🌎 Climate brick by brick #194

A new framework for scaling climate tech companies, just in time for Earth Day

New research from Rhodium & MIT shows US clean investment growing

Happy Monday!

Lots of spice for clean investment this week.

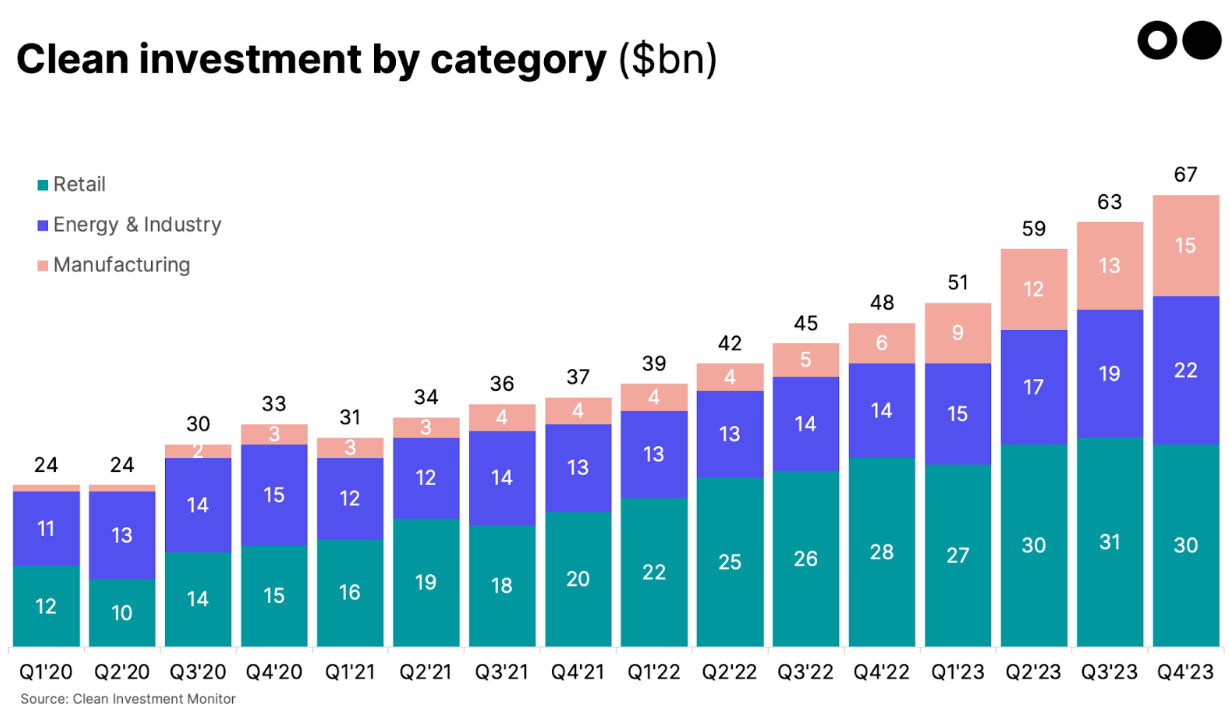

The US Clean Investment Monitor published its annual report for 2023, which saw clean investment total $239bn, up 38% from 2022. Winners include manufacturing, up 133% from 2022, and emerging climate technologies that saw a whopping 10x jump to $4.3bn. The picture was less rosy for new wind and heat pumps, both of which have suffered from high interest rates.

In other news the EU parliament passed a law to restore 20% of the EU’s land and sea by 2030, England requires all new buildings to improve biodiversity, and the US Congress finds something they can agree on with nuclear policy, while the SEC may be set to announce watered down rules on reporting.

In deals, geothermal’s rockin & rollin with $244m, plus $134m for vertical farming, and $109m for EV charging infrastructure.

Thanks for reading!

Not a subscriber yet?

📩 Submit deals and announcements for the newsletter at [email protected].

💼 Find or share roles on our job board here.

