🌏 FERC transform(er)s grid planning #198

FERC approves two landmark orders clearing the path for new transmission

Why battery plants are the unspoken “wild card” of contract negotiations

Happy Monday!

We’re baaaaack from NY Climate Week and Deploy23 in DC with a bursting issue. Climate content never sleeps—and neither do we!

Ford hit the brakes on construction of a new EV battery plant in Michigan last week as union workers escalated the strike against Detroit’s big three automakers. The US OEMs say they can't include planned battery production facilities in the labor contract negotiations, but the EV transition still looms large over the talks.

Meanwhile, young people in Portugal take 32 nations to court over inaction on climate change. Shell faces internal pressure on low-carbon business commitments, and the White House releases a National Climate Resilience Framework for the US.

The deals this week are electric, with $75M for batteries, $70M for electric boats, and $50M for electric aircraft.

Thanks for reading!

Not a subscriber yet?

📩 Submit deals, announcements, events & opportunities, or general curiosities for the newsletter at [email protected].

💼 Find or share roles on our job board here.

Last week, Ford paused construction of its $3.5B EV battery plant in Michigan amid worker strikes from the United Auto Workers (UAW) union.

The IRA and its bevy of EV and battery manufacturing incentives jolted the American EV production race into hyperspeed. Vehicles only qualify for the full $7,500 EV tax credit if the critical materials and battery components are sourced, produced, or assembled in North America or its trade partners. Automakers and battery manufacturers are racing to shore up their battery supply chains, announcing $100B in domestic cell and module manufacturing that could deliver batteries for 18M EVs.

But the sudden gearshift to EVs is driving a wedge between autoworkers and automakers, coming down to profit, pay, and parts. Established automakers are playing defense against Tesla and other rising manufacturers, funneling billions of dollars in investments toward EV strategies while still trying to keep existing ICE business in the green. Ford’s EV business is expected to lose $4.5B this year even as the company plans to spend $50B on EVs through 2026.

"We need the ICE business to generate cash and the EV business to focus on innovation," CEO Jim Farley said in March. On Friday, Farley accused the UAW “holding the deal hostage over battery plants.”

Despite the promise of new plants and jobs, EVs require far fewer parts—like mufflers, catalytic converters, and fuel injectors—than their gasoline counterparts. An EV uses 40% less labor to assemble. This means fewer workers are needed to build and maintain EVs, and vehicle manufacturing jobs will quickly shift to battery ones. The UAW is worried about how this will affect their members.

As the broader energy transition can attest, it's not a simple matter of retraining workers. The new production lines require different skills, and many of the new battery plants springing up are being built in the South where unionization is much weaker. The Ford and SK JV, BlueOval SK, which recently received $9.2B (DOE’s largest conditional loan commitment yet) is building three battery manufacturing plants in Tennessee and Kentucky.

The other roadblock to rapidly scaling a domestic battery supply chain is the lack of experience actually making batteries in North America. Despite the rising backdrop of a climate tech arms race, US automakers still need to look overseas for help. Most newly announced US battery plants are formed as joint ventures between US automakers and Asian battery giants, like LG Energy Solutions, SK On, and CATL. These battery plant workers therefore can’t be included in union contracts, automakers say.

UAW leaders want national contracts with the companies to include workers at battery factories—whether they're owned partly or fully by the automakers—who are exposed to more dangerous working conditions than vehicle assembly plant employees while being paid much less than union members.

For now, this strike puts two of the Biden administration's top priorities at odds: support for union jobs and building out domestic battery supply chains for the climate transition. President Biden is siding with the workers, becoming the first US president to walk a picket line while in office.

While progress at the Michigan battery plant is on hold, Neva Mcgruder Burke, human resources director for the BlueOval SK joint venture in Kentucky and Tennessee, told reporters on Wednesday that the decision doesn’t affect those facilities. She emphasized the steps BlueOval is taking to build the local workforce development pipeline and reach their own labor agreements with non-union workers.

🔋 Morrow Batteries, an Oslo, Norway-based battery energy storage system developer, raised $75M in Growth funding from Nysnø, Å Energi, PKA, Siemens Financial Services, and ABB.

🚢 Arc Boats, a Los Angeles, CA-based electric water boats manufacturer, raised $70M in Series B funding from Abstract Ventures, Andreessen Horowitz, Eclipse Ventures, Lowercarbon Capital, and Menlo Ventures.

✈️ H55, a Sion, Switzerland-based electric aircraft propulsion systems developer, raised $50M in Series C funding from ND Capital, Tippet Venture Partners and RTX Ventures.

