As I indicated in the previous article, BP has turned over publication of the annual Statistical Review of World Energy to the Energy Institute (EI). The Statistical Review is instrumental in providing comprehensive data on global oil, gas, and coal production and consumption, as well as on carbon dioxide emissions and renewable energy statistics.

The full report and all data can be found at this link. Today, I will cover the recently published 2023 report’s highlights.

Overview

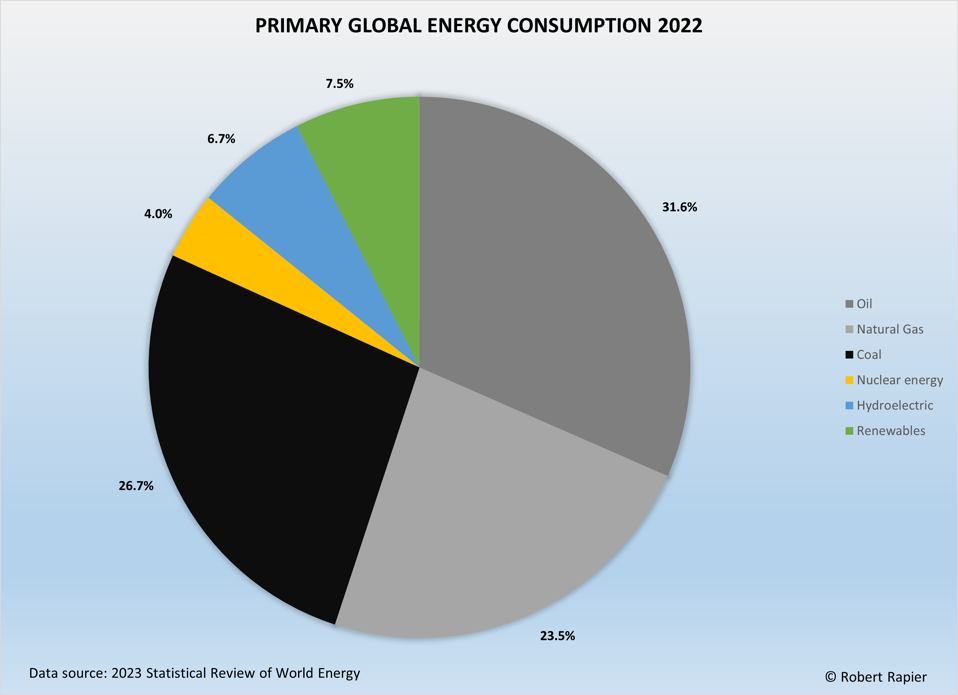

The newest Review shows the world remains heavily reliant on fossil fuels for energy needs, even as renewables like solar and wind continue rapid growth.

While renewable power expanded at record rates, fossil fuels maintained an 82% share of total primary energy consumption. Natural gas and coal demand stayed nearly flat with oil rebounding close to pre-pandemic levels. For reference, this is down from an 87% share in 2010. At that rate of decline, it would be nearly 200 years before fossil fuel consumption reached zero.

Global energy demand grew by 1.1% in 2022 to a new record, but slower than the 5.5% growth in 2021. This was due to a number of factors, including the war in Ukraine, which disrupted energy markets, and the economic slowdown in China.

Renewable energy continued to grow strongly, with solar and wind reaching a 7.5% share of primary energy consumption. This was an increase of nearly 1% over the previous year. Renewable power (excluding hydro) grew 14% in 2022, slightly below the previous year’s growth rate of 16%.

Global coal demand grew by 0.6% in 2022, to the highest level of coal consumption since 2014. The growth was triple the 10-year average growth rate of 0.2%. The growth in demand was largely driven by China (1%) and India (4%). Global coal production increased by over 7% compared to 2021, reaching a record high. China, India, and Indonesia accounted for over 95% of the increase in global production.

Oil demand grew by 3.1% in 2022, also well ahead of the 0.9% 10-year growth average. This was due to the ongoing post-Covid economic recovery. Consumption remained 0.7% below 2019 levels. Global oil production increased by 3.8 million barrels per day (bpd) in 2022, with OPEC+ accounting for more than 60% of the increase. Among all countries, Saudi Arabia (1,182,000 bpd) and the US (1,091,000 bpd), saw the largest increases.

Global natural gas demand declined by 3% in 2022 dropping just below the 4 trillion cubic meter mark achieved for the first time in 2021. Its share in primary energy in 2022 decreased slightly to 24% (from 25% in 2021). The decline was attributable to record price levels in Europe and Asia in 2022, rising nearly threefold in Europe and doubling in the Asian LNG spot market. U.S. Henry Hub prices rose over 50% to average $6.5/MMBtu in 2022 – their highest annual level since 2008.

Global electricity generation increased by 2.3% in 2022 which was lower than the previous year’s growth rate of 6.2%. Wind and solar reached a record high of 12% share of power generation with solar recording 25% and wind power 13.5% growth in output. The combined generation from wind and solar once again surpassed that of nuclear energy.

Coal remained the dominant fuel globally for power generation in 2022, with a stable share around 35.4%, down slightly from 35.8% in 2021. Natural gas-fired power generation remained stable in 2022 with a share of around 23%. Output from nuclear power fell by 4.4%. Renewables (excluding hydro) met 84% of net electricity demand growth in 2022.

Record High Carbon Emissions

Meanwhile, carbon dioxide emissions from energy rose 0.9% to a new high of 34.4 billion metric tons, indicating lack of progress in curbing worldwide carbon output. Emissions have moved further away from the reductions called for in the Paris Agreement.

“Despite further strong growth in wind and solar in the power sector, overall global energy-related greenhouse gas emissions increased again,” said EI President Juliet Davenport. “We are still heading in the opposite direction to that required by the Paris Agreement.”

Ukraine War Drives Energy Crisis

The data shows the profound impact of Russia’s invasion of Ukraine on energy markets. Russia’s disruption of energy imports skyrocketed natural gas and coal prices to all-time highs in Europe and Asia. Global LNG exports expanded but couldn’t offset the loss of Russian pipeline supply to Europe. Oil prices also spiked before moderating.

The crisis led countries like Germany to halt their coal phase-out plans as energy security took priority over climate goals. China and India’s ongoing reliance on coal boosted demand despite Europe and North America cutting consumption.

On a brighter note, wind and solar achieved record additions in 2022. However, this didn’t move the needle on emissions as developing nations continue turning to all available energy sources to fuel economic growth.

Electric vehicles (EVs) spread rapidly, straining supplies of key minerals like lithium and cobalt. But the world’s energy systems are still falling behind on transitioning away from climate-warming fossil fuels, according to the report’s findings. The Review indicated that far more progress is needed to achieve net-zero emissions by mid-century.

Over the next few articles, I will drill down into the production and consumption statistics from several different energy categories.

Follow Robert Rapier on Twitter, LinkedIn, or Facebook