A new report offers an overview of the hydrogen value chain, including an appraisal of different production methods, distribution and where the authors believe it will be used. Market initelligence firm IDTechX writes

Decarbonization efforts have gained momentum globally in recent years. Renewable energy, electrification, and battery storage are primary solutions. However, some sectors remain difficult to decarbonize using such methods, including heavy industry, heating, and certain transport sectors, such as aviation and shipping. Hydrogen offers a promising solution for these challenging sectors. Its potential as a fuel, energy carrier, and chemical feedstock has led to many governments formulating national hydrogen strategies. Consequently, companies are seizing market opportunities, supplying a range of services, products, and technologies. The burgeoning hydrogen market is drawing attention from stakeholders globally.

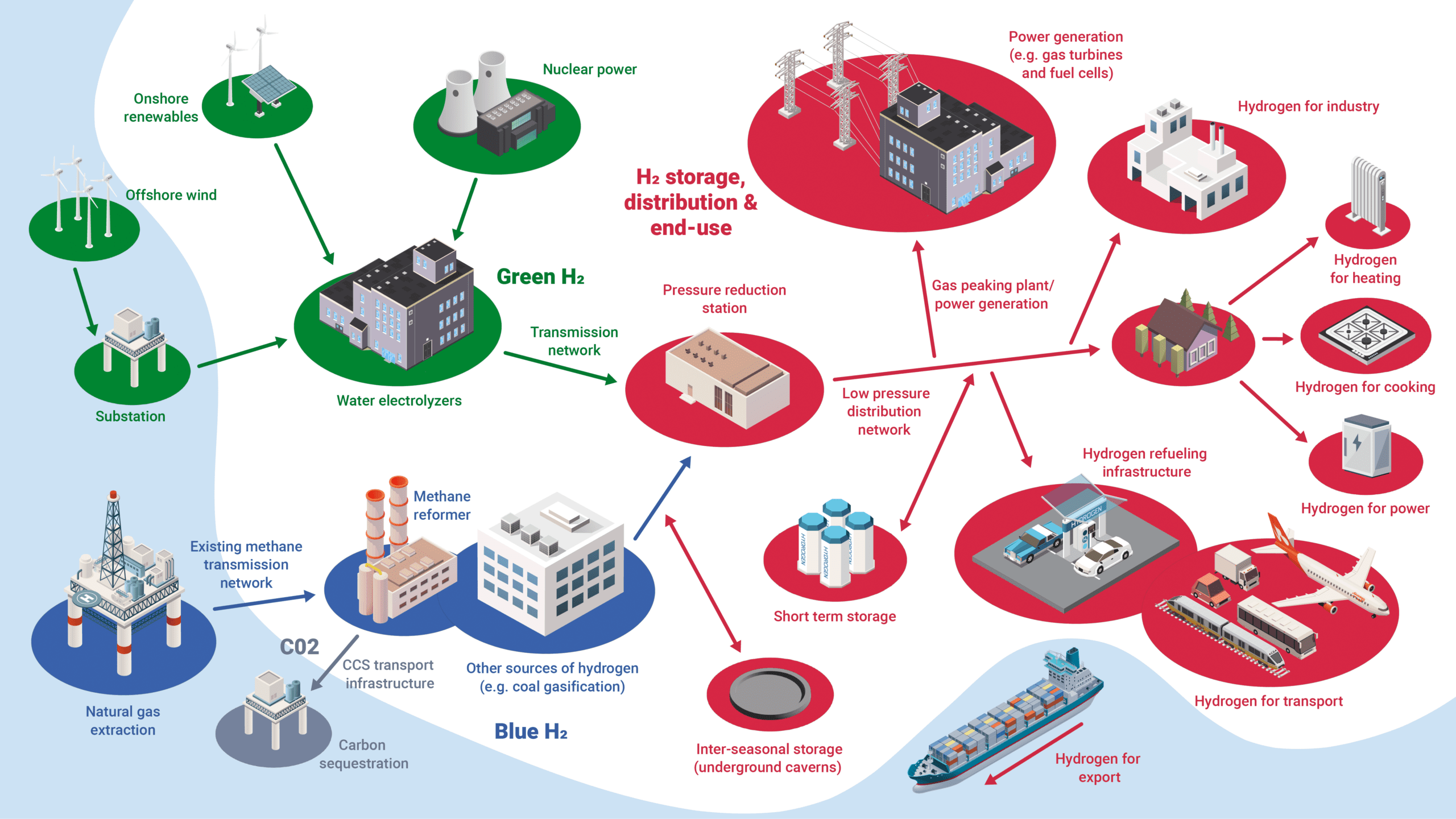

A cohesive value chain is essential for realizing hydrogen’s potential, encompassing low-carbon hydrogen production, storage, and distribution infrastructure, which align with end-user demand. Analogous to the oil & gas sector, the hydrogen value chain comprises upstream (production), midstream (storage & transport), and downstream (end-use) segments. Each segment poses unique technical and socio-economic challenges. The report “Hydrogen Economy 2023-2033: Production, Storage, Distribution & Applications” analyzes many of these issues.

