By Kyle Harrison, Head of Sustainability Research, BloombergNEF

- December retirements 43% more than the previous highest month

- Offset market will need to boost integrity to hold momentum

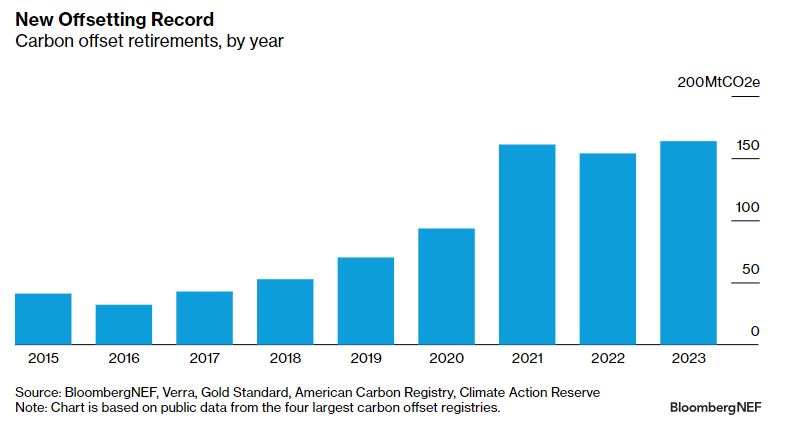

Even after a turbulent year full of scandals and accusations of fraudulent projects generating carbon offsets, companies reaffirmed their commitments to their net-zero goals by purchasing and retiring a record 164 million of these offsets in 2023. This is up 6% from the 154 million offsets retired in 2022.The carbon offset market, where verified emission reduction certificates are bought and sold by companies, was poised for its second straight down year in retirements – the key indicator of demand. Through November, just 127 million credits – representing 127 million tons of CO2 equivalent – had been retired, down from 129MtCO2e at the same point in 2022. However, companies retired 37 million credits in December alone, some 43% higher than the next largest month on record (25.9 million in December 2021). Large companies retiring offsets or signing contracts to do so in December included Shell, Salesforce, HP, Microsoft and Nestle.

The surge in activity in December is a vote of confidence for carbon offsets as a tool to help companies neutralize their residual emissions in order to achieve net-zero goals. The market saw a wave of support from policymakers, corporations and nonprofits at COP28 in Dubai, especially in the wake of failed negotiations to advance a UN-regulated carbon market under Article 6.4 of the Paris Agreement. It’s not out of the woods, however – groups like the Integrity Council on Voluntary Carbon Markets and the Voluntary Markets Integrity Initiative will need to continue to refine standards defining what high-quality offsets look like. Financial institutions will also need to hold companies accountable for poor offsetting practices. The success of these efforts will determine whether this record volume is a mirage or the beginning of a huge growth cycle.

BNEF clients can access more carbon offset data here.