Once a country whose primary contribution to energy innovation aligned with remote microgrids on the western side of the country, Australia is now a hotspot for grid connected virtual power plants (VPPs) in the southeast. The deregulation of Australian energy markets has accelerated reforms that now make VPPs a virtual necessity for intelligent grid management. Consider the following:

- Australian consumers have one of the highest per capita electricity consumption rates in the world. These consumption levels translate into flexible load that can serve as the basis for demand response (DR) programs and, ultimately, VPPs

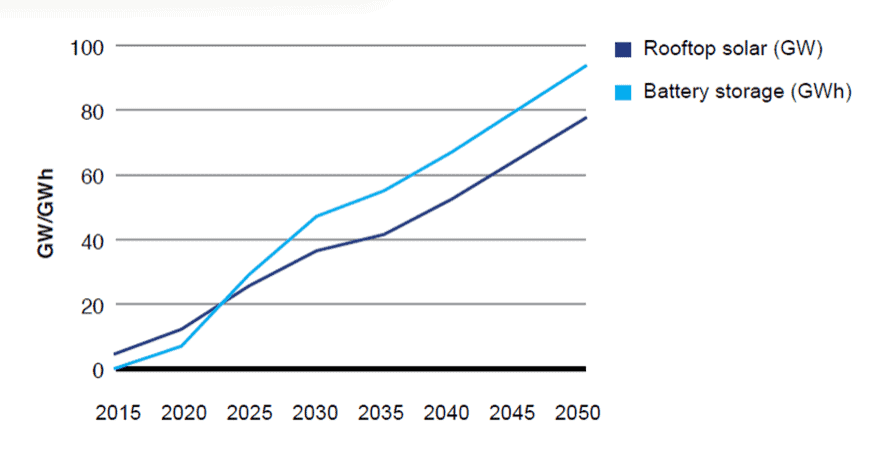

- Australia also has the highest per capita rooftop solar PV penetration in the world, grid assets being paired with battery storage. Adoption is expected to accelerate over time (See Chart below). Curtailment of solar production is a related challenge in western Australia where companies are actively seeking scalable solutions

- Like US markets, such as New Mexico, California, Colorado and Oregon, Australia has been wracked by wildfires and corresponding power outages

- As coal plants are retired and replaced by large-scale solar and wind farms, the Australian Energy Market Operator (AEMO) requires greater visibility into the assets used to balance the grid. This will require integration of behind-the-meter with front-of-the-meter assets to maintain grid reliability

