TGIF, Agents of Impact!

🗣 Nick of time. “When a man knows he is to be hanged,” Samuel Johnson once said (according to Boswell), “it concentrates his mind wonderfully.” U.S. legislators engaged in all manner of distractions before acting to prevent a catastrophic default on the nation’s debt. Distractions can be equally catastrophic in dealing with more slow-rolling risks. ExxonMobil, for example, told shareholders the 1.5° warming scenario under the Paris climate agreement is unlikely to be achieved; therefore, the company’s risks under such scenarios do not “meet the level of likelihood required to be considered in our financial statements.” A coalition of 21 Republican state attorneys general included a similar point among a welter of legal threats to major asset managers that has succeeded in chilling their support for climate and ESG resolutions, as Amy Cortese and I reported (Manifest Social’s Ryon Harms chimed in with a helpful roundup of the mounting costs of the ESG backlash).

Missing the mark on 1.5° is no excuse for climate inaction. In the face of dwindling water supplies from the Colorado River, Los Angeles’ Department of Water and Power this week issued $484 million in bonds to finance capital improvements to the water system, including $300 million for recycled water production, as our partner HIP Investor highlighted in its weekly report on municipal bonds with social or environmental significance (don’t forget to sign up for this month’s Agents of Impact Call on racial equity strategies for muni bond investors). Tesla, Sunrun, 3M and other public companies still are touting their climate bona fides, as ImpactAlpha detailed in our latest roundup of annual impact reports. Capricorn Investment Group is riding on its impressive record of cleantech investing to attract families and foundations to its “outsourced chief investment officer” model, as Capricorn’s Kunle Apampa told me on an Agents of Impact podcast. The pols may have pulled the fat out of the fire in the debt-limit crisis; we can’t afford such folly in the fire next time. – David Bank

The Week’s Podcast

🎧 Impact Briefing. David Bank joins host Monique Aiken to talk about the ownership economy, ESG backlash and system-level investing. Plus the headlines.Listen to this week’s episode, and follow all of ImpactAlpha’s podcasts on Apple, Spotify or wherever you listen.

The Week’s Chart

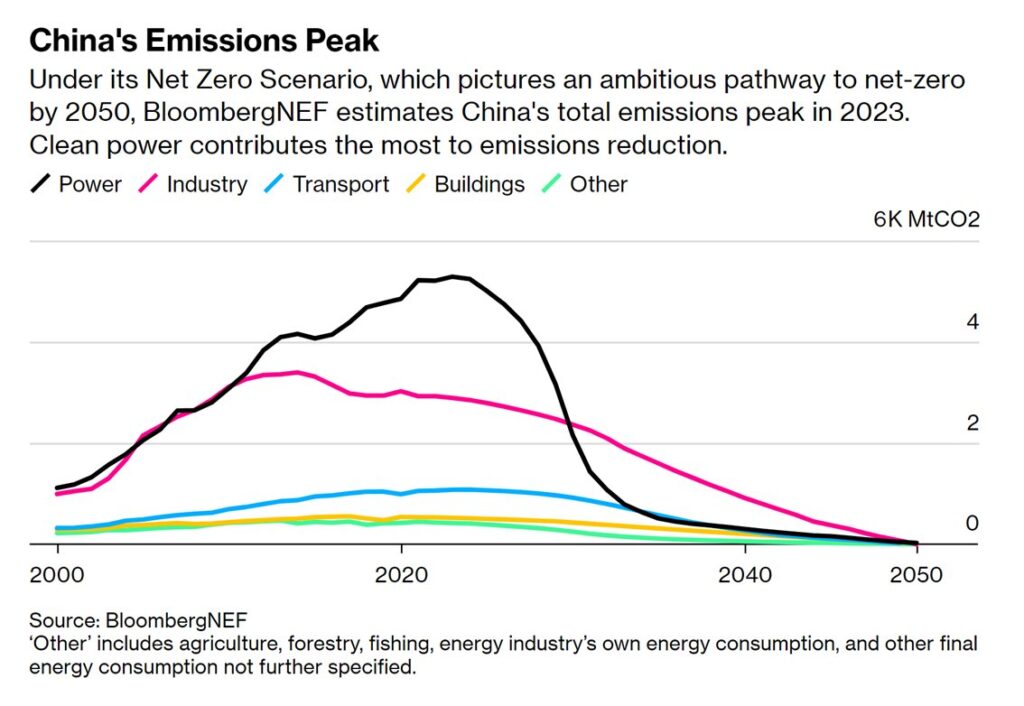

Net-zero pathway. A boom in solar and electric vehicles is driving down emissions and pushing the world’s largest carbon-emitter toward an energy tipping point. BloombergNEF expects China to add three times the amount of solar in 2023 than it did just two years ago. EVs now make up one-third of new car sales. The accelerated progress could push China’s fossil fuel use into long-term decline as early as next year, according to the Centre for Research on Energy and Clean Air. The excitement, says Bloomberg’s Dan Murtaugh, “suggests China is nearing an inflection point in its energy transition more than a half-decade before a 2030 target to peak emissions.”

