Las Vegas witnessed a remarkable jackpot during the recent RE+ conference. Not at the tables, but in a crowded conference hall, as Jigar Shah and the Department of Energy (DOE) team unveiled their much anticipated report: Pathways to Commercial Liftoff: Virtual Power Plants. It would be hard to overestimate the value of the DOE’s data and findings, and the benefit of amplifying the key role that virtual power plants (VPPs) will play in addressing the needs of critical electrical grid infrastructure.

At AutoGrid, we have developed the advanced technology needed to make VPPs a reality, and we’ve been touting their benefits for over a decade – particularly the exponential flexibility and scale achievable through a broad multi-asset approach to VPPs. Now we have the independent “Liftoff” report quantifying the current impact of VPPs and the enormous payoff just ahead. It is a lot harder this week than last to deny that digital innovation is transforming the energy sector and its lifeblood service to our modern economy.

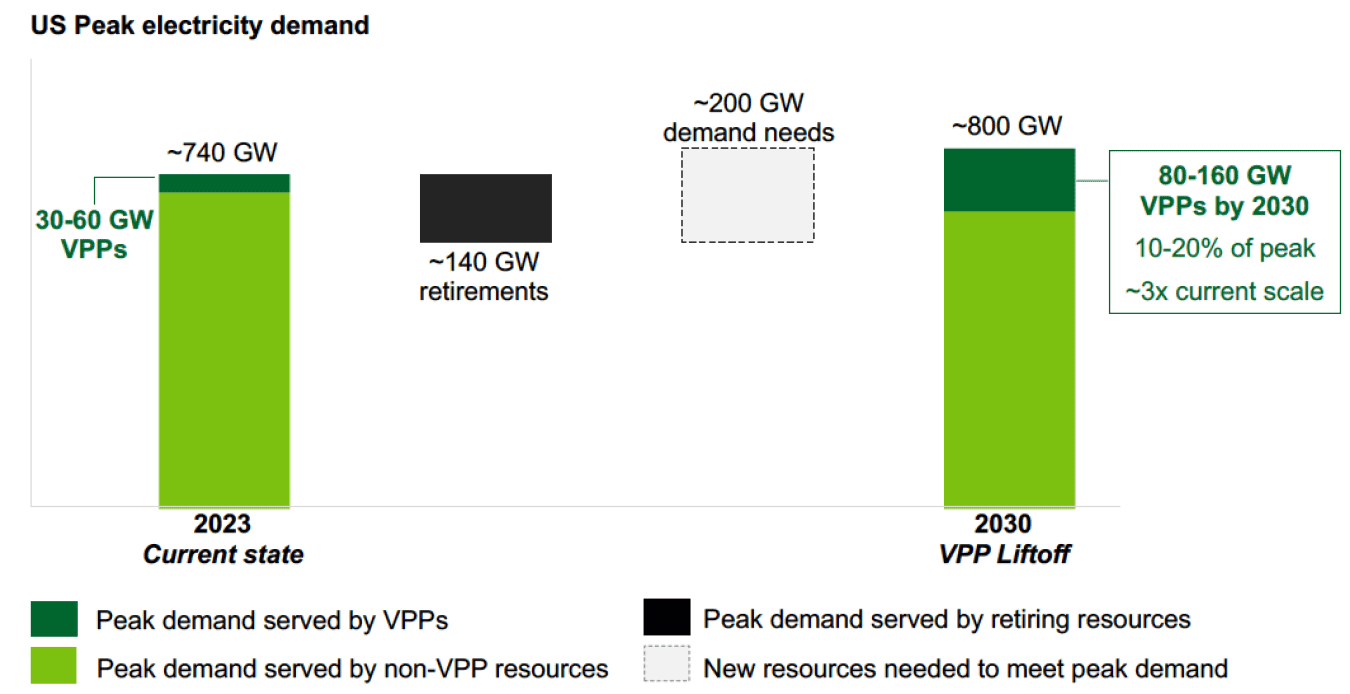

Take this key point: tripling the current scale of VPP deployments – which the DOE estimates at 80-160 gigawatts (GW) of capacity by 2030 – would allow the U.S. to retire polluting fossil fuel peaker plants, respond to new electricity demands that are increasing for the first time in decades, and reduce grid costs. In the graphic below, the DOE illustrates the intersection of increased demand, existing supply resources, and potential new VPP capacity:

Sounds too good to be true? Not at all. And remember, this message is not coming from a vendor or PR firm. This is the federal government confirming what we at AutoGrid and others in the field have known and declared for years.