Rooftop Solar PV and Battery Storage Adoption, Australia: 2015-2050

Why the Five-Minute Market Optimizes VPP Opportunity

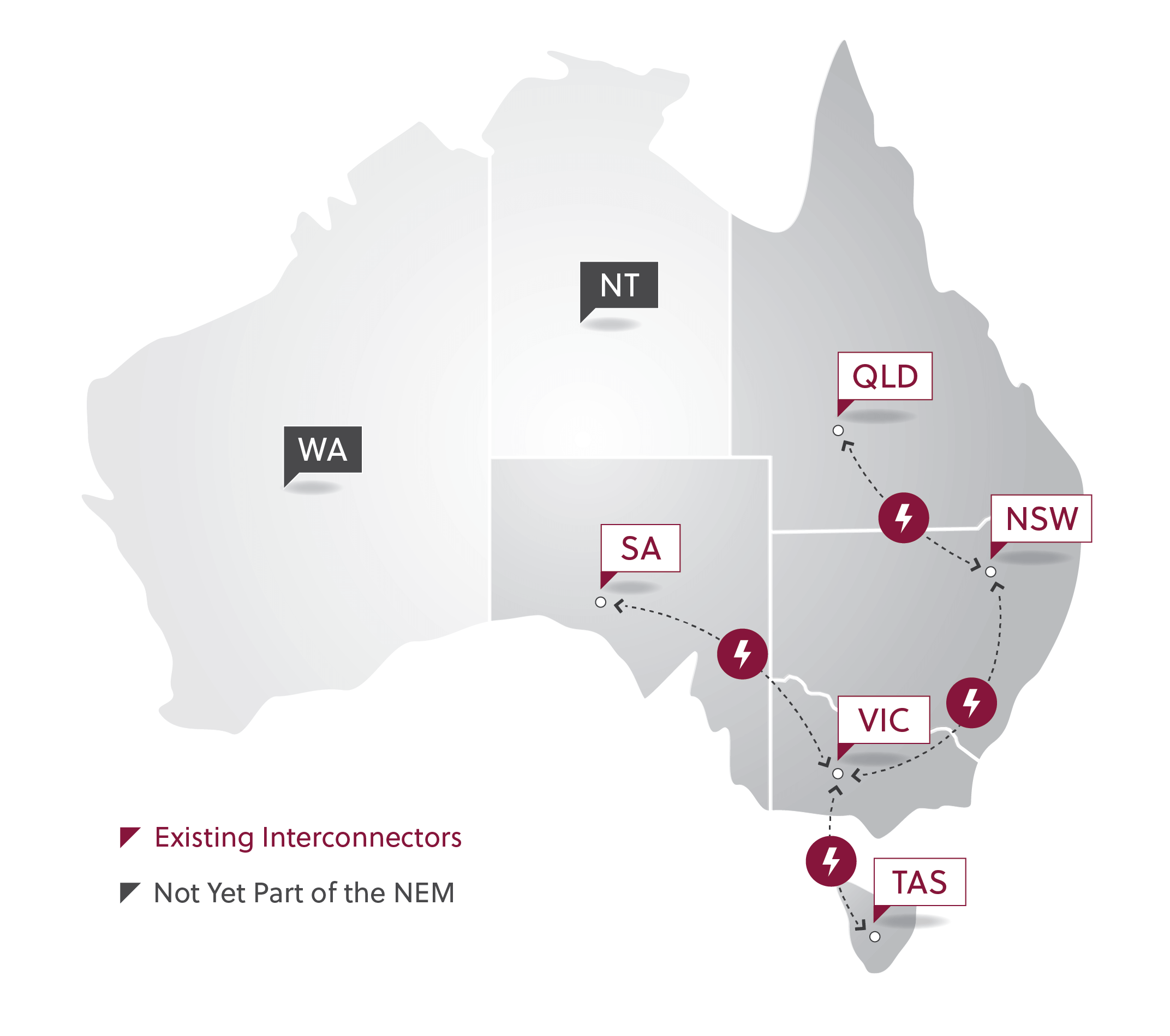

In October of last year, AEMO, which runs Australia’s National Energy Market (NEM), instituted a market reform that changed the rules to shorten settlement periods from 30 minutes to five minutes. The NEM market represents 80% of Australia’s total energy consumption (see below). Commencing operations in 1998, the NEM market supplies approximately 9 million customers with over 54 GW of generating capacity. Over 300 buyers of electricity post more than $16 billion in trading every year.

NEM and Other Regional Energy Markets in Australia

The five-minute market results in a hyper-competitive bidding process that sets the stage for energy retailers and other market participants to embrace the VPP market optimization opportunity fully. The market is an energy-only market lacking a capacity or day-ahead market; therefore, trading activity can be frantic.

Bidders can sell into six frequency services market products as well as eight grid service markets. There are almost 20 different ways a battery can be allocated with compensation spanning nearly a dozen different pricing bands.

The complexity of the Australian market is giving rise to the latest mutation possible within the distributed energy resource (DER) management ecosystem: mixed asset, multi-market VPPs. This new market structure will accelerate the adoption of energy storage devices, a key buffering technology that has emerged as a vital component of state-of-the-art VPPs. And while adoption of electric vehicles (EVs) is remarkably low in Australia — representing less than 1% of total vehicle sales by one estimate — these market reforms set the stage for these EV assets to be bundled together with rooftop solar photovoltaics (PV), batteries and large industrial loads to create portfolios of aggregated flexibility that NEM participants will increasingly rely upon in the future.

Commercial and Industrial Customers Will Move the Market

While VPPs can aggregate and optimize DER assets at either the residential or commercial and industrial (C&I) scale, the biggest near-term impact clearly rests with the latter market segment. Starting with these large loads, these are significant resources that can be brought to the market today. When bundled with on-site generation, as well as any energy storage devices, these sources of flexibility help set the stage for mixed asset VPPs which can then be integrated with residential DER assets down the line. But first things first. Let’s bring some MW to the table without further delay.

Building the business case with C&I customers not only moves the needle but proves out the business cases for the mixed asset VPP in the most cost-effective way. This, in turn, helps build momentum for quantifying the value of VPPs in a dramatic way across stakeholders, including regulators, energy retailers and utility customers perhaps not yet convinced of the efficacy of becoming a prosumer. By bringing larger portfolios of VPP assets to benefit from multi market value streams sooner whilst concurrently delivering behind-the-meter bill savings, AutoGrid believes that this approach will pave the way for smaller residential DER assets to soon follow suit.

The critical role C&I customers play during emergencies came to light during an extreme heat wave in January 2019. AMEO asked Alcoa Australia – the largest electricity consumer in Victoria – to implement dramatic demand response programs to keep the grid up and running. Such demand reduction from single customers (or fleets of C&I loads) represent a first line of defense in responding to emergencies. While AutoGrid’ s Flex platform offers clear advantages when it comes to aggregating smaller residential assets at scale, the biggest bang for the buck today still rests with aggregations of medium-scale C&I loads (and on-site generating capacity).

