Greetings, Agents of Impact!

Featured: Catalytic Capital

Ten lessons for 10 years: Inconvenient truths from an impact-first investor. For years, the roster of family offices willing to provide lower-return catalytic capital for the sake of higher impact has featured Ceniarth… and not many others. Diane Isenberg, heir to an oil-and-gas drilling fortune, launched the now-$650 million family office in 2013 and pursues a strategy of impact-first capital preservation. If you’re rich, and you get your capital back with a bit extra for inflation and expenses, you’ll still be rich tomorrow, Isenberg likes to tell her peers. Ceniarth has found only a few kindred spirits with meaningful assets and intentions, she writes with co-managing director Greg Neichin. Going forward, they are counting on philanthropic partners rather than self-identified impact investors. “Our countless presentations to convenings of those purporting to be impact investors has amounted to far less than what we had hoped,” Isenberg and Neichin write in a guest post on ImpactAlpha.

Going into its next decade, Ceniarth’s mission remains the deployment of investment capital to improve livelihoods in underserved and marginalized communities around the world. Among the lessons from the last 10 years: “Don’t believe the hype: Tradeoffs are real,” and “KISS: Keep it simple… to scale.” Isenberg and Neichin write: “In pursuit of ‘systems change’ and ‘revolution,’ many lose sight of the beneficiaries that our industry is intending to serve. We will always remain believers that large-scale, meaningful, even if incremental, improvements to livelihoods is a worthy goal in a world where the wholesale dismantling of systems seems utopian.” Other inconvenient truths:

- Modest returns. “Maintaining an impact-first portfolio that can predictably earn a modest return is challenging,” the authors admit. As Ceniarth adds new investments to its portfolio – totaling $70 million in 41 transactions in 2022 – “we are slowly divesting of both responsible public equity and fixed-income positions that most foundations and endowments rely on as ballast for targeting commercial returns,” they say.

- Failures and first-timers. Impact investors’ reluctance to own up to their failures means others must approach due diligence with a healthy dose of skepticism. “There are multiple funds and enterprises in our current portfolio that are regularly feted publicly as successes that are not doing nearly as well as you would imagine,” write Isenberg and Neichin. They add, “We have watched as fees and expenses on a number of small, slowly deploying funds have quickly eaten up any chance of even modest returns.” More than one such fund was wound down before the first dollar was invested. “Despite these bumps, the creation of these new managers is essential to our strategy of developing thriving capital intermediaries,” the authors write.

- Flexibility and patience. Unlike many family offices, Isenberg and Neichin say, development finance institutions and foundations are increasingly willing to take on riskier, junior positions in capital stacks. Among the portfolio examples: Global Partnership’s Impact-First Growth Fund, MCE Social Capital’s MESA Fund, the Expanding Black Business Credit network’s Black Vision Fund, Candide’s Afterglow Climate Justice Fund and Mirova SunFunder’s Gigaton Empowerment Fund. “With derisking mechanisms in place,” they write, “we can play a genuinely additional role being the senior capital in a fund or senior lender to an enterprise.”

- Keep reading, “Ten lessons for 10 years: Inconvenient truths from an impact-first investor,” by Ceniarth’s Diane Isenberg and Greg Neichin.

