Understanding Future Prospects for Hydrogen, Energy Storage, and Renewables

The world is undergoing a remarkable energy transition. Clean power systems are in high demand, offering a bright future for hydrogen and renewables. However, energy storage projects that may look promising today could be less attractive as more storage is added.

Many power industry observers are optimistic about the future. While the outlook for fossil fuels may not be great, most non-carbon-emitting technologies are forecast to experience very positive growth.

Hydrogen

In the race toward a more sustainable future, there is a burgeoning demand for clean fuels, with green hydrogen taking center stage. “The Green Hydrogen Market, valued at $676 million in 2022, is anticipated to experience an extraordinary CAGR [compound annual growth rate] of 61.0% from 2022 to 2027,” Shubhendu Tripathi, a senior research analyst at MarketandMarkets, told POWER. “This emphasizes the growing acknowledgment of green hydrogen as a pivotal player in the global energy transition, presenting a clean and versatile solution for diverse industries,” he said.

Frost & Sullivan, which calls itself a Growth Partnership Company that provides disciplined research and best practice models, said the hydrogen industry faced a reality check in 2023. It told POWER final investment decisions (FIDs) dwindled due to rising financing costs and increased project scrutiny, posing challenges for technology OEMs (original equipment manufacturers) in demonstrating cost reductions.

Jonathan Robinson, vice president of Power & Energy Research at Frost & Sullivan, said, “Financing costs are obviously dependent on interest rates and these climbed in 2023. Rates had already been heading up in 2022, so it was not a shock, but they continued further—the U.S. base rate went from 4.5% in January to 5.5% in August. It has stabilised since then, but all of this impacts investor confidence.” Notably, Robinson said only 7% of announced projects have achieved FID. “As a conversion rate, that is pretty low,” he added.

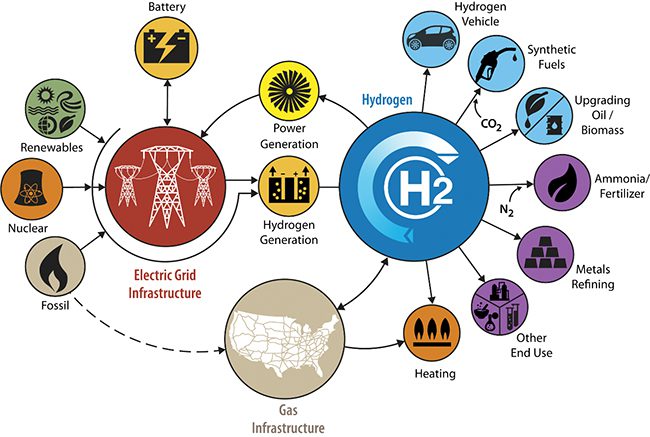

Despite hurdles, hydrogen remains pivotal in the energy transition (Figure 1). The industry generally anticipates a surge in FIDs this year, driven by stronger business cases and strategic shifts toward optimal decarbonization solutions. Challenges may persist, but resilient market participants are well-positioned to prosper, according to Frost & Sullivan.

|

|

1. Recognizing the potential for hydrogen in U.S. transportation, power generation, and industrial applications, the Department of Energy’s Office of Energy Efficiency and Renewable Energy launched the Hydrogen at Scale (H2@Scale) initiative. H2@Scale connects low-carbon energy sources to all the energy sectors. Source: Argonne National Laboratory |

“We finally have some clarity,” Robinson said. “The EU [European Union] has clearly stated its rules for hydrogen classification and will start allocating funding via auctions in 2024 (currently woefully short, though, if it is to achieve its 2030 targets). The Biden administration announced the details for hydrogen in the Inflation Reduction Act at the end of the year. These are being consulted on, but seem to have had a good response from industry as far as I can see.”

Robinson continued: “Interest rates are probably heading down as the rate of inflation falls, so that should improve financing costs. One uncertain element though is the U.S. presidential election. If people don’t approve decisions by the middle of the year, there could be a strong temptation to wait. My view is that a President Trump [re-election] would not be a disaster for hydrogen, as much of the activity benefits Republican states, but we might see some aspects of U.S. policy modified—potentially greater support for fossil-derived hydrogen where the emissions are captured (blue hydrogen).”

Still, when you cut through all the hydrogen buzz, the best prospects are really the ones that have always been there, according to Robinson. Notably, power generation is not on his list. Instead, he said the oil refining, ammonia, methanol, fertilizer, and chemical sectors could benefit more by incorporating clean hydrogen into processes. “These are ones that use hydrogen from fossil fuels now, so the infrastructure is there,” Robinson noted. “The oil and gas companies are keen to try and reduce their emission footprint and decarbonise operations, so this gives them a way to do it. Steel and chemicals are other sectors with potential, although electrification solutions are starting to get a bit more traction. Transport will struggle apart from long-haul trucking. Maritime could take off, but will take time and I think that will go to methanol,” he said.

