🌎 Busting geothermal myths with Bedrock Energy

The Goldilocks effect in geothermal HVAC systems

The role of green banks in climate tech deployment with the Coalition for Green Capital

All banks are in the business of green. So what’s special about literal green banks?

Just as their name suggests, green banks provide catalytic financing and support for clean energy projects, often when these projects are too risky or expensive for private investors or larger-scale lenders.

Green banks have been a part of the “sustainable investing” conversation in the US since the early 2000s, with a national green bank first proposed during the Obama-Biden administration in 2009. When the measure failed, state green banks were established, beginning in Connecticut in 2011 and operating in 28 states as of last year. Now, provisions in the Inflation Reduction Act (IRA) are finally bringing the vision of a federal green bank to fruition, and an expanding network of green banks around the country are preparing to let the green green fly by deploying $27B in funding in the coming years.

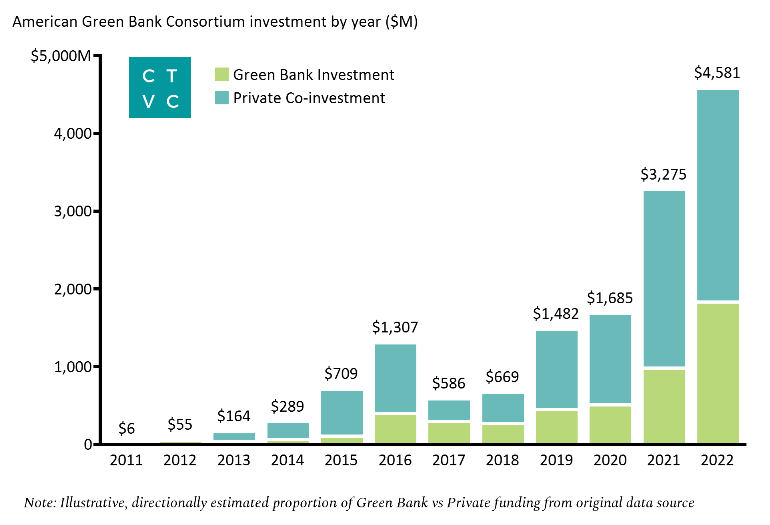

The goal is to provide catalytic capital to clean energy and other climate tech projects—typically attracting a ratio of $3 of private investment for every $1 from the green bank—and prove that clean lending can be profitable for commercial banks or other private sector financial institutions. The number of green banks in the US is growing but remains relatively small. Since 2011, green banks have driven $14.8B in investments—$4.2B public and $10.6B in private.

💸 Catalytic capital: Green banks make investments that are more risk-tolerant, patient, or even concessionary in order to reduce the cost of capital for projects with climate impact.

🫱 Lending products: These institutions provide a range of options, including project finance, bridge to tax credit financing, and support for inventory or working capital as companies grow.

✨ Credit-enhancement: Solar projects, for example, are revenue-generating rather than assets based on credit or debt. Green banks help support low- or no-FICO score customers that traditional lenders may be unable to underwrite.

💪 Confidence for other investors: Through standardization and a proven track record of returns on projects perceived at higher-risk, green banks encourage investment from the private sector.