The Sharing Economy

What is a VPP? In short, it is an aggregation of distributed energy resources (DERs) – everything from solar PV systems to smart thermostats – that with the help of AI, can deliver exactly what the grid needs in real time. In other words, these DER aggregations can provide the same services as traditional power plants but only smarter, cheaper and cleaner. VPPs can be viewed as the ultimate form of energy flexibility, filling in the gaps when utility customers turn up their air conditioners or businesses charge their EV fleets.

VPPs are a more affordable answer to future electricity demand spikes because they rely on non-utility owned grid assets, often installed by prosumers (individuals and businesses that both produce and consume energy) participating in climate action with help from another federal program, the Inflation Reduction Act. As mass electrification advances and new asset types and vendors come online, the flexibility and scale of multi-asset VPPs extends even further.

VPPs are to energy markets what Uber and Lyft are to transportation services. The assets – in this case the motor vehicles – are privately owned. The shared value created comes in the form of orchestrating and dispatching these assets, via a digital platform, to roll up when they are needed by riders. VPPs do the same thing, only they are much more sophisticated because our critical electricity infrastructure has to be balanced literally on less than a second-by-second basis. (In contrast, a rideshare can be late – or even not show up – without jeopardizing the entire transportation sector.)

Numbers Tell the Story

What else does the DOE report say? Far too much to cover in this blog post. But here are two more takeaways that struck me:

- Deploying 80-160 GW of VPPs by 2030 could not only help meet 10 to 20% of US peak demand for electricity, but also save consumers $10 billion in the process. New sustainable energy technologies used to cost more than traditional resources. Not anymore.

- The DER type that will represent the vast majority of capacity for VPPs will be EVs. (It is no coincidence that an EV was the first asset to be integrated into our award-winning AutoGrid Flex™ platform back in 2012.) The DOE estimates EV charging infrastructure could represent between 300-540 GWh of nameplate storage capacity. EVs can also serve as mobile resiliency assets, backing up critical infrastructure in disadvantaged communities.