📦 Traceless materials, a Hamburg, Germany-based plastic alternative developer, raised $39M in Series A funding from United Bankers, Swen Capital Partners, GLS Bank, Hamburg, Planet A Ventures, and other investors.

🔋ESS, a Wilsonville, OR-based iron flow battery developer, raised $28M in Strategic funding from Honeywell.

⚒️ Atlas Materials, a Claymont, DE-based technology platform processing low-grade nickel ores, raised $27M in Series A funding from Grantham Foundation and Voyager Ventures.

⚡ Infravision, a Sydney, Australia-based drone-enabled power line upgrades platform, raised $23M in Series A funding from Energy Impact Partners, Equinor Ventures and Edison International.

⚡ Pexapark, a Schlieren, Switzerland-based PPA software platform, raised $21M in Series C funding from Telstra Ventures, BayWa r.e. Energy Ventures, and Swisscom Ventures.

⚡ Elevation, a Chandler, AZ-based residential solar and home energy solutions platform, raised $20M in Convertible note funding from Bernhard Capital Partners.

🚢 Ayro, a Paris, France-based wingsail developer for cargo ships and yachts, raised $19M in Series B funding from SWEN Capital Partners, Bpifrance, AmInvest, Colam Impact, Ocean Zero, and other investors.

♻️ Resourcify, a Hamburg, Germany-based waste management and recycling platform, raised $15M in Series A funding from Vorwerk Ventures, Revent, Ananda Impact Ventures, Speedinvest, BonVenture, and other investors.

🏠 Ekolution, a Malmö, Sweden-based hemp-based insulation developer, raised $13M from Longrun Capital.

⚡ Continuum Industries, a City of Edinburgh, United Kingdom-based energy infrastructure planning platform, raised $10M in Series A funding from Singular and Playfair Capital.

⚒️ GeologicAI, a Calgary, Canada-based digital rock analysis platform, raised $10M in Series A funding from Breakthrough.

⚡ Neara, a Sydney, Australia-based energy infrastructure modeling platform, raised $10M in Series A funding from Square Peg Capital, Prosus Ventures and Skip Capital.

🌱 Eturnity, a Chur, Switzerland-based sales software platform for renewables deployment, raised $9M in Series A funding from Junction Growth Investors and Alantra.

⚒️ Cornish Lithium, a Penryn, UK-based lithium exploration and development platform, raised $6M in Crowdfunding from Crowdcube.

🏭 Atinary Technologies, Lausanne, Switzerland-based materials discovery platform for climate solutions, raised $5M in Seed funding from AgFunder and Cherubic Ventures.

⚡ Greenwood Power, a Brunn am Gebirge, Austria-based medium voltage power grid sensors developer, raised $5M in Growth funding from eQventure and tecnet equity.

🛵 Raptee Energy, a Chennai, India-based electric motorcycle manufacturer, raised $3M in Seed funding from Bluehill Capital.

🏠 Vamo, a Cologne, Germany-based heat pump marketplace, raised $3M in Seed funding from Neosfer and Caesar.

⚡ Metergrid, a Stuttgart, Germany-based tenant electricity platform, raised $3M in Seed funding from 468 Capital and Tiny VC.

⚡ ePower, a Cork, Ireland-based EV charging installer, raised $2M in Seed funding.

🏠 viboo, a Dübendorf, Switzerland-based predictive control for energy efficiency platform, raised $2M in Seed funding from High-Tech Grunderfonds, Rainmaking Impact and Swisscom Ventures.

🔋 oorja, a New Delhi, India-based predictive modeling for battery design platform, raised $2M in Seed funding from Micelio Fund, Capital-A, Java Capital, and Anicut Capital.

🏠 NOVO, a Berlin, Germany-based automated energy renovation platform, raised $1M in Pre-seed funding from Citizen Capital, 2bX and Antler.

💨 CO2 Lock, a Vancouver, Canada-based carbon removal and storage technology developer, raised $1M in Seed funding.

📦 Recovo, a Barcelona, Spain-based circular fashion platform, raised $1M from Zubi Capital, HearstLab, Telegraph Hill Capital, Draper B1, Social Exchange and Club Impact Angels, and other investors.

☔ Sensible Weather, a Los Angeles, CA-based weather risk consumer management platform, raised an undisclosed amount in Strategic funding from AMEX Ventures, Wonder Ventures and Industry Ventures.

♻️ ReCircle, a Mumbai, India-based waste management logistics platform raised an undisclosed amount in Seed funding from Flipkart Ventures, 3i Partners and Acumen Food.