(Above) Overview of the future hydrogen value chain. Source: IDTechEx. CLICK TO ENLARGE.

Hydrogen economy: Status vs ambition

Currently, over 98% of global hydrogen originates from fossil fuel-based grey and black hydrogen, produced using steam methane reforming and coal gasification. These methods significantly contribute to CO2 emissions. In response, numerous companies are pioneering low-carbon hydrogen production techniques, focusing on blue hydrogen (natural gas reforming with CO2 capture) or green hydrogen (water electrolysis using renewable energy).

The energy transition necessitates new low-carbon hydrogen facilities. Consequently, governments are establishing definitive production goals for upcoming years. For instance, the UK targets 10GW of low-carbon hydrogen by 2030 (2.5 million tonnes of blue H2 annually, 5GW green H2), while the US aims for 10 million tonnes annually. Several other nations also have ambitious production objectives. However, the pace of new production site project announcement and development lags behind these targets due to the high costs of production (especially for green H2), lack of supporting renewable and CCUS infrastructure, long lead times to making final investment decisions, as well as challenges in securing financing and permitting. Coupled with an insufficient midstream storage and distribution network, there is an immense opportunity for development and innovation in both technology and infrastructure across the value chain.

Blue hydrogen production technologies

Currently, blue hydrogen, derived from natural gas, is the most cost-effective low-carbon hydrogen production method, having an estimated levelized cost of hydrogen (LCOH) of around US$2-4/kg H2. In comparison, green hydrogen has a much higher LCOH at US$4-10/kg H2, depending on the production method and regional factors like renewable energy availability. Thus, blue hydrogen is viewed as a transitional solution until green hydrogen becomes commercially viable.

Several technologies can produce blue hydrogen. The most prevalent is steam methane reforming (SMR). Other scalable methods using methane have emerged, such as the partial oxidation (POX) process, which transforms waste hydrocarbon feedstocks into valuable syngas and is used in some refineries globally. Another notable method is autothermal reforming (ATR), a hybrid of SMR and POX.

ATR is favored for its energy efficiency and compatibility with carbon capture technologies, crucial for cost-efficient blue hydrogen production. Noteworthy projects utilizing ATR include Air Products’ Net-Zero Hydrogen Energy Complex in Alberta, leveraging Topsoe’s SynCOR technology. IDTechEx anticipates SMR, POX, and ATR to lead the blue hydrogen sector in the coming decade, with ATR potentially dominating new production capacity by 2034. More on such topics, as well as novel reforming technologies, such as methane pyrolysis and electrified SMR, is available in IDTechEx’s “Blue Hydrogen Production & Markets 2023-2033: Technologies, Forecasts, Players” report.

Green hydrogen production technologies

Green hydrogen, produced through water electrolysis powered by renewable energy, is garnering significant interest. Several technologies exist for its production. The most established is the alkaline water electrolyzer (AWE), which uses a potassium hydroxide (KOH) alkaline electrolyte. Benefiting from affordable construction and catalytic materials like nickel and steel, AWE boasts lower capital costs than its counterparts. Nonetheless, its dynamic operability is poor, and its efficiency is low under atmospheric pressure. Hence, pressurized AWEs have emerged on the market, with most players supplying such systems.

The proton exchange membrane electrolyzer (PEMEL) is the most popular technology as it can integrate extremely well with renewables and follow their profile, ramping production up or down within minutes. This technology has a different build and operating principle to the AWE, using polymer membranes, mainly Nafion, as the electrolyte. The downside is its dependency on platinum group metal (PGM) electrocatalysts, notably iridium oxide at the anode – iridium is a costly and scarce mineral. Consequently, minimizing PGM use and developing alternative catalysts is a key industry focus.

Other technologies include the solid oxide electrolyzer (SOEL), utilizing a ceramic electrolyte, and the anion exchange membrane electrolyzer (AEMEL), which aims to merge the advantages of AWE and PEMEL. However, IDTechEx predicts AWE and PEMEL will lead the market in the coming decade due to their established presence. Cutting electrolyzer plant costs (CAPEX/OPEX), operating large-scale plants, and expanding electrolyzer manufacturing capacity is essential for the future. However, access to affordable renewable electricity will ultimately determine green hydrogen’s success. More on such topics, as well as detailed analysis of the electrolyzer market and players, is available in IDTechEx’s “Green Hydrogen Production: Electrolyzer Markets 2023-2033” report.