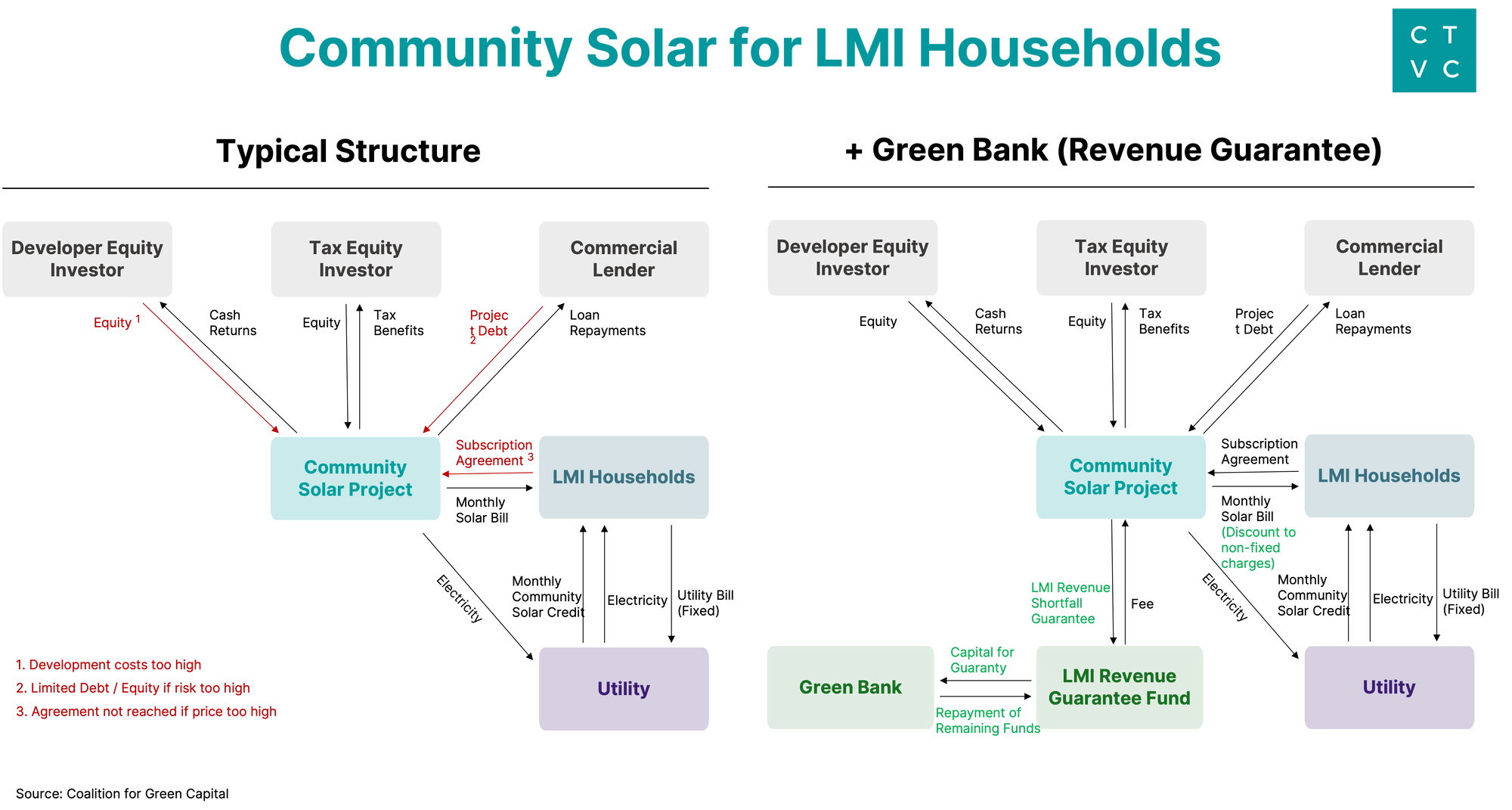

LMI community solar projects using a typical tax equity structure face a slew of barriers, including:

A green bank adding a revenue guarantee fund to the structure significantly de-risks the equation. By providing a pool of capital to guarantee revenue shortfall from LMI households, a green bank essentially erases the perceived repayment risk and puts the project back in the (invisible) hands of the private markets.

The IRA essentially creates a national green bank network to provide capital recycling. The $27B in total funding will be distributed through EPA’s Greenhouse Gas Reduction Fund (GGRF), with the largest portion of money going to a few lenders to act as national green banks that directly invest—especially in areas where the state government likely won’t seek federal clean energy funding—as well as provide standardization and other support to state and local green banks.

The GGRF is divided into three categories:

The notice of funding opportunity (NOFO) for the Solar for All competition launched last week, and the EPA just released the NCIF and CCIA notices this morning. Applications are due in September and October, respectively. Recipients will likely be announced in spring of next year and funding will begin flowing to Solar for All winners in July. All the GGRF money has to be deployed by September 2024.

The Coalition for Green Capital (CGC) has been working toward establishing a national green bank since 2009. During that 14 year legislative push, the organization has helped establish 20 local green banks and mobilize $9B in clean energy financing. Now CGC is seeking GGRF funding to begin directly investing and continue supporting local green banks with standardization.

We spoke with Eli Hopson, executive director and chief operating officer of the CGC, about the role of green banks in the energy transition, the importance of the IRA funding, and how the CGC is preparing to deploy capital and support standardization across the network of green lenders.

What’s your background and how did your past experience led to your work at CGC?