Dealflow: The Transition

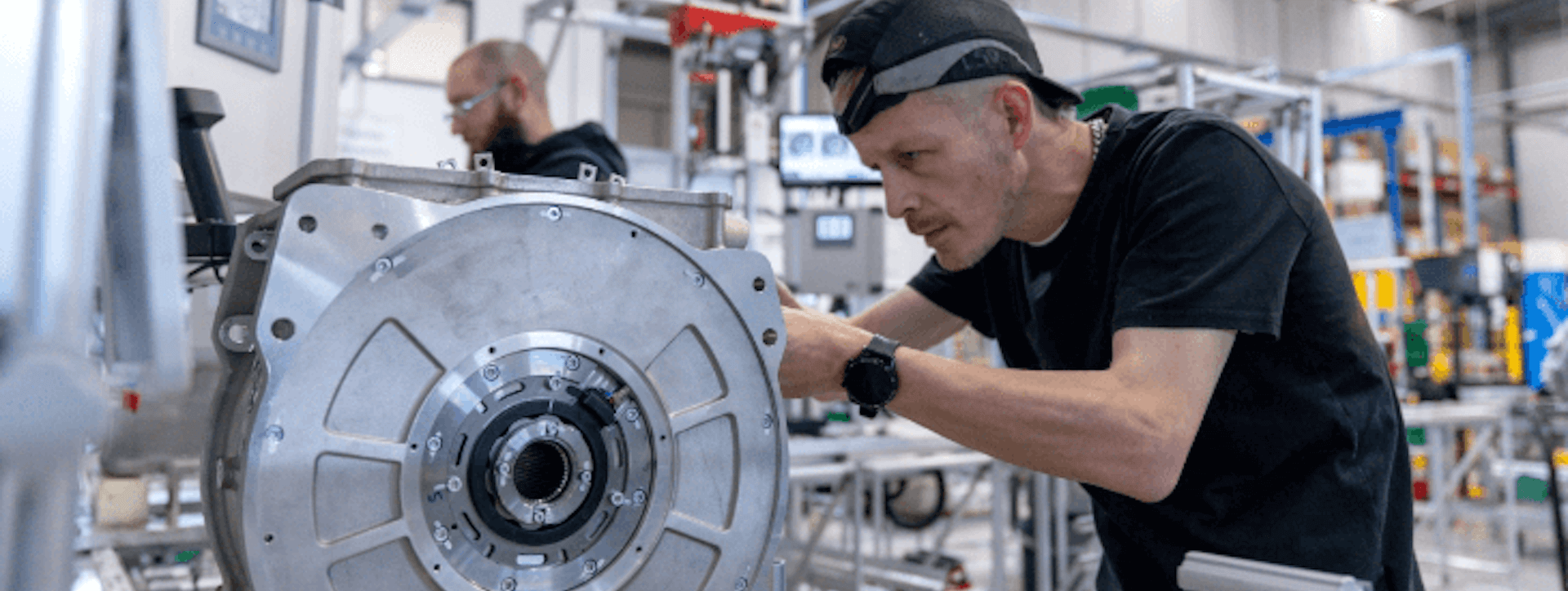

Advanced Electric Machines scores £23 million to minimize extractive minerals in electric vehicles. The green transition has so far depended on intense mineral extraction. Each standard electric vehicle requires nearly 4.5 pounds of rare earth magnets, while each EV battery requires nearly 20 pounds of lithium. “The only way to eliminate this problem is to eliminate the rare earths in motors entirely,” writes the team at Advanced Electric Machines, a UK-based company that’s building more sustainable motors for EVs, industrial machinery and railway systems. The company’s EV motor systems eliminate magnets and copper, relying instead on steel and aluminum that can be reclaimed and recycled. AEM is producing a lightweight motor for small commercial vehicles, and developing one for passenger vehicles. Several UK railway operators use its motors in limited capacities.

- University spinout. AEM was launched in 2017 from Newcastle University’s electric motor research team. The company’s equity round was led by Legal & General Capital and Barclays Sustainable Impact Capital. Par Equity, Northstar Ventures, the Low Carbon Innovation Fund, and Turquoise Capital also participated. Funding will be used for its manufacturing facility in North East England.

- Check it out.

Planet Farms raises $40 million for vertical farms in Italy and the UK. Vertical farming startups have struggled to make unit economics work for high-tech, energy-intensive systems (see, “Collapse of AeroFarms augurs a reckoning for vertical farming”). Milan-based Planet Farms has scored $40 million for a new growing facility outside of Milan and expansion to the UK. The company uses its facilities to grow and process raw greens, pesto and other products for retailers. UniCredit Banca in December provided a loan for its new plant in Italy. Planet Farms also secured a credit guarantee from Sace Group, whose goal is to help Italian companies access finance for the green transition. A planned production site outside of London will serve the UK market.

- Indoor ag. Separately, Netherlands and France-based RED Horticulture raised $17 million million for its AI-controlled greenhouse lighting systems, which help growers deliver the right kind of light to plants at the right time to improve yields and cut energy consumption.

- Share this post.

Dealflow overflow. Other investment news crossing our desks:

- Cameroon’s Waspito raised $5.2 million in seed funding to mitigate Africa’s health worker brain drain by connecting patients to doctors virtually. (Disrupt Africa)

- HumanForest raised £17 million ($21.4 million) from Triodos Bank UK and others in Series A financing for the B Corp’s electric-bike sharing in London. (TechEU)

- In India, Baaz Bikes secured $8 million from Singapore’s BIG Capital, Japan’s Rakuten Group and others for its electric two-wheelers, batteries and network of swapping stations. (YourStory)

- Singapore-based Climate Alpha scored $5 million for its software to help real estate, asset management and insurance companies predict and manage climate volatility. (FinSMEs)

Impact Voices: Business and Society

Fiduciaries have a duty of care to their investors and to the world. Economist Milton Friedman’s 50-year-old adage that “there is one and only one social responsibility of business – to use its resources and engage in activities designed to increase its profits,” hasn’t held up, argues Pedro Henriques da Silva of Sierra Club Foundation. In a guest post, da Silva says businesses do not operate separately from society or from the world. “The very premise of business, the very concept of resources and profits, are intimately, inextricably dependent on well-functioning ecological and social systems in which we all reside.”

- Duty to society. For fiduciaries like banks and investment firms, “duty of care” extends not just to their owners and investors, but “to the world in which they operate,” writes da Silva. “If you have a duty to clients or shareholders who are embedded in a larger ecosystem and society, then it is in your clients’ and shareholders’ interests to take action that benefits that same ecosystem and society.”

- Risk-adjusted. Maximizing risk-adjusted returns over the long-run requires a broader view. The world’s largest businesses currently face nearly $1 trillion of risk from climate change, while climate-positive businesses present more than a $2 trillion investment opportunity. “By not incorporating an asset’s or business’s impact on people and the planet, fiduciaries ignore a significant risk to the assets they’ve been tasked with stewarding,” says da Silva. “By ignoring climate-positive and socially-beneficial activities, businesses leave a tremendous source of value-creation on the table.”

Agents of Impact: Follow the Talent

Calvert Impact adds Lisa Winslow of Morgan Stanley Investment Management to its board of directors… New York State Insurance Fund has an opening for an ESG and sustainable investing associate… Reinvestment Fund is looking for a commercial loan portfolio manager in Atlanta… Glenmede seeks a sustainable and impact investing intern for next summer… ECMC Group is hiring a remote impact investment associate.

Sorenson Impact is looking for an operations and student engagement associate in Salt Lake City… Diverse Investing Collective has an opening for a remote manager… World Economic Forum’s open innovation platform Uplink is recruiting an investor community lead in Switzerland… UNDP is on the hunt for an impact investing and accelerator assistant in Jakarta, Indonesia…

👉 View (or post) impact investing jobs on ImpactAlpha’s new Career Hub.

Thank you for your impact!

– Nov. 27, 2023