Gordon Feller serves on the boards of several non-profit organizations focused on the future of greener mobility. He formerly served as President Obama’s appointee to a US Federal Commission established to assess emerging energy-focused digital technologies.

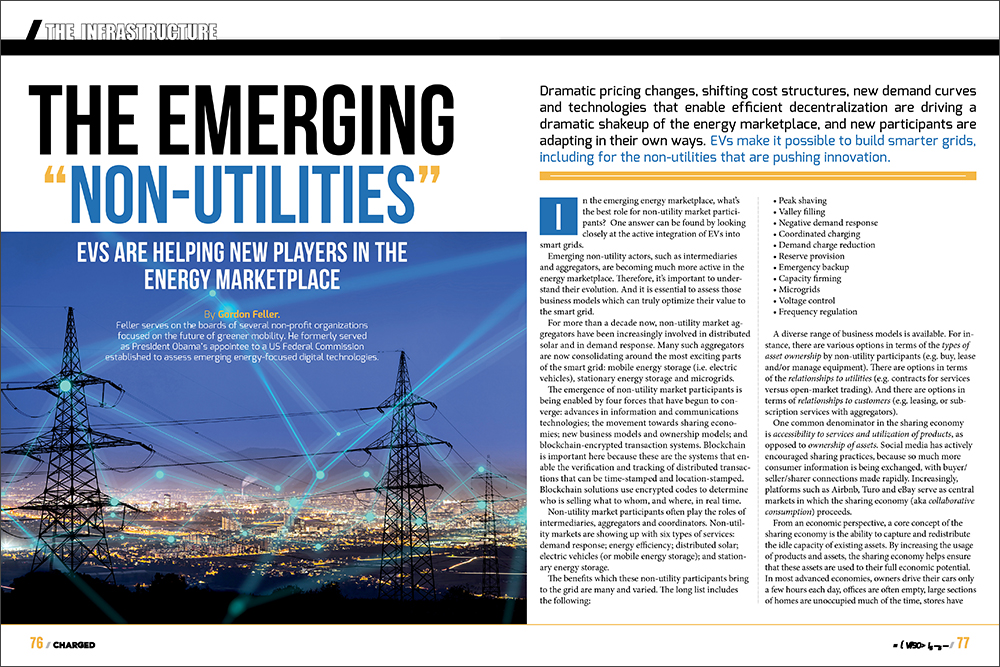

Dramatic pricing changes, shifting cost structures, new demand curves and technologies that enable efficient decentralization are driving a dramatic shakeup of the energy marketplace, and new participants are adapting in their own ways. EVs make it possible to build smarter grids, including for the non-utilities that are pushing innovation.

In the emerging energy marketplace, what’s the best role for non-utility market participants? One answer can be found by looking closely at the active integration of EVs into smart grids.

Emerging non-utility actors, such as intermediaries and aggregators, are becoming much more active in the energy marketplace. Therefore, it’s important to understand their evolution. And it is essential to assess those business models which can truly optimize their value to the smart grid.

For more than a decade now, non-utility market aggregators have been increasingly involved in distributed solar and in demand response. Many such aggregators are now consolidating around the most exciting parts of the smart grid: mobile energy storage (i.e. electric vehicles), stationary energy storage and microgrids.

The emergence of non-utility market participants is being enabled by four forces that have begun to converge: advances in information and communications technologies; the movement towards sharing economies; new business models and ownership models; and blockchain-encrypted transaction systems. Blockchain is important here because these are the systems that enable the verification and tracking of distributed transactions that can be time-stamped and location-stamped. Blockchain solutions use encrypted codes to determine who is selling what to whom, and where, in real time.

Non-utility market participants often play the roles of intermediaries, aggregators and coordinators. Non-utility markets are showing up with six types of services: demand response; energy efficiency; distributed solar; electric vehicles (or mobile energy storage); and stationary energy storage.

The benefits which these non-utility participants bring to the grid are many and varied. The long list includes the following:

- Peak shaving

- Valley filling

- Negative demand response

- Coordinated charging

- Demand charge reduction

- Reserve provision

- Emergency backup

- Capacity firming

- Microgrids

- Voltage control

- Frequency regulation

A diverse range of business models is available. For instance, there are various options in terms of the types of asset ownership by non-utility participants (e.g. buy, lease and/or manage equipment). There are options in terms of the relationships to utilities (e.g. contracts for services versus open-market trading). And there are options in terms of relationships to customers (e.g. leasing, or subscription services with aggregators).

