🌍 Overheard at SFCW #195

Sunny techno-optimism in foggy San Francisco

Lessons from recorrecting clean energy public markets

Happy Monday!

👀 ICYMI, last week we unveiled Sightline Climate, our new market intelligence platform for the new climate economy. Built on the foundation of this newsletter, Sightline Climate’s subscription intelligence product goes beyond the inbox with data, tools, and frameworks to bring clarity to industry professionals navigating climate transition decisions. Think of it as your favorite deep-dives from the newsletter, 10x’d. More than 20 leading investors, corporates, and governments already use the platform including the US Department of Energy, BHP, and Galvanize Climate.

And now back to your weekly scheduled programming. The around-the-block line outside of Spirit Halloween reminded us that we’re getting shockingly (spookily?) close to the end of the month… Maybe trade in your Barbie costume to dress up as one of the newly delisted Endangered Species?

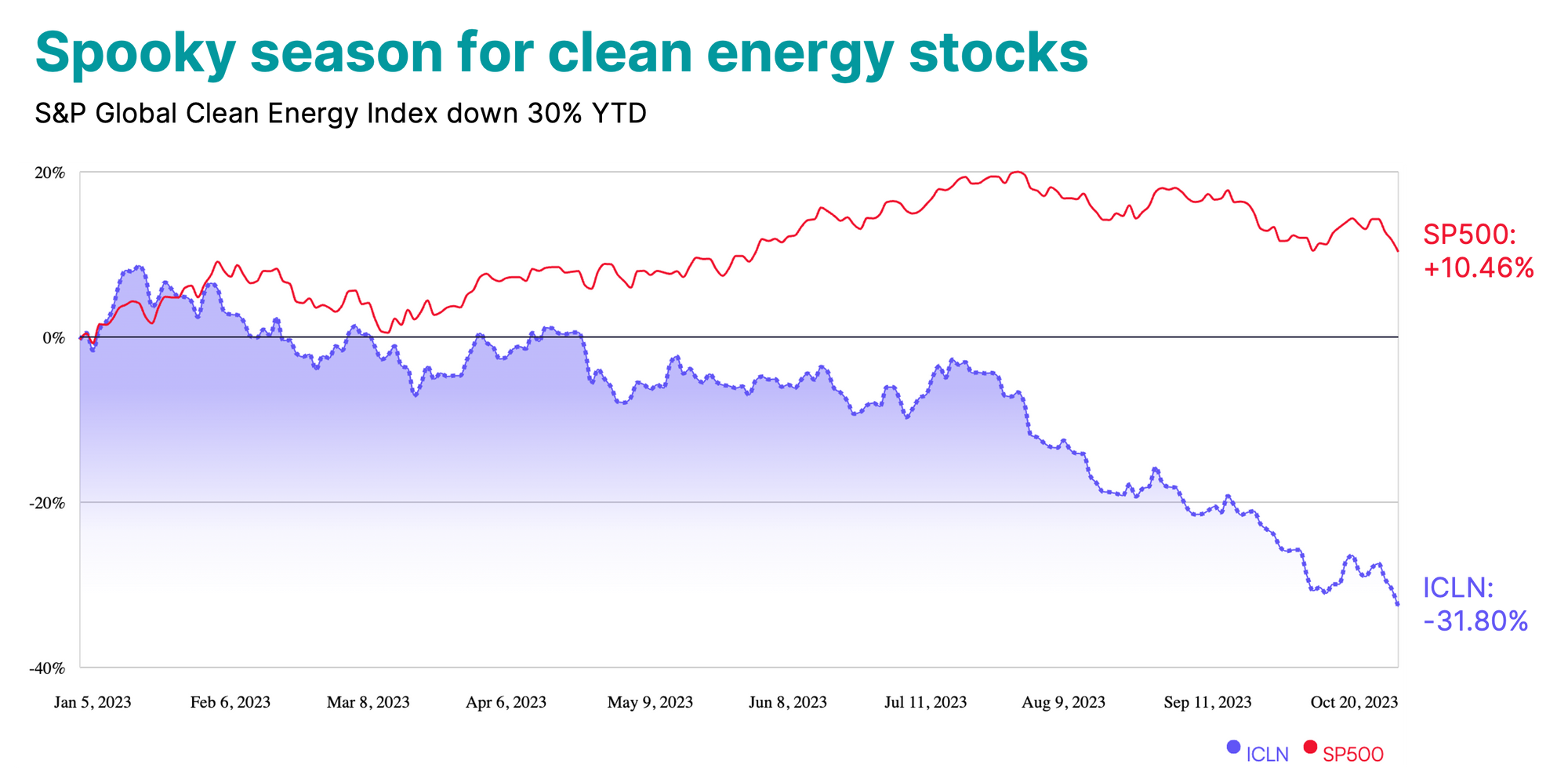

With spooky season upon us, clean energy stocks have plummeted 30% since the start of the year, driven by higher interest rates sending shocks through already fragile wind and solar supply chains. Plus, the US funds $3.5B for grid enhancements, Navigator CO2 cancels its midwest CO2 pipeline, and Germany switches on a 20 MW ‘river’ heat pump.

In deals, $91M for a vertically-integrated European heat pump platform, $50M for direct lithium extraction, and Volta Trucks goes bankrupt.

Thanks for reading!

Not a subscriber yet?

📩 Submit deals, announcements, events & opportunities, or general curiosities for the newsletter at [email protected].

💼 Find or share roles on our job board here.

What goes up must come down. In the ESG exuberance of 2021 and 2022, public markets and institutional investors piled into public climate tech companies and prices (valuations) reached all-time highs. Now, demand has quickly fallen off amidst the rapid run up in interest rates and supply / demand imbalances.

The S&P Global Clean Energy and MAC Global Solar Energy indexes have swiftly dropped ~30% YTD, as the US 10 year treasury yield soared to above 5%.

Over the past few months, higher interest rates coupled with recovering from post-COVID supply shocks created a snowball effect that set the clean energy market rolling downhill:

Higher interest rates = higher cost of capital. Renewable energy projects are particularly sensitive to interest rates, especially since most require debt to finance a high upfront sticker price for the tech. Higher interest rates lead to a higher cost of capital, making it pricier for developers to fund renewable energy projects and narrowing the spread between financing costs and the return on acquired or financed assets.