Clean investment in the US totaled $239bn, up 38% from the $174bn invested in 2022, according to Clean Investment Monitor (CIM), a joint venture between Rhodium Group and MIT following public and private investment in clean energy and transportation. 14% of total investment came from the feds, with $33.7B of dollars put to work.

The breakdown

CIM’s clean investment methodology breaks out into three categories – manufacturing of GHG emission-reducing technology (“Manufacturing”), deployment of technology to produce clean energy or decarbonize industrial production (“Energy & Industry”), and purchase and installation of climate tech by individual households and businesses (“Retail”).

A first look at the feds

CIM also tracked the deployment of federal dollars since the passage of the CHIPS and Science Act, Infrastructure Investment and Jobs Act (IIJA) and Inflation Reduction Act (IRA).

Behind the numbers

There’s plenty of arithmetic here, but it all nets out to big gains for manufacturing, emerging climate tech, and points to the power of the federal purse in climate.

Thank you to Lisa Hansmann and Lily Bermel from MIT and Trevor Houser from Rhodium for taking us through the numbers.

⚡ Fervo Energy, a Houston, TX-based geothermal project developer, raised $244m in Growth funding from Devon Energy, Capricorn Investment Group, Congruent Ventures, DCVC, Elemental Excelerator, and other investors.

🌾 Oishii Farm, a Kearny, NJ-based strawberry vertical farming developer, raised $134m in Series B funding from NTT Finance, Bloom8, McWin Partners, Mitsubishi Corporation, and Mizuho Bank, and other investors.

⚡ Powerdot, a Lisbon, Portugal-based EV charging infrastructure operator, raised $109m in funding from Antin Infrastructure Partners and Arié Group.

☔ Hellas Direct, an Athens, Greece-based climate risk-based insurance platform, raised $32m in Growth funding from ETF Partners.

🌱 Xcelerate, a Singapore City, Singapore-based GRC and ESG solutions platform, raised $25m from AltaIR Capital, Exacta Capital Partners, and Federated Hermes.

⚡ Insolare, a Bangalore Urban, India-based solar and wind energy platform, raised $8m in Growth funding from Anchorage Capital Group, Khazana Tradelink, and Negen Capital.

⚡ Exodigo, a Tel Aviv, Israel-based advanced power grid sensing platform, raised $105m in Series A funding from Greenfield Partners, Zeev Ventures, 10D, Jibe Ventures, National Grid Partners, and other investors.

🚚 Range Energy, a Mountain View, CA-based electric trailers for commercial trucks developer, raised $24m in Series A funding from Trousdale Ventures, R7 Ventures, UP.Partners, and Yamaha Motor Ventures.

🔋 Anthro Energy, a San Jose, CA-based lithium-ion battery developer, raised $20m in Series A funding from Collaborative Fund, Emerson Collective, Energy Revolution Ventures, Nor’easter Ventures, Overlap Holdings, and other investors.

🏭 Elevated Signals, a Vancouver, Canada-based manufacturing logistics software company, raised $6m in Series A funding from Yaletown Partners, Third Kind Venture Capital, WGD Capital, Raiven Capital, Pareto Holdings, and other investors.

🏠 Heat Geek, a London, UK-based heat pump platform, raised $5m in Seed funding from Transition and Triple Point Ventures.

🌱 Sunhat, a Köln, Germany-based sustainability data platform, raised $5m in Seed funding from Capnamic Ventures, EnBW New Ventures, WEPA Ventures, and xdeck Ventures.

🍎 Mondra, a London, UK-based food sustainability analytics platform, raised $4m in Seed funding from 7 Generation Ventures, AlbionVC, Foodsparks by Peakbridge, GC Foodtech Ventures, Ponderosa Ventures, and other investors.

☔ Looq AI, a San Diego, CA-based digital twin platform, raised $3m in Seed funding from BootstrapLabs, Longley Capital, and Spatial Capital.

🚗 Polestar, a Göteborg, Sweden-based electric cars manufacturer, raised $950m in Debt funding from BBVA, BNP Paribas, HSBC, Natixis, Shanghai Pudong Development Bank, and other investors.