One common denominator in the sharing economy is accessibility to services and utilization of products, as opposed to ownership of assets. Social media has actively encouraged sharing practices, because so much more consumer information is being exchanged, with buyer/seller/sharer connections made rapidly. Increasingly, platforms such as Airbnb, Turo and eBay serve as central markets in which the sharing economy (aka collaborative consumption) proceeds.

From an economic perspective, a core concept of the sharing economy is the ability to capture and redistribute the idle capacity of existing assets. By increasing the usage of products and assets, the sharing economy helps ensure that these assets are used to their full economic potential. In most advanced economies, owners drive their cars only a few hours each day, offices are often empty, large sections of homes are unoccupied much of the time, stores have peak- and off-peak shopping hours, and power plants have substantial unutilized capacity. Collaborative consumption is helping to put this excess capacity to better use.

In the energy sector, the rise of collaborative consumption parallels the shift towards reconceptualization of the energy market to emphasize the services delivered by energy systems and de-emphasize the equipment through which these services are being provided.

When assessing this field, it’s helpful to have a taxonomy to illustrate the alternative business models, to clarify the role of non-utility service providers, and to specify the array of energy services provided by non-utility market participants.

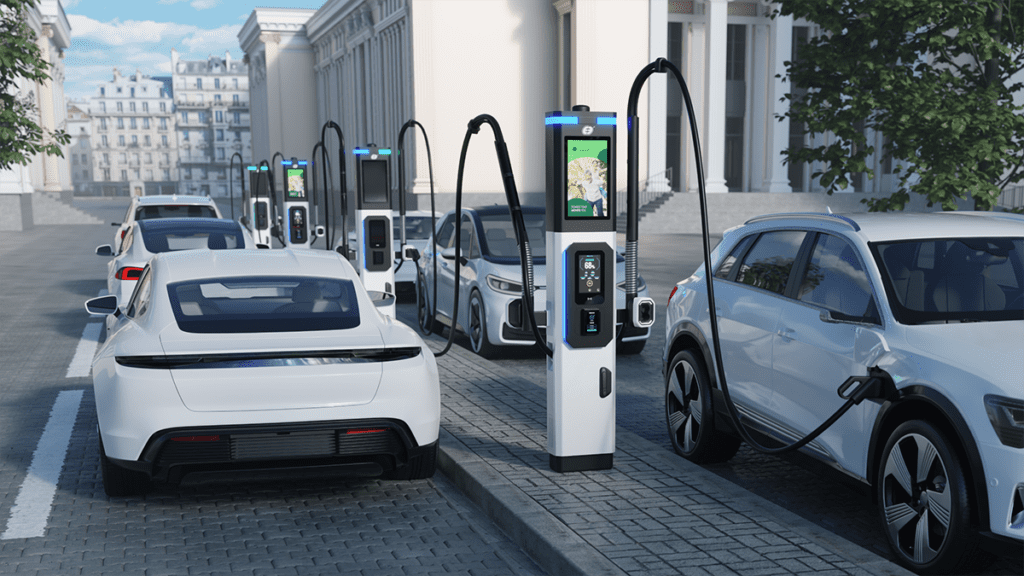

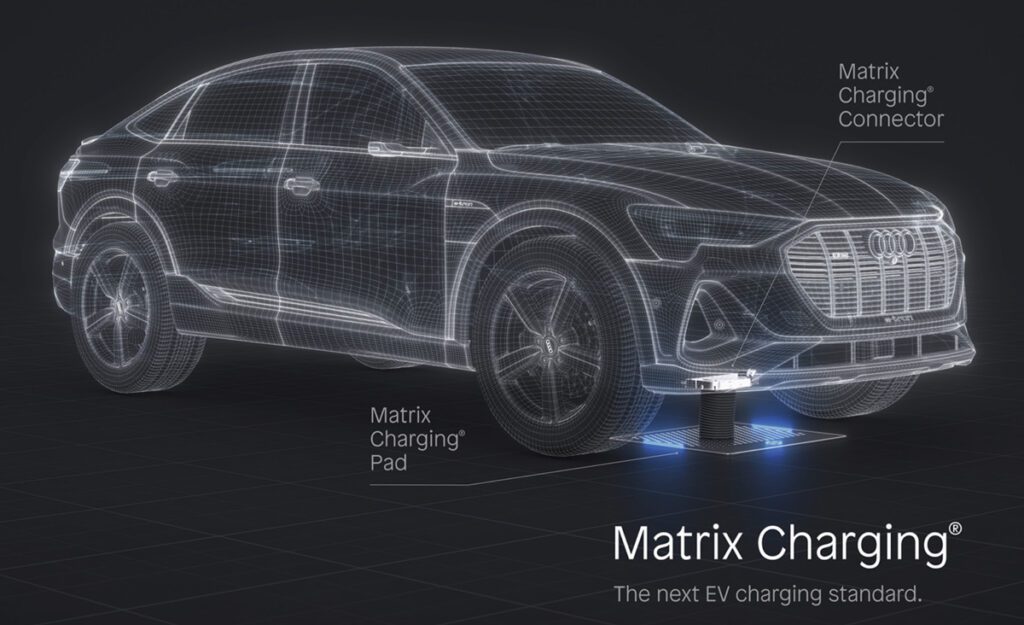

Aggregators offering vehicle-grid integration (VGI) solutions (sometimes referred to more generally as V2X) provide one example of a market in which non-utility energy service providers actively play a key role. The VGI business model envisages a transportation market in which vehicles not only draw power from the grid, but can also be used as a mobile source of supply to power homes, buildings, and businesses. Three different models are emerging:

Grid-to-vehicle: Services based on smart and coordinated charging. The aim is to make vehicle charging more efficient and ensure that EVs positively impact the grid.

Vehicle-to-grid: EVs provide the grid with ancillary services, including storage for frequency and balancing of the local distribution system. This relies on bi-directional flow of power between the grid and the vehicle to enable the provision of advanced grid services.

Vehicle-to-building: This service type is currently receiving a great deal of attention because of its value for back-up and emergency services.

Who are some of the leaders providing useful examples in this realm?

Oak Ridge National Laboratory is working on a Vehicle-to-Home demonstration project, together with the non-profit Habitat for Humanity and automaker Fiat (in North Carolina). This is part of the US government’s DOE Grid Modernization Program.

