How Fleetification is Driving Electrification and Innovation in Mobility

Although no one is sure what the future of mobility will look like, and quarantine mandates imposed due to the Covid-19 pandemic have forced significant changes to mobility patterns, many leaders in transportation agree that shared vehicle fleets will play a large role in mobility in the coming years and decades. To reach the goals outlined by the Paris Agreement, global transportation systems need to become more efficient by shifting towards vehicle sharing, rather than ownership.

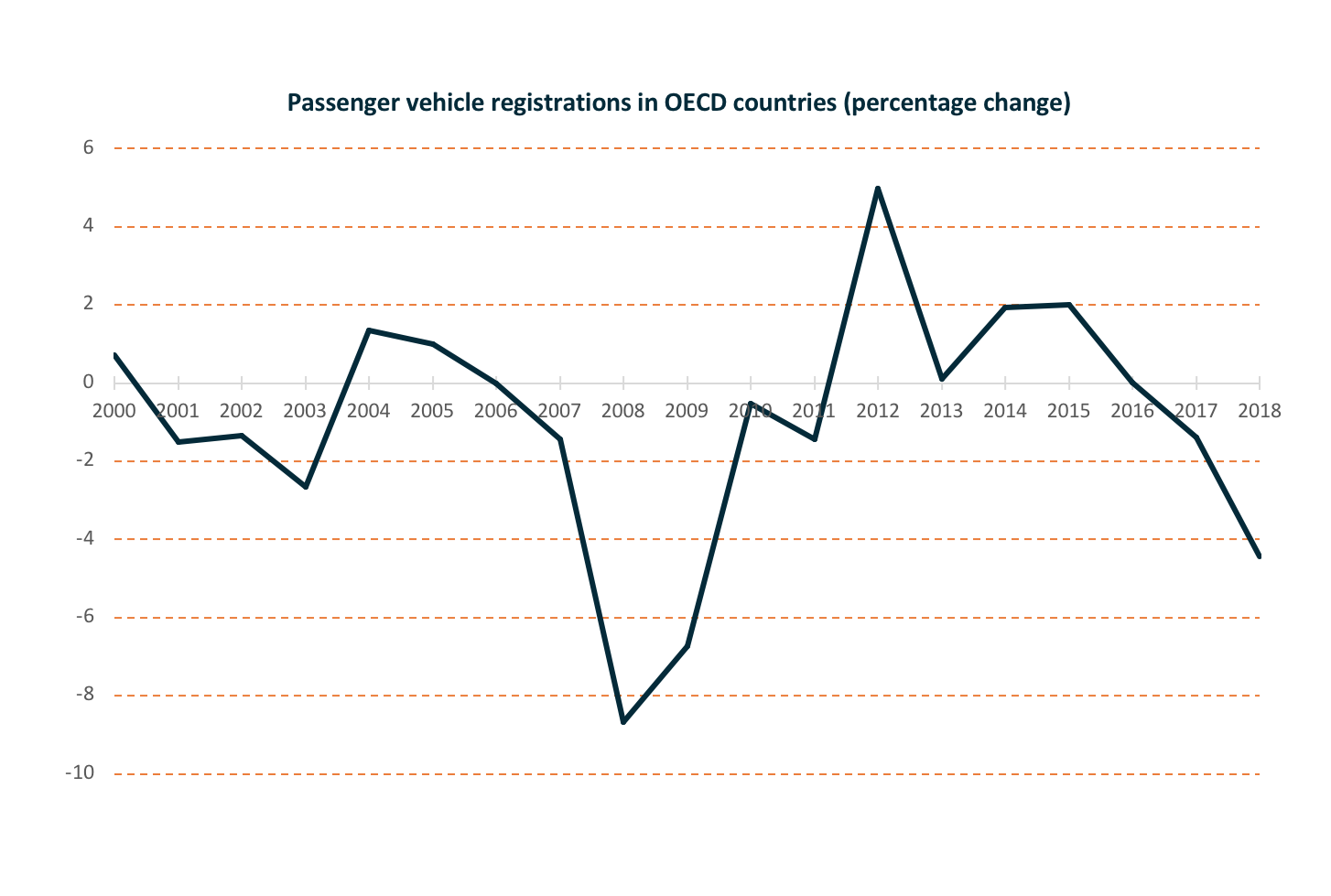

Prior to the pandemic, we could see this reflected in the growth of mobility services, with passenger vehicle registrations declining and additions to carsharing fleets increasing, a trend many refer to as ‘fleetification’.