Frequency Regulation a Key VPP Driver for Energy Retailers?

The AutoGrid Flex platform can provide the full gamut of asset integration and market participation VPP applications.

In Australia, however, the VPP use case that has risen to the top of the agenda for energy retailers is frequency regulation, especially in South Australia and New South Wales2.

A report released by Cornwall Insight Australia claims that the majority of utility scale battery assets currently operating in the NEM derive 75 to 80% of their market revenue from supplying Frequency Control Ancillary Services (FCAS.) The study shows that location matters.

While FCAS figures to be a market revenue bonanza throughout NEM, South Australia is particularly attractive for a couple of reasons. Despite having a portfolio of large-scale batteries, the region has a significant shortfall in regional suppliers of FCAS due to the proliferation of both behind the meter and in front of the meter variable renewables. This growth in variable renewable generation translates into a corresponding lack of spinning synchronous generation typically used to bolster grid reliability.

The study found that a battery located in New South Wales in 2020 fiscal year would have generated $76,000 more than a battery located in Victoria. The frequency deviations can theoretically be addressed over a much wider geography than more localized voltage issues, which often have to be mitigated on specific feeders. The study verified that potential new market revenues generated from FCAS are greatly impacted by regional resource portfolios.

AEMO has estimated that it will require up to 200 MW of fast frequency response capacity in 2022. The majority of this grid service capacity is expected to come from batteries. Where those batteries are located will clearly impact the potential for market revenues to be captured by VPPs. Furthermore, the large C&I loads that are also integrated into VPPs can also generate grid service revenues for slow frequency response markets. Those frequency regulation revenues will also vary by location and remain a key of the VPP value proposition in Australia.

The full gamut of grid services is required to balance the increased volatility in NEM. A recent study by the University of New South Wales concluded that up to 95% of network voltages are out of the allowable range at key times across all jurisdictions in Australia. Higher than ideal voltages limit the operational band in which DER assets can optimally operate. Market reforms may need to be introduced to mitigate these voltage deviations to accommodate expected future growth in DER pools that feed future VPP projects in Australia.

Conclusion: Building the Business Case for Staying Connected

Major investments in grid infrastructure have translated into high connectivity costs. This has led some consumers to consider abandoning grid networks altogether. Horizon Power, the utility with the largest service territory in the world but the fewest customers per square mile/meter, is disconnecting remote customers and allowing them to operate as standalone power systems.

Reducing reliance upon coal and other fossil fuels is only a first step. Only by embracing both large-scale front-of-the-meter renewables – such as on-shore wind farms – and behind-the-meter rooftop solar PV, will Australia be able to meet its environmental and economic goals. This increase in reliance upon variable renewables will require creative solutions that clearly include batteries but also solutions that incorporate DR and other load management technologies that operate in tandem in the form of VPPs.

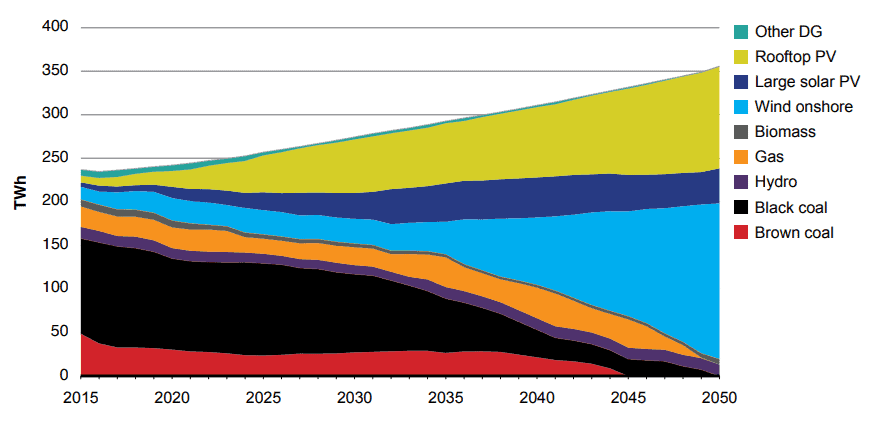

Plausible Future Energy Resource Trends for Australia

Remote-islanded 24/7 microgrids may make sense in some specific circumstances. Still, the study referred to at the start of this article – the Electricity Network Transformation Roadmap – found that the potential benefit of prosumers, large and small, staying connected to the power grid tallied up to $1.4 billion in avoided network investment. Staying connected to existing and expanded grid networks would allow prosumers with DER assets to lower their household electricity bills by approximately $414 annually.

These same DER assets, if aggregated and optimized with VPPs, can also displace dirty fossil plants that have been relied upon historically to keep the grid in balance. VPP use cases enabled by AutoGrid’ s Flex platform are key enablers of a low-carbon energy future that is affordable, sustainable, and democratic.