I have an undergrad and Master's in environmental engineering. I actually came to DC to work at the EPA, but it was during a hiring freeze. So I got a position at the Department of Energy in the Renewable Energy Office. I spent about 10 years at DOE on the energy policy side. Then I got interested in the legal aspects, so I went to law school and spent about 10 years as an energy attorney—first at Latham & Watkins and then at a hydropower startup, Cube Hydro, which sold to Ontario Power Generation for $1.2B. As I was thinking about what the next opportunity might be, the posting for DC Green Bank’s inaugural CEO came out. I applied for that and got selected, so I was getting DC Green Bank set up for ~2.5 years. Then the CGC team, who I had worked with when I was at Latham & Watkins as pro bono counsel, came to me with the opportunity to set up a national green bank, with the IRA finally being passed. The opportunity to make that kind of a difference on a national scale was too good to pass up.

Where do you see capital from green banks fitting in the capital stack? Which types of companies or projects do you work with?

We think of ourselves as being the flexible catalytic capital—where there's a gap, we're going to figure out if there's a way we can fill it. The asterisk to that is green banks are typically not taking first of a kind technology risk. It’s much more common to be looking at scale-up or business model risk. So solar is an easy example. Even though solar is an established technology and has had a lot of success nationally, many of the local banks weren't familiar with it. And it certainly doesn't have the kind of lending history that commercial real estate does of 100 years or 50 years, and all of that related experience in underwriting and credit score systems and methodologies, etc. The local banks viewed solar as a relatively new technology. That's an area where a green bank can step in, take that perceived risk, and demonstrate that in the local market, solar is eminently financeable.

But you take that sort of simple example and you can apply it to building efficiency, you can apply it to EVs—any of these technologies that are proven from a technical sense, but they haven't really reached the scale where the commercial sector is fully comfortable financing them at competitive rates. That's the bullseye scenario for the green banks. Let’s figure out is there some kind of first-loss position or some kind of other credit enhancement in that deployment effort that we can take?

Where do green banks sit on the private to public spectrum? Is the capital complementary or supplementary?

Our goal is to be the path to private sector commercial capital. So if it's a company that needs 100% of the financing for a particular project, there are green banks that will do that. With the goal being that that's a demonstration, and then the next project the company does, maybe there's participation from the private sector and the green bank role is more in the credit enhancement vein. Moving along that path to full private sector financing is our ultimate goal, because when you look at the need for climate-focused financing over the next 10 years, there’s an estimated $1T in additional capital that’s necessary. The GGRF is very large, but it's not nearly that large. The public sector sources are sizable, but they're not going to be 100% of that financing. So we're really focused on how do we finance projects in a manner that's bringing the private sector in or demonstrates for the private sector that this is going to be an ideal target market for them?

What are your ideal project profiles relative to other public sector capital, such as the Loan Programs Office (LPO)?

The central idea is that we don't want to displace any other capital. Our goal is not to compete with LPO. Similarly, it's not the goal to compete with Citi or Bank of America or any of the local or other private sector banks. I see a lot of opportunities for us to work in partnership. Because LPO has to address credit risk as it's graded by the agencies currently, LPO may not be comfortable with a low- or no-FICO score project, for example. There might be an opportunity there for us to work with LPO, to take some of that risk that they are unable or would be very expensive for them to take on. We're actively having discussions with LPO about projects that might be a good fit for some of the new language authorizing LPO’s additional authority. There's also a scale opportunity, because where LPO is most effective is on the very large-scale projects. A lower threshold, like a $25 million or $30 million project, that's going to be below their comfort level, just from the amount that they need to make those projects pencil out. We would ideally be in the position of helping to put together portfolios, where we can get to a scale that's useful for LPO and fits into one of their programs. Or running along side-by-side for projects that they're not able to finance. Ideally, we're not doing fully concessional finance. We want to be able to show that this can be successful at a rate that the market is going to see as interesting, once it's proven out and demonstrated.

What types of companies or at what stage of development should companies be seeking out green bank financing?

We're very interested in supporting the smaller-scale businesses as they are growing, because I think that's a target market that is not currently very well-served by the financial sector. Not in terms of providing startup equity, but that scale-up challenge, whether it's financing for inventory, for working capital, to help bridge some of the gaps of growth. When we look at how much investment needs to happen in the business community to meet the demands for EV charging, all of the services associated with energy efficiency, solar—that's an area where we don’t want the economy to be held back because those businesses weren't able to grow at the speed that they need to, especially with all the IRA and tax credit-related funding coming. But we also work with Fortune 500 companies and fully national-scale companies, so happy to be working along the full spectrum of size. It's any of those companies that are having challenges financing projects for the climate and particularly in low-income communities. There is more flexible support coming out of EPA for companies that are based in low-income and disadvantaged communities, so that is a target to some extent for growth.