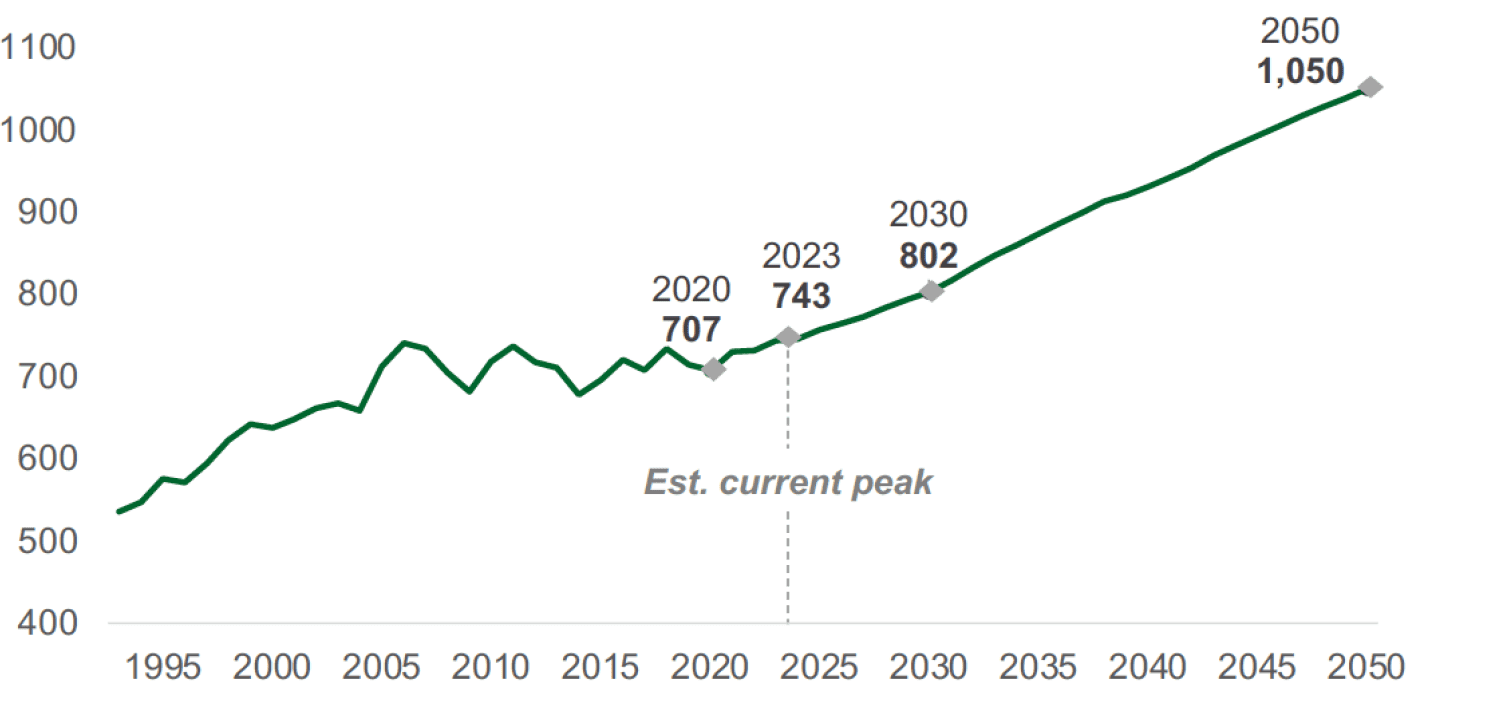

One of the most attention-grabbing charts included in the report is the forecast for future electricity demand. After zig-zagging for a number of years between 2005 and the present, the trajectory is projected to climb steadily and steeply as we march forward in time out to 2050.

Reforms Will Be Rocket Fuel for Liftoff Goals

If we are to meet the challenge of the climate crisis, the DOE urges a series of important reforms designed to spur VPP implementations, including:

- Expand DER adoption with equitable benefits. Low-cost financing and rebates for VPP-friendly DERs are suggested. We couldn’t agree more, and the IRA takes some steps in this direction.

- Simplify VPP enrollment. AutoGrid is clearing this market hurdle with our turnkey VPP solution, allowing utilities and others to purchase aggregated VPP MW capacity like any other supply side resource.

- Increase standardization in VPP operations. Standardized service agreement contracts and measurement and verification (M&V) methods are absolutely critical, and AutoGrid has also articulated the importance of technology-agnostic approaches to facilitate interoperability within the VPP space.

- Integrate into utility planning and incentives. DOE urges support for utility regulators and governing boards of smaller cooperative utilities to develop new distribution system planning requirements, updated procurement processes, and ratemaking reforms to adjust to the new energy transition’s need for flexibility and VPPs.

- Integrate into wholesale markets. Thanks to new Federal Energy Regulatory Commission’s (FERC) Order 2222, DERs can also deliver shared value to wholesale markets when the wind stops blowing or clouds block the sun. But there is much more work to be done to make these upstream value transactions a fully commercialized opportunity.

All of us at AutoGrid commend the DOE for the Liftoff report and its compelling flight plan. While governments play a fundamental role in making VPPs a compelling reality not only in the US. but also around the world, it will be private companies and public/private partnerships that translate vision into value – economic, socioeconomic, and environmental.

Who won last week? We all did.