⚡ Kairos Power, an Alameda, CA-based novel advanced reactor technology platform, raised $303m in Grant funding from the US Department of Energy.

🔋 Nouveau Monde Graphite, a Saint-Michel, Canada-based green graphite production platform, raised $50m in Corporate funding from General Motors and Panasonic.

⚡ Logan Energy, an Edinburgh, UK-based hydrogen energy developer, raised $5m in Corporate funding from Lanxing New Energy.

🏠 Axiom Cloud, an Oakland, CA-based AI solutions for commercial refrigeration platform, raised $5m in funding from Toshiba Corp and WindSail Capital Group.

🛵 Cake, a Stockholm, Sweden-based electric motorcycle manufacturer, was acquired by Espen Digernes for an undisclosed amount.

Verdane, an Oslo, Norway-based investment firm, raised $1.2b for a new fund that focuses on digitization and decarbonization investments in Europe.

Zacua Ventures, a San Francisco, CA-based investment firm, announced a $56m debut fund that focuses on investments in construction tech companies.

Can’t get enough deals? See full listings and deal analytics on Sightline Climate

The EU passed a watered down nature restoration law. The law also aims to restore 20% of member countries’ land and sea by 2030 and all ecosystems in need of restoration by 2050, as well as placing restoration obligations on specific types of habitat and identified protected areas. The legislation faced significant opposition from right-wing parties and farmers, leading to a watering down of the law last year.

England introduced its Biodiversity Net Gain (BNG) policy, which mandates that all new building projects must result in a 10% net gain for biodiversity. This can be achieved either through the project itself, or through the purchase of Government issued biodiversity credits to support habitats elsewhere.

The US Securities and Exchange Commission (SEC) may omit scope 3 reporting from climate disclosure rules, following lobbying to dilute regulations proposed in 2022. The decision remains speculative for now, with some commentators predicting an announcement prior to the potential agency shutdown if congressional funding isn’t passed this week.

Texas emergency crews fought the worst wildfire in state history, devastating an unprecedented 1,700 square miles. Xcel Energy, an electricity utility company, lost $1.9 billion in market value over potential liability for negligence in inspecting and maintaining power lines that may have ignited the blaze. Meanwhile, Southern California Edison agreed to pay an $80m settlement for the 2017 Thomas fire which burned more than a thousand homes and over 400 square miles. This settlement could be one of many as there are multiple sites where Edison's equipment may have ignited the fire.

Shell’s US solar unit, Savion, put up nearly a quarter of its assets on sale. The sale, equivalent to 10.6 GW of solar generation and storage capacity, followed comments from Shell’s CEO last year that Shell wanted to focus on selling and trading low carbon power rather than owning the underlying assets themselves, where the returns are lower.

Ørsted’s Sunrise Wind and Equinor’s Empire Wind 1 projects received provisional contracts for a combined 1.7 GW from New York State. The state of New York had a total of 2.4 GW of wind capacity in 2023, making these projects equal to 70% of existing wind generation.

UN resolution calls for more equity in Africa's critical mineral mines, the source of more than half of the world’s cobalt and manganese. The resolution aims to avoid repeating the fossil fuel sector's dark legacy and instead champions labor rights and benefit-sharing, ensuring Africa's mineral wealth benefits its people.

Amid UN pushback, Switzerland withdrew their solar radiation modification (SRM) exploration proposal. SRM, a type of geoengineering, is a contentious idea to dim the sun by releasing aerosols in the stratosphere. The impact of SRM is largely unknown and countries in opposition fear that even SRM research could flare up geopolitical tensions and inadvertently slow progress on decarbonisation.

Apple pulled the brakes on “Project Titan” the company’s own EV, reallocating engineers to generative AI. Meanwhile, Honda announced the first production plug-in hydrogen fuel cell EV in America. The CR-V e:FCEV is set to have a production volume of just 300 cars per year and would be available for leasing in California starting in 2025.