In the long term, however, geologic hydrogen could be a gamechanger for the industry. Robin Millican, senior director of U.S. Policy and Advocacy at Breakthrough Energy, said there is a scenario where hydrogen becomes extremely affordable at scale. “There are companies out there that are working on identifying where hydrogen exists naturally in the subsurface, and then trying to extract that hydrogen, which could be super affordable, because again, it’s abundant in some areas,” Millican explained as a guest on The POWER Podcast. “If we’re thinking about hydrogen in that scenario, we might want to use it a lot more ubiquitously.”

Energy Storage

Sarp Ozkan, vice president of Commercial Product with Enverus, noted that 2023 marked the successful commercial operation of numerous new energy storage projects, and he said the queues promise plenty more in the years to come (Figure 2). “While storage projects hold the potential to mitigate certain challenges like curtailment and locational congestion, they still grapple with issues related to economics and their ability to ensure grid reliability,” said Ozkan.

|

|

2. Terra-Gen and Mortenson announced on Jan. 29, 2024, completion of the Edwards & Sanborn Solar + Energy Storage project, which stretches over 4,600 acres and is the largest project of its kind in the U.S. It can generate 875 MWdc of solar energy and has 3,287 MWh of energy storage with a total interconnection capacity of 1,300 MW. Courtesy: Mortenson |

A significant portion of the revenues and returns for existing storage projects is derived from ancillary services and capacity markets. However, the finite nature of these markets poses a challenge. “As storage projects inundate these markets, the marginal bid, presently established by thermals, is poised to be determined by storage projects. This shift will lead to a downturn in ancillary services/capacity prices, as storage projects start bidding at the cost of capital,” observed Ozkan.

“The other stream of revenue that storage projects can chase—arbitrage—eats its own tail. In effect, the construction of additional storage on the grid to capitalize on arbitrage leads to the contraction of arbitrage opportunities. This occurs as the price curve flattens, causing diminishing returns for all engaged in arbitrage,” he said.

While the price curve flattening may not be imminent, current returns for battery storage operators employing arbitrage strategies are already modest, according to Enverus. Consequently, the fervor surrounding storage is likely to decelerate. “We expect this slowdown will impact standalone storage projects first, as co-located or co-managed storage projects enjoy advantages stemming from the flexibility they offer in operations and optimization,” said Ozkan. “While storage has been heralded as a means to enhance grid reliability by addressing the intermittency of renewables, the challenge of diminishing returns exists when extending the duration of storage as well. As batteries pursue returns in arbitrage markets, those with shorter durations and superior optimization strategies stand to secure the most favorable returns. This trend is likely to manifest in developers strategically targeting shorter durations in their future projects.”

Renewable Energy

BMI, a FitchSolutions company, said in a report issued on Nov. 30, 2023, that it expects a surge in grid investments in 2024 as markets work to meet the transmission needs of growing non-hydro renewable capacities, with a focus on large-scale projects and renewable interconnection. “We believe that the preference for solar will intensify over 2024, further pushing solar’s lead up when compared to wind as the main non-hydropower renewables type,” the report says.

Furthermore, BMI expects the strategic focus on non-hydropower renewable sources will be leveraged to enhance energy security. “This transition is driven by global markets’ efforts to decrease their reliance on imported electricity. While this shift will come with substantial costs, we expect that these expenses will not deter the transition, but rather, stimulate the creation of supportive financial policies and incentives,” BMI’s report says.

“The energy landscape is currently undergoing a significant transformation, marked by a shift toward sustainable and clean sources that are reshaping the global energy paradigm. Playing a pivotal role in this transition, renewable energy, encompassing wind and solar power, has seen substantial growth,” Tripathi said. “According to MarketsandMarkets analysis, the global offshore wind market is poised to experience a remarkable surge from $31.8 billion in 2021 to an estimated $56.8 billion by 2026, with a robust CAGR of 12.3% from 2021 to 2026. Similarly, the global photovoltaics market is forecasted to reach an impressive $155.5 billion by 2028, boasting a CAGR of 10.0% during the forecast period of 2023 to 2028.”

Independent Commodity Intelligence Services (ICIS), which provides data and analytics focused on the chemical, fertilizer, and energy markets, expects European renewable additions to have another strong year in 2024, with 33.4 GW of solar and 17.4 GW of wind forecast to be added. It said the combined additional output from these two sources—estimated to be about 106 TWh—will comfortably exceed the 75 TWh of increased demand that is expected this year, which will negatively impact thermal generation in Europe.

Meanwhile, a separate report issued by BMI in December said the global solar project pipeline has expanded by about 15% in project count since May 2023, despite a slew of projects moving to completion. “This is representative of the strengthening support for the solar power sector amid the pivot away from fossil fuels and rising costs for wind projects,” the report says. BMI also reported net solar capacity additions from large-scale solar projects had surged over the previous six months, surpassing those of past years. “We believe this is due to easing supply chain bottlenecks and disruptions as energy costs soften and more solar equipment manufacturing comes online,” BMI said.

Concluded Tripathi, “The convergence of these trends paints a promising outlook for a future where renewable energy, nuclear power, energy storage, hydro, and green hydrogen collaboratively propel a more sustainable and resilient energy ecosystem.”

—Aaron Larson is POWER’s executive editor.