Assets and liabilities mismatch. Renewable energy projects face an assets and liabilities duration problem. Renewable assets have a duration of ~30 years and are contracted for the first 10-15 years, but financed with debt at an average maturity of 7 years. This means existing assets developed and financed during a period of lower interest rates, could be uneconomic in today's current rate environment.

Supply chain oversupply. The pendulum for clean energy supply chains has swung the other way. After wacky COVID supply chains and the Russia-Ukraine war drove supply shocks for solar components and battery materials, manufacturers and miners quickly built up capacity. Then supply chains normalized, and distributors were left holding the bag with anecdotes of 1-2 years worth of supply sitting in warehouses. Meanwhile, battery metals prices including for lithium carbonate have dropped 62% to $30 per kg since the start of the year.

Gone with the offshore wind. Offshore wind has been especially hard hit, facing longer development timelines, more complex supply chains, and contracts signed before finalizing costs and financing. Two years ago, companies were making plans for offshore wind projects on the Eastern coast of the US based on a projected cost of $77 per MWh - now that’s jumped 48% to $114, according to BNEF. Pile on top of that uncertain IRA tax credit qualifications, and Biden’s plan to deploy 30 GW gigawatts of offshore wind by 2030 is looking near impossible by the day.

NEM 3.0. California’s latest net metering plan ‘NEM 3.0’ reduces payment for excess electricity from residential solar to the grid by 75%. The updated policy worsens the savings and payback period profile of residential solar, with residential solar developers like SunPower are feeling the punch.

While climate tech public markets face more real-time valuation gyrations, private climate tech companies developing projects all experience the same underlying challenges. Capital is no longer cheap, and the founders and developers that succeed will go back to their excel drawing boards to make sure project economics work. Momentum swings will always happen, and marking deals at mid-cycle multiples would go a long way to ensure discipline longer-term.

Shoutout to Shanu Matthew for talking us through this clean energy equities wild ride.

🏠 Aira, a Stockholm, Sweden-based home energy efficiency platform, raised $91M in Growth funding from Vargas Holdings, Altor, Collaborative Fund, and Kinnevik.

🛰️ Hayden AI, a San Francisco, CA-based geospatial analytics and data platform, raised $53M in Series B funding from Drawdown Fund.

⚒️ EnergyX, a San Juan, Puerto Rico-based direct lithium extraction and refining platform, raised $50M in Series B funding from General Motors, Elohim Partners, and IMM Investment.