The world’s longest hydrogen pipeline has received approval for construction in China, spanning 700km for $845m. The pipeline is being developed in co-operation between the state-owned China Petroleum Pipeline Engineering Corporation (CPPEC) and Tangshan Haitai New Energy Technology (THNET).

The House approved legislation aimed at boosting US nuclear energy production, in a rare display of bipartisan agreement. The proposed law, if approved by the Senate, would streamline permitting processes, reduce application fees for advanced nuclear reactor licenses, and limit industry liability for accidents.

Brazil’s government has created a currency risk hedging program to protect foreign investors financing sustainability projects in the country, reducing project costs. If effective, the program could be a precedent for other countries wanting to reduce costs for investment in sustainable projects where currency risk is a driver of project cost.

UK in for a shock with £115 billion of energy sector investment potentially departing for greener pastures.

The mounting environmental cost of generative AI

Scientists are feeling the heat as ocean temperatures boil over

The melting ‘Doomsday Glacier’, holding back a 10 foot sea level rise

How to build a zero AC schools that stays cool in 40C heat

China leaves Europe’s solar industry in the shade.

After going into the rough, these golf courses are now teed up for wildlife

Using AI and Twitter to map US climate change denial

📅 Corporate Climate Action Webinar: Register for the "Revised Oxford Offsetting Principles & Their Impact on Corporate Climate Action" webinar on March 5th for a discussion on the impact these principles will have on corporate climate action and investment.

📅 FSIcon 2024: Register for the 2024 Brown University Future of Sustainable Investing Conference on March 8th for networking and panel discussions on topics such as nuclear power, sustainable fashion, and the role of AI in sustainability.

💡 Grist 50 Nominations: Submit nominations for Grist’s annual list of climate and justice leaders to watch by March 11th to uplift people from all walks of life across the U.S. who are working towards a clean, green, and just future.

📅 Planet Jam Happy Hour: Register to join fifty friends working in climate or sustainability-related fields at the first Planet Jam, hosted by Mike Lewis on March 12th, for an opportunity to meet others, share ideas, and network.

💡 Biodiversity Lab Venture Program: Apply to the Brainforest Biodiversity Lab Venture Program by March 15th if you are a tech-enabled company addressing biodiversity loss or ecosystem restoration, to gain access to a vast network of investors, corporates, and mentors.

📅 Transcending Glass Breakfast: Register to attend the Founder & Funder Breakfast co-hosted by Transcending Glass and Fidelity for Startups on March 19th to gather with other female and non-binary tech founders and supporters in the Boston climate tech ecosystem.

💡 Green Accountability Tech Accelerator: Apply to the Climate Collective and the World Bank's GPSA Green Accountability Technology Accelerator by March 21st for an opportunity to receive $20-50k in funding, mentorship, and a platform to showcase your startup’s impact.

💡 Silverstrand Biodiversity Accelerator: Apply for the Silverstrand Biodiversity Accelerator by March 31st for opportunities to network with other investors and fellow founders with your early-stage nature tech startup.

💡 Norrsken Accelerator: Apply to the Norrsken Accelerator seeking 20 early-stage impact startups by March 31st for a $125k upfront investment, mentorship, and connection to investors.

Community Engagement Lead, Controller, VP Project Development @Planetary Technologies

Founder in Residence, Industrial Water Supply @Deep Science Ventures

Senior Full Stack SWE @Arch

Process Engineer; Engineer, Electrochemistry & Storage; Principal Venture Scientist @Marble

Finance Lead; Chief of Staff/ Ops Lead; Mechanical Engineer @Pacific Fusion

Senior Associate, Associate @B Capital

Director, Private Investment @Builders Vision

Program Manager @Evergreen Climate Innovations

Associate, Commercialization Collaborators @The Engine

Chief of Staff, Investor Operations @LowerCarbon Capital

AI/ML Carbon Reduction and Net Zero Lead @Google

📩 Feel free to send us deals, announcements, or anything else at [email protected]. Have a great week ahead!

A new framework for scaling climate tech companies, just in time for Earth Day

Tech companies and utilities cover their bases as data center electricity demand skyrockets

A new green bank to finance climate projects