Dominion is doubling down on its massive Atlantic coastal offshore wind project, even as the broader industry faces supply chain and building cost challenges. Dominion says supplier agreements struck in 2021 before ballooning prices have shielded their first project off the coast of Virginia, expected to begin construction in Q2 2024, and the company plans to pursue a second project of a similar size in the region.

Rivian is losing $33k per vehicle despite raising prices up to 20% on some models in recent years. Outside design firms say the automaker’s extraneous use of in-house components, cutting edge suspension and beefy frame all add to high manufacturing costs. Rivian has accused suppliers of over-charging and says it can reign in its $1B-per-quarter cash burn.

Pop-up

Wind is welcome in a majority of American communities—even across party lines. Interestingly, Republicans are more comfortable with nuclear developments in their backyards.

Source: Washington Post

Buying LEGO outperforms most VC fund returns. Call it real alternative investing.

Despite the high-budget promo, Apple’s new sustainable products might not fall as far from the tree as previously claimed.

Could climate tech free the American West from barbed wire?

Meet the 17 year-old runner who risks her career to keep her carbon footprint low.

Your heavy EV might be the one that breaks the car garage’s back.

Climate change seemingly leaves no stone unturned. Now it’s coming for mummies.

Need a boost? Read this collection of dopamine-inducing climate stories.

Learn how destructive hurricanes are a part of the atmosphere’s support system.

Who is the real invasive species, lanternflies or humans?

Carbon cost capture and storage.

💡 Carbon13 Venture Builder: Apply to Carbon13’s various venture programs to develop and further your carbon tech initiatives. Venture Launchpad is due by Oct 16th, Venture Builder Berlin by Oct 28th, and Venture Builder Cambridge by Nov 19th.

🗓️ Global Direct Air Capture Conference: Register to join a conference hosting innovators and leaders across the industry on Oct 16th-17th, sponsored by DAC Coalition, Breakthrough Energy, RMI, and Columbia Carbontech Development Initiative.

💡 2024 Berkeley Lab Cyclotron Road: Apply by Oct 17th to the Department of Energy’s Cyclotron Road Fellowship Program, a two-year fellowship to nurture your research into a sustainable business.

💡 Earth AI Hackathon: Attend this generative AI hackathon from Oct 20th-21st and develop innovative products to address climate challenges.

🗓️ Verge Climate Tech Event: Register to join Verge’s Climate Tech Event on Oct 24th-26th, and engage in discussions regarding accelerating climate change solutions. Use CTVC23 for a 10% discount, and use this link to apply as a startup for 40% discount. We’ll see you there!

🗓️ 3 Talks, 100 People, All Climate: Attend the climate conversation on Oct 25th and partake in innovative conversations and talks with various professionals working in climate.

🗓️ Australian Climate Tech Festival & Awards 2023: Join Sophie and 1,000 founders and investors in Australia for the annual Climate Tech Festival in Sydney on Nov 28th.

Strategic Associate, Direct Air Capture @Fervo Energy

Scout @Climate Scout Fund

Chief of Staff @Global Impact Investing Network (GIIN)

Analyst, Investor Relations @Energy Impact Partners

Vice President, Innovation and Expansion @Galvanize Climate Solutions

Supply Manager US @Carbonfuture

Feel free to 📩 send us new ideas, recent fundings, events & opportunities, or general curiosities. Have a great week ahead!

Sunny techno-optimism in foggy San Francisco

A new framework for scaling climate tech companies, just in time for Earth Day

Tech companies and utilities cover their bases as data center electricity demand skyrockets