🏠 42watt, a Munich, Germany-based retrofitting advisory platform, raised an undisclosed amount in Seed funding from Contrarian Ventures, BonVenture and Proptech1.

☀️ Sunnova, a Houston, TX-based residential and commercial solar developer, received a $3B partial loan guarantee from the US Department of Energy.

⚡ InterContinental Energy, a Singapore, Singapore-based green hydrogen company, raised $115M in funding from GIC and Hy24.

BXVentures, a New York, NY-based investment firm, announced its target to raise $250M to back climate tech trapped in universities.

Anzu Partners, a Washington, WA-based investment firm, closed its $200M fund that invests in clean technology, industrials and life sciences.

Blume Equity, a London, UK-based climate tech investment firm, announced a $43M injection from the European Investment Fund (EIF).

Share new deals and announcements with us at [email protected]

The U.S. federal government narrowly avoided a government shutdown over the weekend, with Congress reaching a stop-gap agreement to have the same fight again in six weeks. Meanwhile, the White House released the National Climate Resilience Framework, designed to align the federal government and its partners on climate resilience investments and activities, and the structure of the IRA and the Infrastructure Investment and Jobs Act ensure that much of the federal government’s climate initiatives are resilient to government shutdowns.

The International Energy Agency reported on the realities of clean hydrogen projects and rekindled hope for a 1.5C pathway this week. The Agency’s updated 2021 Net Zero Roadmap lays out a harrowing tightrope walk requiring the United States to reach net zero before its stated goal of 2050. Germany and the UK also signed an agreement on hydrogen collaboration to spur the development and international trade of low-carbon hydrogen.

Six young people arrived on Wednesday at the European Court of Human Rights to bring charges over climate change against 32 European countries. The youths, aged 11-25 and all from Portugal, are plaintiffs in the first climate change case brought before the court. It is the largest global climate legal action in history.

The Biden administration announced offshore drilling rights in three areas in the Gulf of Mexico—the fewest in history. This was following a U.S. appeals court decision that required the Biden administration to include an additional 6 million acres they had previously removed to protect habitats of an endangered species.

U.S. Energy Secretary Jennnifer Granholm has set her sights on a commercial nuclear fusion reactor within the next decade. The Lawrence Livermore National Laboratory in California demonstrated the first viable fusion facility last December.

Shell’s CEO received an open letter from employees after announcing that the company would slow investment in renewables and low-carbon business. Shell recently removed the role of global head of renewables and divided its low-carbon business. BP, the only major oil company that had aimed to cut fossil fuel output by 2030, may also falter on its renewable energy ambitions following the departure of its CEO, who had driven those efforts.

Given the state of carbon markets, people are digging deeper into commitments and impacts. Carbon credits analysis by CarbonBrief shows half of the offsets purchased by the world’s 50 largest companies with net zero targets are from questionable forest protection projects. And in a ranking of VC-backed companies in the UK that included offsets, Supercritical found that despite collectively raising $40B in capital, 76% of the 500 companies included in the research have done nothing on climate action.

British International Investment (BII), the UK’s development finance institution, is planning for $1 billion in investments for renewable energy projects in India by 2026.

Multiple EU-based insurance companies are behind underwriting for ~1/3rd of US coal, going against climate commitments. And FEMA’s flood insurance program is underwater, with suits for insurance prices incorporating risk being both too high and too low.

“Free-range organic humans have the most delicious blood,” jokes the satirical songwriter, who went viral vampire to save the planet.

Just to put it all into perspective… mammals might all fry when the world becomes a supercontinent (again) in 250 million years.

Gone with the wind. Hurricane Lee blew birds straight across the Atlantic.