What level of collaboration and cooperation have you seen among green banks?

In DC, we used programs from four other green banks as we were getting started. At CGC, we are running an emerging green bank working group. There's about 20 operating green banks right now who are members of the consortium. Those range from full state agencies to quasi-public entities to fully independent nonprofits. Because of the IRA, the interest in starting a state or local green bank has grown significantly over the past year. So we have another 20 members who are somewhat established but seeking significant capital expansion or are becoming established. Then on top of that, there's yet another ~20 groups that we're talking to across the country, filling in some of the gaps where there's not a green bank that exists yet.

How can green banks help foster an equitable energy transition? What is the focus of your work with low income or disadvantaged communities?

At DC Green Bank, we worked with PosiGen to provide construction-to-permanent financing, but we required that they not consider FICO score as part of that financing. That was part of creating a pool of loans that is based on going into the market without having that credit score hurdle. Over time, we'll see how it performs, and we'll be able to use that as a model of why the current FICO standards are not really the best fit for solar finance pools.

Another very pertinent example is the affordable housing market, and this is one of the products that I borrowed from another green bank. When I started, I did a listening tour talking to a lot of real estate developers, renewable energy developers, asking what's the gap? Where do we see the opportunities? Pre-development financing turns out to be pretty critical. It's high-risk, but it's a relatively small dollar amount. So if you can provide pre-development financing—and encourage consideration of green factors when the permits and the basic engineering designs are being done—you can actually have a pretty massive impact relative to the amount of dollars that you're deploying. That one is harder to see how it gets to be a fully commercial enterprise, because you have to really value the impact, which the green bank does. But we view that as almost a marketing and investment expense, where you're spending a very small amount of money, building a network that you work with, and there's the opportunity to participate in construction and permanent financing down the road for those projects.

What does your risk/return profile look like?

The capital is recycled over time. You have to build a strong track record, and our current member default levels are under 0.5%. There are more accelerated recycling options. The McKinsey report models how that can turn the GGRF into the $250B that we see as necessary to meet the climate goals.

For example, If you have a portfolio of solar loans across the country and they are standardized enough, they can be put into a pool, securitized, and recycled that way on a much more accelerated basis than the end of the term of that loan. So that's part of why we see the national standardization and coordination as really critical—to be able to accelerate that recycling or other similar types of recycling, where you're putting together portfolios, you're engaging the large-scale private sector market in a way that right now our members, for the most part, can't reach that scale. Rates will be preferable. And from a national portfolio perspective, you can also spread the cost of those kinds of financing. That's one of the key goals of having a national focus institution.

What else should investors know about green banks?

There's a ton of private sector participation at the local green bank level, and we're actively having a variety of those conversations with potential large-scale financial partners at the national level. The capital ratio for the average green bank project is only 25% from the public capital versus 75% from other sources, and that's usually private.

The EPA will name recipients of Solar for All dollars in March 2024 and funding will start flowing in July. All the GGRF money has to be obligated by September of next year. So for your philanthropic and impact investor-focused readers, there's a real need over the next six to eight months to help build the capacity—both in the recipients space, like ourselves and other nonprofit community lenders, but also on the business side, to help get everyone ready for the capital infusion so that the dollars can be deployed as quickly as possible. Not only is time money here, but time is so important from a climate perspective. We want to make sure that we're not missing the next eight months of opportunity, so we're actively seeking impact investments. We're talking to a lot of projects that are ready and wish we had funding now, and we'd love to be helping to connect those to existing climate investors, while also building the capacity and getting folks ready for when the decisions are made, and the dollars start to flow from the GGRF.

Even after the EPA dollars are flowing, we think there will continue to be an opportunity for side-by-side investments with larger investors. We don't want to compete. We want to make it easier for these projects to move into the more traditional private sector markets. So if folks are interested in what a potential partnership looks like later next year, as we're scaling up, we're open to that as well.

Got green bank envy? CGC is looking for ideas from businesses, community lenders, and other organizations on how to partner with their national green bank network on clean energy projects. Submit your concept by July 15.

The Goldilocks effect in geothermal HVAC systems

Scaling “symbiotic manufacturing” with Rubi Laboratories

How software and AI could reduce barriers to clean power purchases with Verse