Figure 1. Passenger vehicle registrations in OECD countries (Source)

The proliferation of enabling technologies, including:

- IoT devices

- Artificial intelligence and machine learning

- Connected and autonomous vehicles

- Shared mobility and electrification.

are converging to drive innovation within fleet management. Fleet operators are leveraging technology innovation to improve operating margins, drive profitability and better compete in the ever-evolving transportation landscape. In addition, increasing fleet sizes and numbers of connected vehicles are creating an opportunity for new solutions in vehicle maintenance and operation.

Fleets are well-suited to be both the drivers and first adopters of innovative technologies. The impact of efficiency improvements and cost savings enabled by electric vehicles and connected vehicle technologies are compounded across fleets, and the business case only improves as fleet size increases. DoorDash completes over 800,000 deliveries per day, and in 2019, Uber completed 7 billion trips. At this scale, even small improvements in delivery, pickup or drop-off times for each transaction dramatically improve efficiency and cut costs across the entire operation.

Competition and costs

Low switching costs and low barriers to entry make it easy for customers to switch between competing mobility platforms. Therefore, customer retention depends highly on new features, products, services and consumer experience (accurate and fast pickup and dropoff times, efficient routes, ability to use multiple modes of mobility within one platform, etc.).

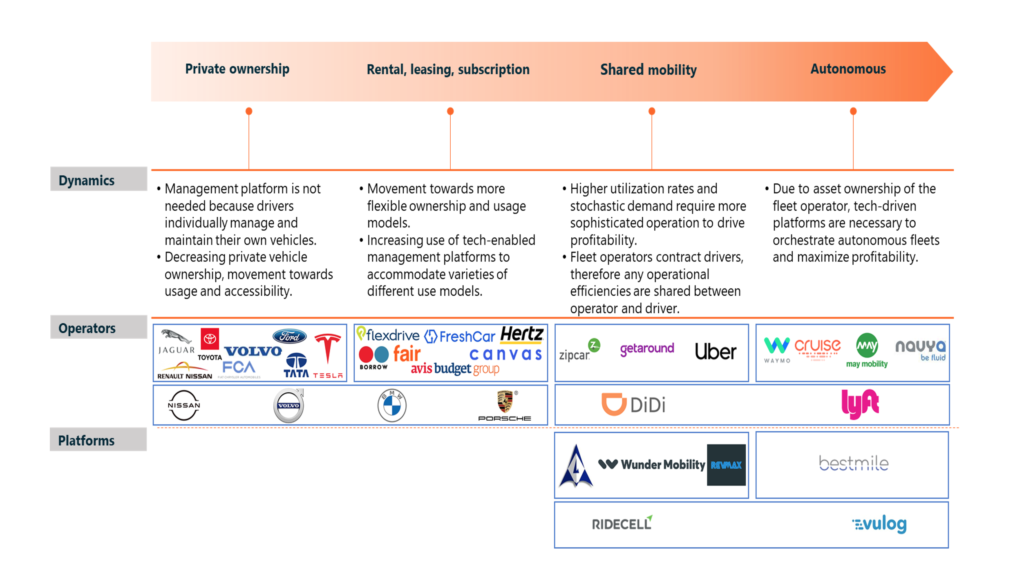

Fleetification and falling costs of electric vehicles are key trends impacting passenger fleets. In addition, the need to improve operating margins and accommodate increasingly complex demands are driving demand for more sophisticated operating platforms that can integrate multiple modes of transportation.

Profitability is a major challenge for mobility platforms due to high operating costs, particularly customer and driver acquisition costs. In 2019, Uber incurred $8.6 billion in operating losses, up from $3 billion in 2018, and had accumulated a $16.4 billion deficit by the end of 2019.

Transportation incumbents, such as OEMs and traditional leasing companies are building out new flexible usage models and digitizing operations to compete with new players, such as vehicle subscription companies Canvas, Flexdrive and Freshcar. In April 2019, Ford entered an agreement with Autonomic and AWS to expand Ford’s connected vehicle services. In May 2019, Autonomous partnered with Fujitsu to develop a mobility service platform for Ford, with eventual rollout to other automakers.