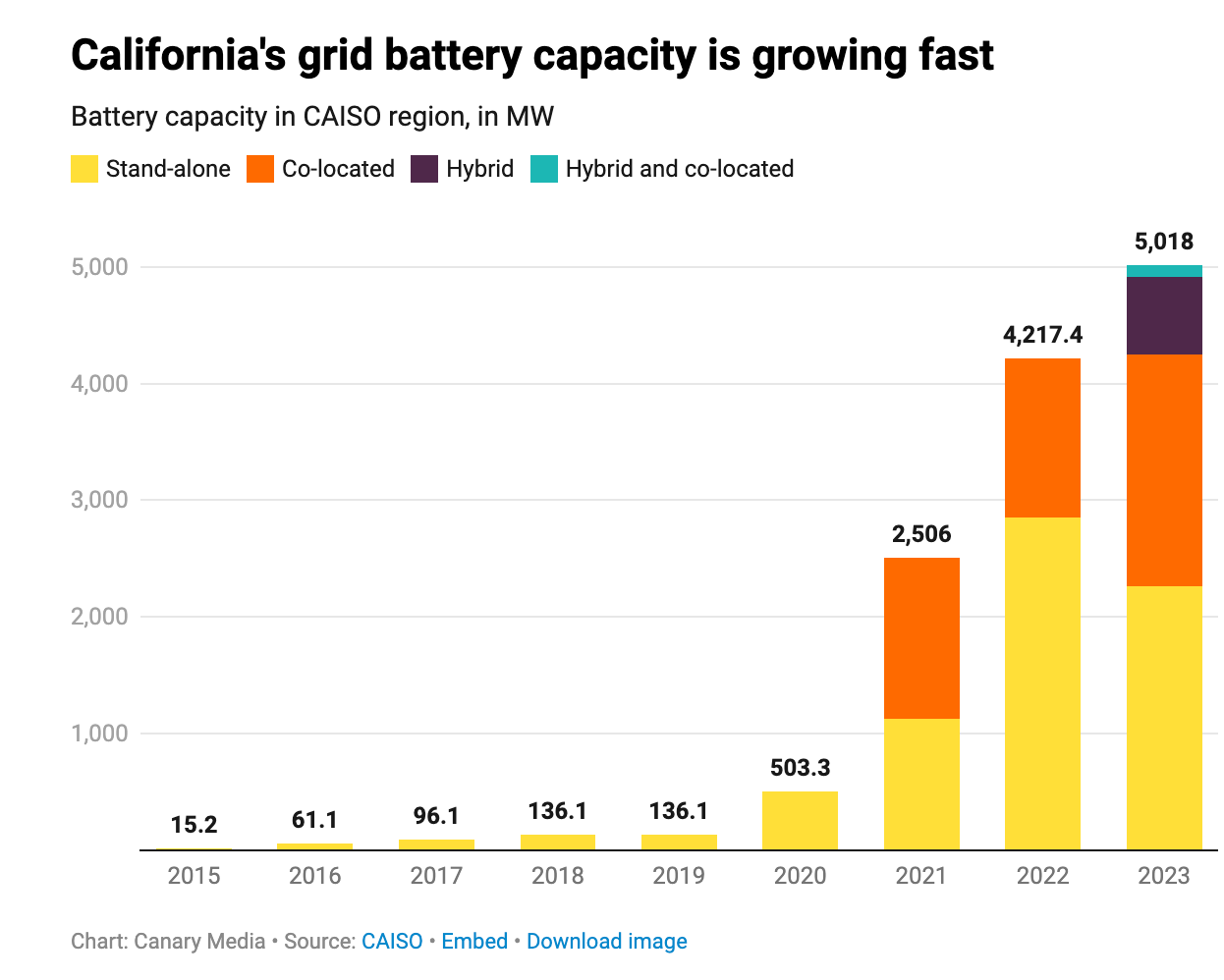

A welcome surge in grid storage capacity in California.

Lego builds on its green commitments, despite its latest failed sustainable materials attempts.

Green on green billionaire violence comes to punches with Gates’ vs Benioff's “trillion tree plan.”