🥩 Moolec Science, a Warwick, UK-based molecular farming developer, raised $30M in Convertible Note funding from Grupo Insud.

⚡ EarthGrid PBC, a Richmond, CA-based plasma boring for grid infrastructure developer, raised $30M in Seed funding and Crowdfunding from NetCapital.

☀️ Cosmos Innovation, a Singapore City, Singapore-based perovskite silicon tandem solar cell technology developer, raised $20M across two rounds including a Seed from Innovation Endeavours and Two Sigma Ventures and Series A from Xora Innovation.

☔ Overstory, an Amsterdam, Netherlands-based vegetation data for infrastructure resilience platform, raised $14M in Series A funding from B Capital, CapitalT, Convective Capital, Moxxie Ventures, and Pale Blue Dot.

⚡ Ampacimon, a Grâce Hollogne, Belgium-based grid monitoring analytics platform, raised $11M in Series C funding from Junction Growth Investors, Korys, Noshaq, Creos, and Gesval.

🌱 Cloover, a Stockholm, Sweden-based renewable energy financing platform, raised $7M in Pre-Seed funding from 9900 Capital, Index Ventures, Broadhaven Ventures, Centrotec, and QED Investors.

🔋 Skoon Energy, a Rotterdam, Netherlands-based on-site power source rental marketplace, raised $5M in Series A funding from Blue Bear Capital and Graduate Entrepreneur Fund.

🏠 Harvest Thermal, a Berkeley, California-based smart thermal battery heating system developer, raised $4M in Seed funding from MUUS Climate Partners.

✏ Latitude Media, fka Postscript Media, a Boston, MA-based climate research and news platform, raised $4M in Seed funding from Prelude Ventures, Starshot Capital, and Portfolia.

🏠 Bisly, a Tallinn, Estonia-based energy-efficient building appliances installation marketplace, raised $4M in Seed funding from Aconterra, Second Century Ventures, REACH UK, SmartCap Green Fund, and Pinorena Capital.

💨 Klimate.co, a Copenhagen, Denmark-based corporate carbon removal platform, raised $4M in Seed funding from Eneco Ventures, Helen Ventures, Rockstart, and the Export and Investment Fund of Denmark.

🌳 Natrx, a Raleigh, NC-based nature-based adaptive infrastructure company, raised $4M in Seed funding from Ponderosa Ventures and Oval Park Capital.

✏ ImpactAlpha, a Berkeley, CA-based sustainable finance news and data platform, raised $3M in Seed funding from The Ford Foundation, Sorenson Impact Foundation, and Common Future.

⚡ Volteras, a London, United Kingdom-based EV charging software platform, raised $3M in Seed funding from Mercedes, BMW, Volvo, and Enphase.

🥩 Amatera, a Paris, France-based non-GMO perennial crops developer, raised $2M in Pre-Seed funding from PINC, AgFunder, Joyance Partners, Exceptional Ventures, and Mudcake.

⚡ Circadian Technologies, a Berlin, Germany-based energy management system provider, raised $1M in Seed funding from BayWa r.e. Energy Ventures, Rockstart, Persistent Energy Capital, Great Stuff Ventures, Tofino Capital, and other investors.

⚡ Novohydrogen, a Golden, CO-based green hydrogen project developer, raised $20M in funding from Modern Energy.

⚡ Helical Fusion, a Tokyo, Japan-based High-Temperature Superconducting (HTS) cable technology manufacturer, raised $14M in Grant funding from Japan’s Ministry of Education, Culture, Sports, Science & Technology.

🚚 Volta Trucks, a Stockholm, Sweden-based electric trucks manufacturer, has filed for bankruptcy after being hit with supply chain issues amid Proterra’s fallout.

Copenhagen Infrastructure Partners, a Copenhagen, Denmark-based investment firm, raised $2.1B across two new energy funds.

Vertien, a Houston-TX-based energy research firm, raised $85M for their first energy investment fund that invests in sustainable solutions with minimal environmental impact.

Share new deals and announcements with us at [email protected]

The US made a $3.5B commitment to grid enhancements for 58 projects across 44 states in the largest ever federal investment in existing grid infrastructure. Projects range from new transmission lines and batteries in Georgia, to wildfire assessment and resiliency across Western US.

Navigator CO2 Ventures canceled its Heartland Greenway pipeline project aimed at capturing 15 million metric tons of carbon dioxide annually from Midwest ethanol plants and storing it permanently underground. The company blamed its decision on "unpredictable" state regulatory processes.