The Week’s Dealflow

Deal spotlight: Fusion is heating up. Some $5 billion in private capital already has been invested in fusion energy startups. Last month, Microsoft inked the first pre-purchase agreement for grid-connected fusion power – to be delivered by 2028. This week, the U.S. Department of Energy awarded $46 million to eight fusion companies to help commercialize the technology, contingent on milestones to be met over the next 18 months. “It’s no longer a question of possibilities,” said Energy Secretary Jennifer Granholm. “It’s a question of ingenuity and whether we can muster up the investment and the commitment that this challenge demands.” As ImpactAlpha’s Climate Co-Investor Tracker, developed by Vibrant Data Labs and SecondMuse, shows, the DOE and National Science Foundation have long been the hub of the climate-tech ecosystem.

Advances in technology and materials are bringing commercial fusion, long considered the holy grail of energy, tantalizingly close to reality. Commonwealth Fusion Systems in Cambridge, Mass. uses a doughnut-shaped tokamak and high-powered magnets. Type One Energy in Madison, Wisc., which employs a stellarator design, raised $29 million this week in a round led by Breakthrough Energy Ventures, TDK Ventures and Doral Energy Tech Ventures. Redwood City, Calif.-based Xcimer Energy uses laser inertial confinement, the same approach used by Lawrence Livermore National Laboratory to generate “net energy” last year. Seattle-based Zap Energy eschews magnets and lasers for a sheared flow “Z-pinch” system that could lead to low-cost, compact fusion generators. Realta Fusion is developing compact magnetic mirror fusion generators with an eye towards decarbonizing industrial processes. The University of Wisconsin-Madison spinout raised a $9 million seed round from Khosla Ventures this week.

Fusion is “the ultimate energy source,” said Phil LaRochelle of Breakthrough Energy Ventures, which has invested in Commonwealth and Zap in addition to Type One. The public milestones could help investors better evaluate progress towards commercial viability, he said, “opening the doors for a lot more private investment to come in.”

- Keep reading, “Fusion is heating up,” by Amy Cortese on ImpactAlpha.

Africa’s green transition. Sun King raised $130 million through securitization of off-grid solar payments… Ghana’s Kofa raised a seed round for multi-purpose EV batteries… E3 Capital and Lion’s Head Global Partners raised $48 million to invest in African ventures supporting low-carbon economic development… FSD Africa Investments invested £1 million in Africa Climate Ventures, a venture builder for carbon tech and climate change mitigation in Africa.

Clean energy. FinDev Canada and Triodos Investment Management provided a $10.2 million loan to Maranatha to develop solar capacity for the Dominican Republic’s electricity grid… Boeing inked a deal to buy green hydrogen from Equatic… CleanJoule raised $50 million to use agricultural waste and other biomass to make alternative jet fuel… Proxima Fusion raised €7 million and is spinning out of Germany’s Max Planck Institute to deliver fusion energy by 2030.

Climate tech. Google Ventures joined a £5.3 million equity round for CUR8 to help companies identify carbon removal projects to meet 2050 net-zero goals.

Education and skills. Korbit Technologies raised $11.3 million for its AI-guided mentoring application for software developers… KKR’s Global Impact Fund reupped its investment in EQuest Education Group to expand EQuest’s network of international schools in Vietnam.

Investing in health. Generation Investment Management backed Toronto-based BenchSci, which is using artificial intelligence in new drug discovery and life sciences research… YeneHealth secured funding from The Case for Her to provide menstrual cycle and health information to women and girls in Ethiopia.

Place-based investing. Opportunity Zone investors bet $5 million on a Pennsylvania factory supporting the green building transition… Los Angeles issued an impact muni bond for water sustainability… Boston Impact Initiative invested in Boston While Black, a membership network designed to “enable Black people to thrive in Boston.”Returns on inclusion. Packard and Ford foundations backed Nusantara Fund to bolster climate resilience for Indonesia’s Indigenous communities… Seed Commons provided debt financing to support Third Eye Trucking, a trucking cooperative founded by three formerly incarcerated individuals… Mission Driven Finance invested in KIGT, a Black-owned company making small-sized EV charging stations.

The Week’s Talent

Wanjiru Kamau-Rutenberg of Black Women in Executive Leadership joins the board of Autodesk Foundation… Former Enel CEO Francesco Starace joins EQT Infrastructure as a partner… Isabelle Schmidt, ex- of Wellington Management, and Pooja Monga, ex- of KOIS, join Beyond Capital Ventures as an operations associates.

The Week’s Jobs

💼 Share the week’s impact jobs. Want to post a job in The Brief? Drop us a note.

In New York: Domini Impact Investments has an opening for a senior marketing and communications associate, and AXA IM is on the hunt for a global health investing vice president.

On the West Coast: Elemental Excelerator is hiring a chief of staff and the Alliance for Community Development seeks an executive director in the San Francisco Bay Area… Illumen Capital is hiring a vice president of investor relations in Oakland.

In Canada: FinDev Canada is recruiting an environmental and social risks director in Montreal… TELUS Pollinator Fund for Good is looking for a senior associate and principal in Toronto… Ontario Teachers’ Pension Plan seeks a sustainable investing principal for a 16-month contract.

Elsewhere: Palladium is hiring a director of financial inclusion in London… Impact-Linked Finance Fund is recruiting a board treasurer and board secretary in the Netherlands… Triple Jump is hiring a seed capital investment manager in Amsterdam… Root Capital is looking for a gender equity advisor in Indonesia.

That’s a wrap. Have a wonderful weekend.

– June 2, 2023