Nuvve is currently in commercial operation mode providing “Energy as a Service” with its V2G technology in Europe. Nuvve is also launching projects in California, with support from the California Energy Commission. These all involve a combination of technology demonstration and commercialization.

Austin Energy (the municipal-owned power company in Austin, Texas) has developed alternative VGI models.

Fiat Chrysler is testing V2G technology in collaboration with Italian grid operator Terna.

Nissan is working with Fermata Energy on a vehicle-to-building pilot, and also says it is introducing vehicle-to-home technology in Japan.

Who will win this particular race? “Heavy vehicle and large fleet owners will be best positioned to take advantage of the technology and financial opportunity that V2G offers,” said Bob Stojanovic, ABB’s Director of EV Infrastructure for North America. “EV standards bodies are working to make this happen while the marketplace is developing.”

What do the utilities think of all this? One innovator working in these domains is the Sacramento Municipal Utility District (SMUD), which serves more than a million residential customers. Bill Boyce is SMUD’s Manager of Electric Transportation and Distributed Energy Strategy. He and SMUD “view VGI as a tool that will help us connect and serve all the electric transportation load growth that we anticipate over the next 20 years. It fits in with other load-management capabilities that we are enabling through development of our Distributed Energy Resource Management System.”

Boyce sees a natural progression of VGI—starting with simple time of use rates, moving to more actively managed applications for daytime solar integration, load flattening and avoided costs, as well as vehicle-to-home/buildings to support localized grid resiliency, and finally getting to full V2G to help with meeting afternoon grid ramping conditions. SMUD is using time-of-use rates now to manage EV loads, and Boyce says, “We have active research ongoing regarding V1G, V2G and blockchain. We see all of this at the big picture level as electric vehicles, stationary energy storage, photovoltaics, demand response and building electrification all come together for our clean low-carbon energy future.”

What types of challenges might VGI face in the near term?

- V2G could be limited by the potential accelerated degradation of lithium-ion batteries due to battery cycling.

- EV warranties could be cancelled by OEMs.

- EVs could lead to surges in demand for charging power over space and time, requiring investment in new transformers.

- Owners of DC fast charging stations have to pay for transformer upgrades, and they also must pay demand charges, which can be onerous. (Demand charges are additional fees, usually substantial, that utilities charge commercial customers for maintaining a constant supply of electricity.)