Germany is providing further proof of concept that heat pumps work at the municipal level. One of Europe’s largest units just came online, providing 20 MW of output to a 3,500 household district bordering the Rhine River, from which the pump derives its thermal energy.

Hydrogen has found a new and exciting home in the power generation space. A consortium of German, UK and French energy component manufacturers alongside 4 European universities demonstrated the world’s first 100% renewable hydrogen gas turbine. The news comes just 6 months after a similar project showed promising results using a 30% hydrogen, 70% natural gas mix.

Climate tech investment has followed the public market down, but there are still bright spots. PwC’s annual State of Climate report found a 40% decrease in climate tech funding over the last year. Climate tech did nab a greater share of the total startup investment market, though, and drew plenty of first-time investors, showing the sector still has a good dose of gumption on the horizon.

Canada announced a new initiative called Radarsat+ for a $740M investment over the next 15 years in satellite technology to boost earth observation data used to track wildfires and other environmental crises.

Jigar Shah and the Department of Energy (DOE) are in the hot seat. In a congressional hearing last week, the Loans Program Office Director and senior staff were warned of potential for sloppy spending as the department begins to dole out loans from funds allocated to DOE by the 2022 Inflation Reduction Act (IRA). The warning came largely from DOE Inspector General Teri Donaldson, who voiced concern that funds could end up in the hands of Chinese or Russian companies. Some Republican senators pounced at the opportunity to call for a full IRA repeal, and flirted with accusing the LPO Director of corruption.

Scientists see net zero within reach by 2050 after new federal investments, a 700 page report by the National Academies of Science and Engineering found. A positive highlight to remember all of the work being put into the energy transition is paying off!

21 species have been promoted off of the US Endangered Species list, including a little fruit bat, a Texas fish, and the flat pigtoe and 7 other mussel friends.

A new report from CREO indicates that offtakes (aka advanced purchase agreements) are taking off as early-stage climate startups tap into their demonstrated demand and less dilutive capital.

What’s holding back the uptake on heat pumps? Corporate consolidation, an aging workforce, and high costs top the list.

We need some serious steel in the ground to meet global climate targets… 80 million km of new grid, in fact.

Report finds that companies buying carbon credits off the VCM tend to be climate leaders, not greenwashing laggards.

Gas utilities were “cooking with gas” using tobacco tactics to keep stoves from going electric.

Elemental Excelerator’s 12th Cohort of 15 companies just dropped, including the friendly faces at Yard Stick, Ebb Carbon, Glacier, C16 Biosciences, Bedrock Energy, and Gradient.

The gravitational pull of capital costs on EnergyVault’s business model means a nifty pivot from disrupting batteries to selling them.

New superhero unlocked? How India’s ‘Lake Man’ is easing a water crisis using 1,500 year old techniques.

Y’all liked last week’s very special trees. Here’s another particularly impressive specimen.

A sarcastic but must-click guide to anti-wetland language.

Well done impact report from (the massive) Builders Vision group.

🗓️ Sustainability Investor Showcase: Register to join gener8tor Sustainability’s virtual Fall ‘23 Sustainability Investor Showcase, on Oct 31st or Nov 2nd, that features 15 climate tech startups raising money across various verticals.

💡 Climate Innovation Challenge: Apply to the Climate Innovation Challenge by Nov 1st to engage in a virtual program to foster climate-focused social enterprise for university students.

💡 2024 OpenAir Carbon Removal Challenge: Apply to a student innovation challenge for carbon removal solutions, where finalists will present at an in-person showcase at the Carbon Unbound conference in May 2024.

Investment Associate @Keyframe

Americas Lead @Energy Tag

Data Engineer @Sightline Climate (CTVC)

Lead Data Scientist @Tierra Climate

Battery Optimization Lead @Tierra Climate

Head of Insights @SET Ventures

Technical Associate, Physical Sciences & Engineering @Lowercarbon Capital

Public-Private Partnerships Director, CA/Northwest @Pearl Certification

Public-Private Partnerships Directors, Northeast @Pearl Certification

Feel free to 📩 send us new ideas, recent fundings, events & opportunities, or general curiosities. Have a great week ahead!

Sunny techno-optimism in foggy San Francisco

A new framework for scaling climate tech companies, just in time for Earth Day

Tech companies and utilities cover their bases as data center electricity demand skyrockets