Company valuations and developer premiums for project sales have come down in the UK battery storage market amidst rising financing costs and plummeting revenues.

Project premiums have fallen 15% in the last few months, a source told Energy-Storage.news, while the share prices of the three big listed energy storage funds have fallen 40-50% since the start of the year.

Enjoy 12 months of exclusive analysis

- Regular insight and analysis of the industry’s biggest developments

- In-depth interviews with the industry’s leading figures

- Annual digital subscription to the PV Tech Power journal

- Discounts on Solar Media’s portfolio of events, in-person and virtual

Or continue reading this article for free

Falling revenue expectations and higher financing costs

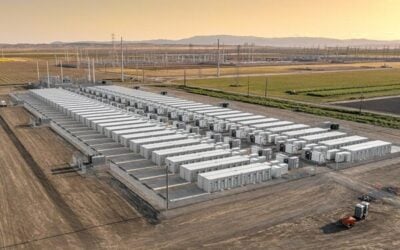

The UK market for short-duration battery energy storage system (BESS) projects has boomed in recent years to become the largest in Europe with over 3.5GW now online, with projects benefiting from high ancillary service market prices, particularly in 2022.

Saturation of those markets was always expected for 2023 but revenues may have fallen more sharply than expected as the wholesale energy trading opportunities, like in the balancing mechanism (BM) haven’t materialised to make up the difference.

This has led to a fall in both the valuations of those companies developing and operating projects, and the prices that purchasers are willing to pay for early-stage or ready-to-build (RTB) projects.

“Development premiums have come down 15% in the last few months as revenue expectations have fallen,” a BESS finance source told Energy-Storage.news, speaking anonymously.

This is also partially to do with the rising cost of capital. The effect of rising interest rates is felt in the debt space instantly, but with debt typically 20-40% of BESS financing at most the effect on the cost of equity, which takes longer to be felt, is more significant.

Both of these factors have been partially offset by falls in the cost of BESS equipment seen this year as the supply-demand imbalance closed after 2022’s supply chain shock, which saw BESS costs rise by 25% and led to the untimely fall of some firms in the engineering, procurement and construction (EPC) sector.

“Because the cost of raising these investment funds has gone up, people will want to make more return on their equity. So if I was happy to invest in this and get 9% return before, now i want an 11% return. So the price they will be willing to pay is going to drop,” a separate source said.

In the Spring, ready-to-build (RTB) projects were still selling for north of £100,000/MW (US$121,000) in the UK market but that has now come down.

A separate way to take the temperature of the market is to look at the share prices of the listed vehicles investing in and operating energy storage projects, of which there are three main ones in the UK: Gresham House Energy Storage Fund (listed under the ticker GRID), Gore Street Energy Storage Fund (GSF) and Harmony Energy Income Trust (HEIT).

Since the start of the year to the time of writing, HEIT is down 40% to 75p, GSF is also down 40% to 68.06p while GRID is down nearly 50% to 88p. The FTSE 100 meanwhile is up 1-2% in the same period.

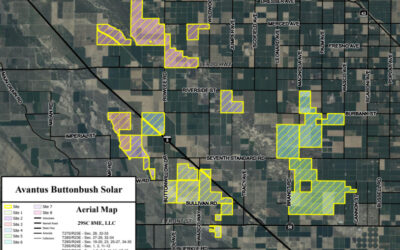

All three are diversifying internationally to mitigate against an increasingly saturated UK market, with GSF buying projects in the US and Germany, HEIT’s manager Harmony Energy targeting various European markets and GRID acquiring in California.

In a LinkedIn post today, Gore Street Capital wrote: “As the #GreatBritain (GB) market suffers from market saturation and the lack of wholesale #trading as a material revenue in place of ancillary services, our diversification strategy continues to deliver for shareholders.”

“Our international fleet under management now accounts for over 62% of the Company’s operational capacity and drove estimated weighted average revenue of £18.9/MW/hr during the September-end quarter. This is against the £6.6/MW/hr estimated average accrued by the GB portfolio.”

Perhaps not coincidentally, this period of falling revenues, falling revenue expectations and falling valuations has coincided with a flurry of acquisitions of both listed and privately-held BESS developer-operators in the UK by global asset managers.

Global infrastructure investor Brookfield bought Banks Renewables last week, private equity firm KKR acquired Zenobē in September while asset manager Searchlight acquired Gresham House, the manager of GRID and other clean energy vehicles, in July. Energy-Storage.news has been told that more deals are coming.

Energy-Storage.news’ publisher Solar Media will host the 9th annual Energy Storage Summit EU in London, 21-22 February 2024. This year it is moving to a larger venue, bringing together Europe’s leading investors, policymakers, developers, utilities, energy buyers and service providers all in one place. Visit the official site for more info.