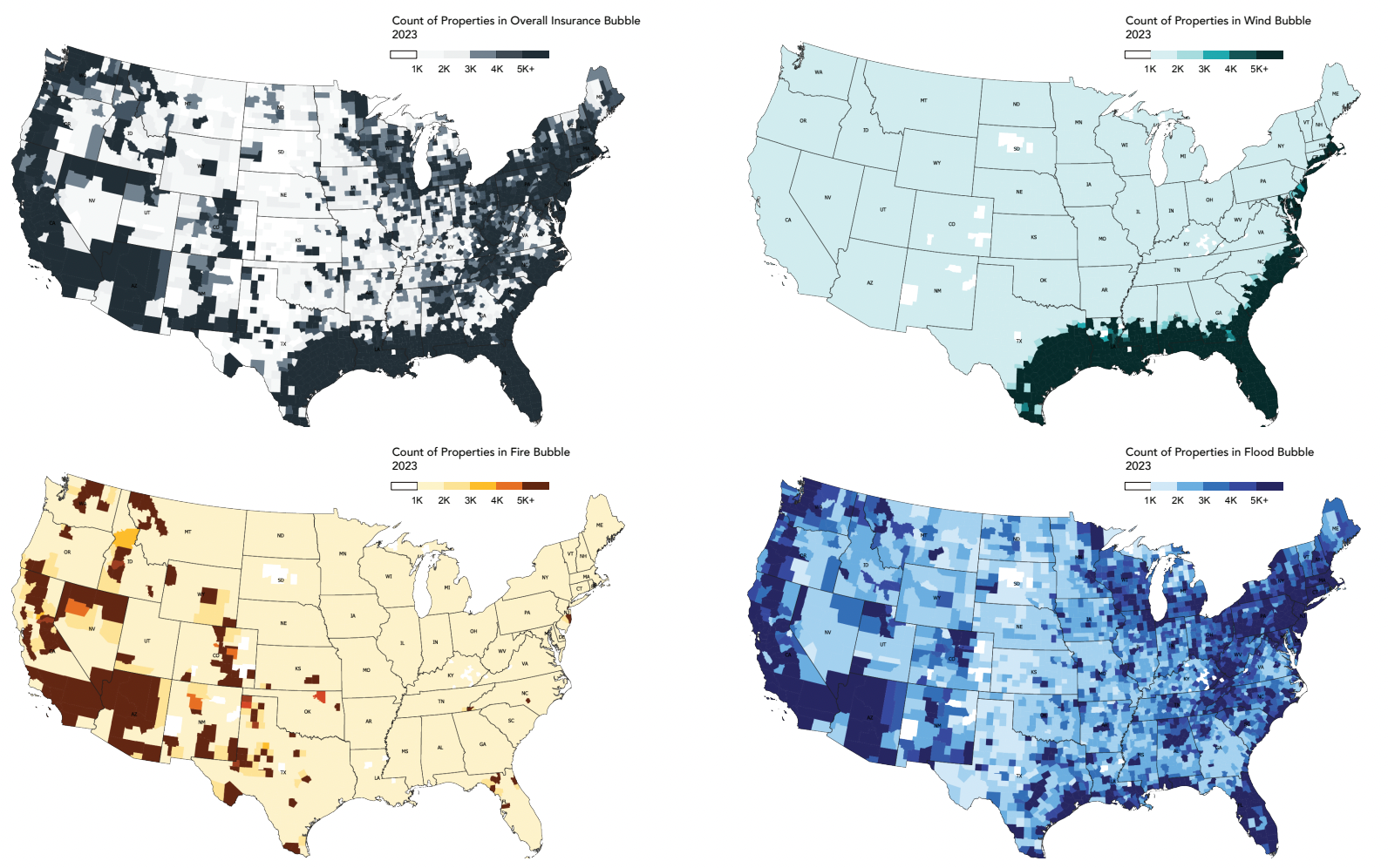

39 million properties are at high risk of flooding, wildfires, and hurricane winds—yet to be accounted for in insurance premiums.

Climate change brings new meaning to vacation “hot spots”.

Liquid assets. Israel makes a splash by trading water for power with Jordan and UAE.

Meet Itziar Irakulis Loitxate, the 27-year-old Ph.D. student aka climate police.

Opportunities & Events:

🗓️ Carbon Unbound: Register to join Carbon Unboard, Europe’s leading carbon removal summit on Oct 3rd-4th in London. The conference will showcase numerous global leaders and innovators across climate tech.

🗓️ Energy in 3D Conference: Attend the 2023 Wharton Energy and Climate Conference on Oct 27th to learn from featured experts, academics, and policymakers discussing the 3Ds: decarbonization, digitalization, and decentralization.

💡 Uptake Alliance: Apply to Uptake Alliance's new venture development program by Oct 27th, to receive 6-months of support for your market-ready startup to land commercial agreements, gro revenue, and build your teams.

💡 FAST Grants: Apply to the Fueling Aviation’s Sustainable Transition grant program by Nov 27th to access nearly $245m of sustainable fuel grants to support your low-emission aviation technologies.

Data Engineer @CTVC

Founder Industrial Heat, Industrial-scale Heat Pumps, Zero Emission Shipping @Deep Science Ventures

Enterprise Account Manager @Pave Power

Climate Impact Expert @World Fund

Investment and Fund Partnerships Senior Associate @Third Derivative

Director of Finance @RE-volv

Director of Innovation (Renewable Energy) @Elemental Excelerator

Policy Manager, Project Manager @EV Realty

Feel free to 📩 send us new ideas, recent fundings, events & opportunities, or general curiosities. Have a great week ahead!

FERC approves two landmark orders clearing the path for new transmission

Key development signals across nuclear, DAC, geothermal, and DLE

The U.S. gives new guidance on qualifying for SAF tax credits.