Greetings, Agents of Impact!

👋 Hop on today’s Call: Women as agents of change for climate resilience. If and when we meet the climate challenge, women will have been a key success factor. Heading for Change, the investment fund and legacy project of the late Suzanne Biegel and her husband Daniel Maskit, is investing at the intersection of climate and gender, and opening its processes to others. To put a gender lens on climate investing, join Camilla Nestor of MCE Social Capital, Shally Shanker of AIIM Partners, Noramay Cadena of Supply Change Capital, and Samantha Anderson and Rose Maizner from Heading for Change, in conversation with ImpactAlpha’s David Bank. Zoom in to today’s call at 10am PT / 1pm ET / 6pm London (no need to RSVP but Zoom login is required).

🗞️ Background reading:

- “With climate + gender fund, Suzanne Biegel is heading for change”

- “These fund managers are putting climate + gender strategies into action”

- “How Heading for Change invests in climate solutions with a gender lens”

- “MCE Social Capital is unlocking capital for climate + gender”

- NEW: ImpactAlpha’s database of three dozen funds investing at the intersection of climate and gender.

Featured: Ownership Economy

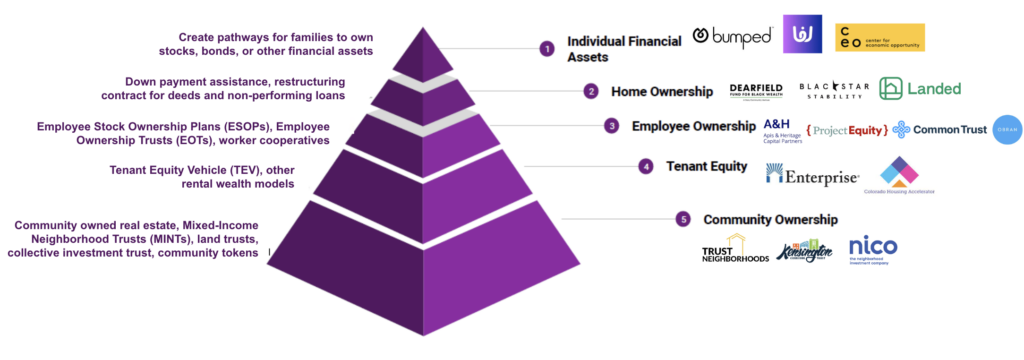

Building an ownership movement to close racial wealth gaps. Making ownership of assets that appreciate in value more accessible, particularly for people of color, could dramatically reduce racial wealth gaps. “We are on the cusp of catalyzing an ownership movement,” Smitha Das of World Education Services and Santhosh Ramdoss of Gary Community Ventures write in a guest post on ImpactAlpha. The two funders have developed an Ownership Pyramid framework that includes multiple pathways to put appreciable assets on the balance sheets of low-income families, especially households of color. “Ownership-led approaches can be a tremendous source of alpha for private market actors,” they write. “Sharing a small part of equity upside with those that are integral to creating value (workers, homeowners, community members) can be good for the investment overall.”

- Appreciable assets. The Dearfield Fund for Black Wealth offers Black and African American first-time homebuyers access to no-interest down payment funds. Homeowners repay the amount, plus 5% of the home’s appreciation, upon selling or refinancing (see, “How Dearfield Fund helps Black women buy homes to build wealth”). Apis & Heritage Capital Partners buys small businesses employing majority workforces of color and transitions the companies to 100% employee ownership (see, “Labor and capital align in movement for worker ownership”).

- Community ownership. “At the bleeding-edge of solutions are approaches where we start sharing prosperity and wealth generated in the entire neighborhood with people who live there and are key to the economic fabric of that community,” Das and Ramdoss write. Kensington Corridor Trust uses a neighborhood trust to acquire, redevelop, and manage mixed-use real estate property and maintain collective neighborhood ownership and control in perpetuity (for background, see, “Neighborhood trusts are taking on speculators and building community wealth”).

- Keep reading, “Building an ownership movement to close racial wealth gaps,” by Smitha Das of World Education Services and Santhosh Ramdoss of Gary Community Ventures. Catch up on all of ImpactAlpha’s coverage of the Ownership Economy.

Dealflow: Inclusive Economy

Jack Dorsey’s Block backs First Australians Capital for Indigenous-led enterprises. Like Indigenous communities in the US, Canada and other countries, many first, or Aboriginal, Australians lack access to housing, employment, health and education services, as well as capital to build their businesses. First Australians Capital, an Indigenous-led nonprofit investment and advisory firm, is raising a $30 million catalytic impact fund to provide patient debt capital to Indigenous enterprises. “Our approach is relational and grounded in Indigenous ways of connecting and trading, an approach that has been built on thousands of years of Indigenous business practices,” First Australians Capital’s Tiarne Shutt told ImpactAlpha. A $3 million allocation from Block (formerly Square), led by Twitter co-founder Jack Dorsey, brings the fund’s total commitments to roughly $18 million.

- Inclusive finance. The catalytic impact fund is “our first social impact investment here” in Australia, said Dorsey. “We know first-hand that many people are left out of the economy by mainstream services.” Dorsey says Australia is Block’s largest market outside of the US. Block backed First Australians Capital through its $100 million US social impact fund launched in September 2020, which included a $10 million set-aside for other countries. In Canada, Block supported the $153 million Indigenous Growth Fund, managed by the National Aboriginal Capital Corporations Association, which provides loans to Indigenous-led financial institutions to lend to Indigenous businesses in Canada.