The impact of autonomy

Currently, on-demand delivery and mobility service providers contract drivers who either own or lease their own vehicles. As a result, any operating cost reductions through more efficient use of assets is partially captured by the service provider and partially passed through to the driver. Therefore, any economic benefit from efficiency improvements are only partially realized by the operator. However, when autonomous vehicles reach higher penetration levels into fleets and drivers are largely removed from the equation, it will make more sense for mobility and delivery service providers to own the vehicles, and asset optimization will be critical.

Electrification. Some estimate that EVs could have a TCO that is 15%-25% less than that of equivalent ICE vehicles by 2030. From corporate fleets to direct-to-consumer shared fleets, the shared fleet model particularly lends itself to electric vehicles. Savings from lower maintenance and fuel costs of electric vehicles are compounded from higher utilization rates of shared vehicles. In addition, mobility platforms are increasingly integrating charger location and battery health and state of charge data to make operating EVs easier.

Fleetification. This trend can best be understood as end customers shifting from vehicle owners to users, where transportation goes from owning a car to having access to some form of mobility service. As shared fleets grow and experience higher utilization rates, increasingly variable and complex demand and emergence of different form factors, vehicles in mobility service schemes will need to be acquired and operated in new ways.

Innovation can help fleet owners:

- Leverage increasing amounts of data generated from larger fleets with more transactions,

- Integrate new form factors, such as autonomous vehicles and micro-mobility

- And optimize vehicle use to improve margins and drive profitability.

Ridesharing and carsharing

In the B2C market, consumer behavior, such as a general shift from private vehicle ownership to shared mobility and changing preferences for different form factors, is driving market trends. Traditional leasing companies are expanding their service offerings to provide more flexible usage models, such as vehicle subscription and sharing. In June 2019, Hertz launched a vehicle subscription service. Following the 2013 Zipcar acquisition, Avis Budget Group has maintained a focus on initiatives such as a smart mobility platform, connected vehicles and offering fleet management as a service. In the past year, the company helped found Urban Movement Labs and partnered with Otonomo and Arrive to leverage connected car data and provide enhanced mobility services.

Utilization is a major cost factor for leasing companies and the key challenge is to intelligently use assets in different ways (leasing, subscription, sharing, etc.) while keeping utilization rates high. Leaders in the space, such as Wunder Mobility, make this a focus area. In March, Wunder acquired Keaz, an Australia-based provider of car-sharing and rental technology, to further build out the Wunder Rent brand.

Existing shared vehicle operators are bringing new form factors onto their platforms, testing autonomous vehicles and developing predictive routing algorithms to maximize asset utilization. Vulog, a leading provider of an end-to-end platform for vehicle sharing services, recently partnered with Citymapper to provide access to electric cars, mopeds, scooters and other mixed fleets from Vulog customers on the Citymapper platform.

Autofleet is a Tel Aviv-based provider of AI-powered fleet optimization and vehicle-as-a-service solutions. The company’s platform enables optimization of existing assets and enables development of new business models, such as vehicle sharing, for end customers. Major global automotive fleets such as Avis Budget Group, Zipcar, Keolis and Suzuki are just a few of the company’s customers. Autofleet raised a $7.5 million Series A round in April from MizMaa Ventures, Maniv Mobility, Next Gear Ventures and Liil Ventures.

Keep an Eye Out For…

New business models are emerging, such as fleet management-as-a-service and vehicle-as-a-service. In addition, mobility platforms are, in turn, enabling new business models for incumbent OEMs and vehicle leasing companies, like car subscription and car sharing services. Maintenance and operational service providers can integrate with a shared vehicle platform to receive repair tickets and dispatch maintenance crews in real time.

Spiffy, a Raleigh-based provider of on-demand car care, technology and services for fleets, office parks and residential customers, operate a fleet management as a service model. Car care technicians operate out of fully-equipped maintenance vans and are dispatched to provide on-site services. Beyond the obvious convenience, this model improves vehicle uptime and asset utilization for fleets. The company, founded in 2014, has raised nearly $20 million in the past two years and was recently backed by Shell.

Merchants Fleet recently partnered with YourMechanic to provide mobile contactless repair services as part of a fully integrated Merchants Fleet Maintenance Program. Zerology, a provider of 100% electric shared mobility, recently partnered with Trov for on-demand insurance to address the complex risk challenges Zerology’s shared fleet faces.