According to Nuvve, both data and stress tests indicate that the damage to batteries can be reduced, and battery quality can be maintained, with use of the proper monitoring. Batteries with VGI management can maintain their health and last longer than unmanaged batteries in EVs which are used only for mobility.

The Pacific Northwest National Laboratory has been working on “grid-friendly” charging technologies that provide grid services while charging vehicles. Sensors on the charging station measure grid stress conditions and then control the charging of the battery accordingly. “This is low-cost technology, though the business case for grid sensing capabilities in charging infrastructure is still challenging,” said Michael Kintner-Meyer, electrical engineer at PNNL who’s focused much of his research on the grid impacts of transportation electrification. “However, as EV adoption accelerates over the next few years, it will become not only prudent, but necessary to add these shock-absorbing capabilities to the grid.”

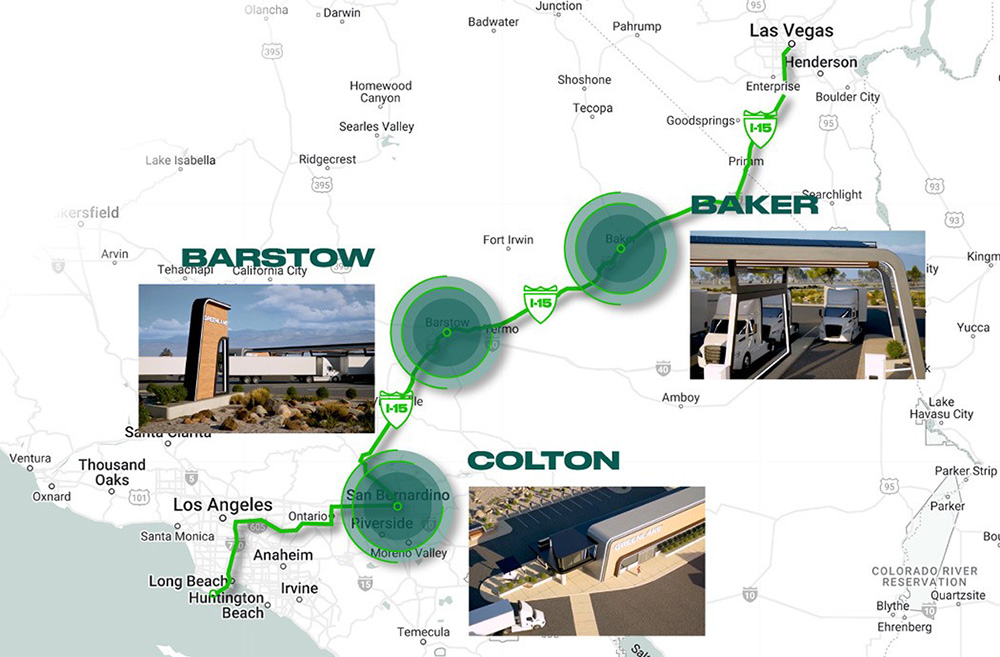

Kintner-Meyer sees new business models emerging with the advent of electric trucks and buses. Commercial EV fleet owners will be interested in working with utilities or third-party providers (if the regulations allow it) to find technology solutions and procurement strategies for e-fueling these larger vehicles. “The electric energy needed for fleets is considerable and the charging profiles tend to be very peaky if not managed as a fleet,” said Kintner-Meyer. (In-Charge Energy, profiled in the March/April 2020 issue of Charged, addresses issues of this kind with its turnkey infrastructure solutions for EV fleets.)

Another issue has to do with locational constraints—when EV fleets are parked at central depots, it can be a challenge to provide the necessary levels of power. For instance, transit bus yards tend to be in urban areas, which may have limited power supplies. If you consider that a bus could have a charge rate of 300 to 500 kW, and if 20 buses are charging at the same time, then the service to the bus yard has to be able to carry 6-10 MW.

“This may not be possible in some locations, in which case the charging has to occur elsewhere or sub-transmission lines need to be upgraded at high cost, or a storage device will be placed as a buffer between the grid and the charging station,” Kintner-Meyer said. “This is going to require creative thinking, and new business models are being explored to package DC charging stations and energy storage together as a non-wires solution to defer distribution system upgrades to support these commercial EV fleets.”

What are the trends that will shape future scenarios? What types of alternative future business models are likely to take hold as the economy embraces collaborative consumption? What (and who) might facilitate this? What might prevent such future models from materializing? These are the questions we should be examining in the months ahead.

This article appeared in Charged Issue 49 – May/June 2020 – Subscribe now.