- Check it out.

Easy Solar scores $7 million for energy access in Sierra Leone and Liberia. Among the many consequences of civil wars in Sierra Leone and Liberia is poor infrastructure, including low electrification rates. Only about a quarter of Sierra Leoneans have access to power (and only 5% in rural areas), while less than 10% of Liberians have reliable electricity. Freetown-based Easy Solar, one of the few providers of household and commercial solar systems in both West African countries, serves one million people. The company raised $5 million in equity from Cygnum Capital and existing investor Acumen, and a $2 million convertible note from Triodos Investment Management.

- Underserved market. Easy Solar is backed by debt from the Energy Inclusion Facility’s Off-Grid Energy Access Fund to boost its presence in rural areas, as well as a grant from the Mastercard Foundation Fund for Rural Prosperity. Separately, InfraCo Africa, PowerGen Renewable Energy and the Universal Energy Facility are funding solar mini grid development with grants. Sierra Leone’s government is looking to expand energy access with both on- and off-grid energy systems.

- Share this post.

Dealflow overflow. Other investment news crossing our desks:

- The Families and Workers Fund clinched $110 million for its philanthropic collaboration to upskill American workers for the green transition (listen to ImpactAlpha’s podcast, “Solving for both unemployment and labor shortages with high-quality jobs”). The fund is led by the Ford Foundation and Schmidt Futures. (Families and Workers)

- Cox Enterprises invested $250 million in DSD Renewables, a developer and operator of solar and storage projects in the US. DSD is majority-owned by BlackRock’s Climate Infrastructure group. (DSD)

- Supernova Invest and Crédit Agricole are partnering on a €60 million ($65.3 million) agtech fund to invest in European startups supporting a low-carbon diet, preserving natural resources and producing food with a low-waste approach. (TechEU)

- Milestones: Invest in Our Future, formed earlier this year by the Hewlett, MacArthur, Packard and Rockefeller foundations to help underserved communities take advantage of federal funding for climate-resilient projects, has grown its pooled capital to $240 million, up from $180 million. New backers include Charles and Lynn Schusterman Family Philanthropies, the High Tide and Zegar Family foundations, and a Ballmer Group donor-advised fund. The nonprofit named as its executive director Peter Colavito, an advisor to unions, environmental groups and foundations. Invest in Our Future expects to make $60 million in grant awards this year.

Signals: Climate Finance

Impact investors brave Delhi’s smog to champion climate finance in India. Impact investors in India gathered last week in Delhi’s hazardous smog to strategize ways to raise, and deploy, more climate finance. “This morning, none of us can breathe in Delhi,” Ruchira Shukla of the International Finance Corp. said the India Green Investment Forum. Funding of all sorts has declined in India, as it has globally, but investors are betting on renewable energy and electric vehicles. The forum, organized by the Impact Investors Council, sought to highlight other investment opportunities as well, including battery storage and climate-smart agriculture. “There is a need for investors to look beyond renewable financing, at the next frontier of [climate] opportunities,” Ramraj Pai, the IIC’s former CEO, told ImpactAlpha contributor Shefali Anand.

- Climate+. Shukla wants to see more investing at the intersection of climate and health. Polluted air, she said, “is a climate impact that over the long haul will destroy the respiratory health of everyone in this room, and everyone in this city.” Climate investing with a gender lens barely registers with investors, despite its outsized impact opportunity. Entelechy, which has been trying to raise a $50 million climate + gender fund, has to dispel investors’ perception that gender-lens investing is concessionary, said Entelechy’s Megha Goel.

- New players, new funds. Indian government-owned National Bank for Agriculture and Rural Development, or Nabard, is adding climate to its investment agenda and lining up a climate-related social bond of about 50 billion rupees ($600 million). The Global Energy Alliance for People and Planet, an initiative of the Rockefeller Foundation, IKEA Foundation, and Bezos Earth Fund, is setting up a catalytic capital fund to invest in climate technologies “where the risks are very high, and we know other funds will not come in ab initio,” said GEAPP’s Saurabh Kumar.

- Read on.

Agents of Impact: Follow the Talent

Elizabeth Roberts, ex- of Aegis Ventures, joins SJF Ventures as a senior analyst… ArcLight Capital Partners appointsAndrew L. Ott, former president and CEO of PJM Interconnection, as a senior advisor… Calvert Impactseeks a technical services and impact senior officer in the Washington, DC area.

Energy Impact Partnersis on the hunt for an analyst or associate for its research and innovation group in Atlanta… NatureVestis recruiting an impact investments director in London… Allianz Global Investorsis hiring a sustainability and impact investing intern in Munich… Telos Impacthas an opening for an analyst intern in Brussels.

USAID’s Climate Finance for Development Acceleratorissues a funding opportunity notice for investment managers seeking grant capital and guarantees to launch innovative climate adaptation funds or investment vehicles… LOHAS, Mossy Ventures, and Seattle Angel Conferenceare hosting “Investor strategies with donor-advised funds to create impact and returns,” tomorrow Nov. 16, at 12pm PT, featuring LOHAS’ Rick Davis.

👉 View (or post) impact investing jobs on ImpactAlpha’s new Career Hub.

Thank you for your impact!

– Nov. 15, 2023