The EV Battery Metal Index

While many may think of lithium, cobalt, and maybe now nickel when they think of Tesla batteries, there are a lot more components that go into the creation of an electric vehicle’s battery. Mining.com earlier this year launched its EV Battery Metals Index to specifically measure the value of metals that are used in batteries — apparently the first time that any such type of measurement (open to the public) has taken place.

In its article, Mining.com reminds us that the very first all-electric vehicle that used a lithium-ion battery was the Tesla Roadster, in 2008. In the past 12 years, this new technology has advance pretty far. A few years ago, something else happened, too. Positive headlines that championed the ushering in of the EV era came just in time to save the mining industry. The mining industry was “at the bottom of a brutal business cycle and in desperate need of a feelgood news story.”

The Basics

There are two sets of data that Mining.com used to create its EV Metals Index, which shows an industry in better shape than falling prices and bleak new stories imply.

Prices Paid For Mined Minerals At The Point Of Entry Into Global Battery Supply Chain. The prices paid for the mined minerals as they entered into the global battery supply chain were determined by Benchmark Mineral Intelligence. Benchmark is tracking the global battery supply chain, including factories and market forecasts. It provided Mining.com with monthly sales-weighted price data.

Sales-Weighted Volume Of Raw Materials In EV Batteries. Adamas Intelligence provided data for the raw materials deployed. Adamas tracks the demand for EV batteries by chemistry, cell supplier, and capacity in over 90 countries.

Since Tesla broke ground on its Sparks Gigafactory in 2014, Benchmark has been tracking the construction of megafactories and beyond, while Adamas records all of the battery power that is hitting the road.

The Volatility of This Sector

Battery production can be up to 50% of the cost of a car, with raw materials taking up the bulk of that. In a study by UBS on EVs, it was found that the only commodity an average EV — for example, Chevy Bolt — compared with an internal combustion engine (ICE) car would have in equal amounts is rubber. That’s pretty much all that an EV has in common with an ICE car.

This has contributed to volatility in the new automotive industry’s raw material supply chain. When you have a company that wants enough cobalt to create, say, 500,000 EVs a year, they have to overcome the challenge of getting that cobalt out of the ground. The annual global cobalt mining revenue is less than what Volkswagen collects in a week.

A Look At The Index: Lithium, Cobalt, & The Devil’s Copper

Lithium

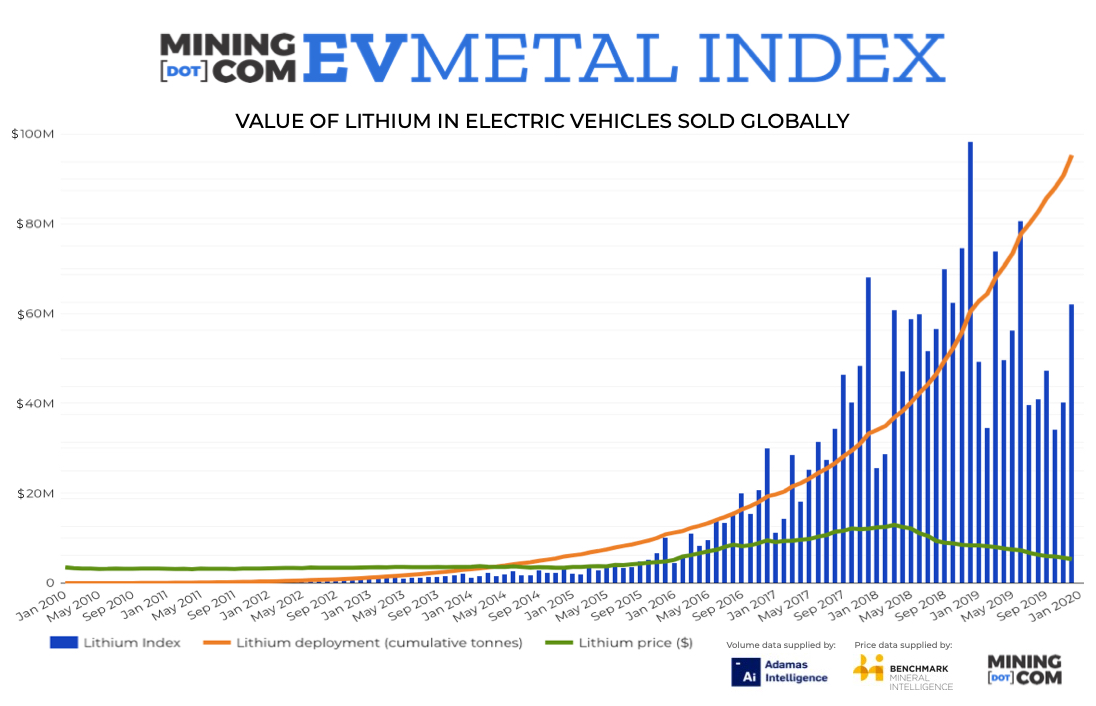

In 2009, the lithium market was at $182,000. Fast forward 11 years and the market grew to $609 million. Between 2015 and 2019, the price tripled and then peaked. It’s dropped 60% from the peak value but is still well higher than the value it had in 2009. What about the coming 2–5 years?

Cobalt

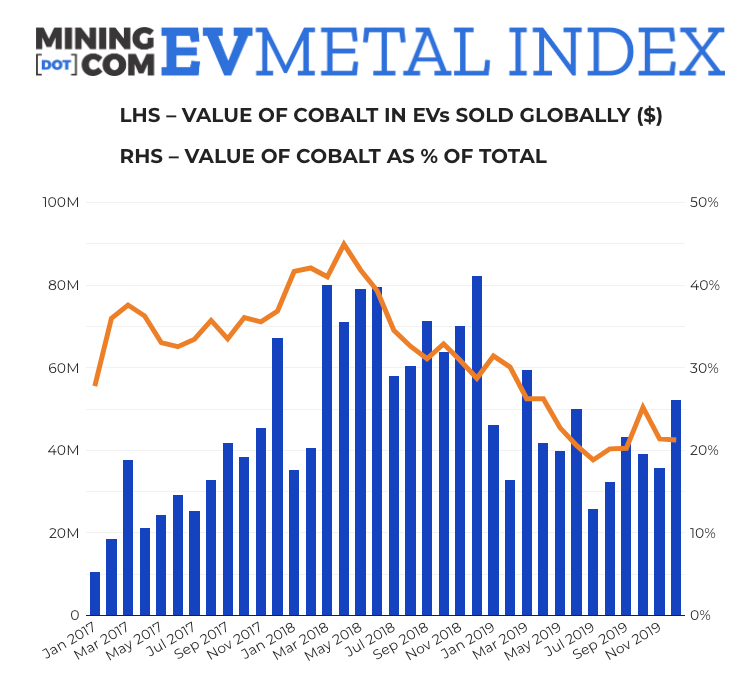

Cobalt is a bit trickier. Most of the world’s supply comes from Congo, where child labor is a common practice. The price of cobalt was rising steadily as EV sales grew, but then the market dropped down a bit from China cutting subsidies for EVs in mid-2019. In 2018 cobalt’s value was around $110,000 a tonne; 15 months later it’s below $26,000 a tonne. Still, though, it is well above historical prices.

Nickel, “The Devils Copper”

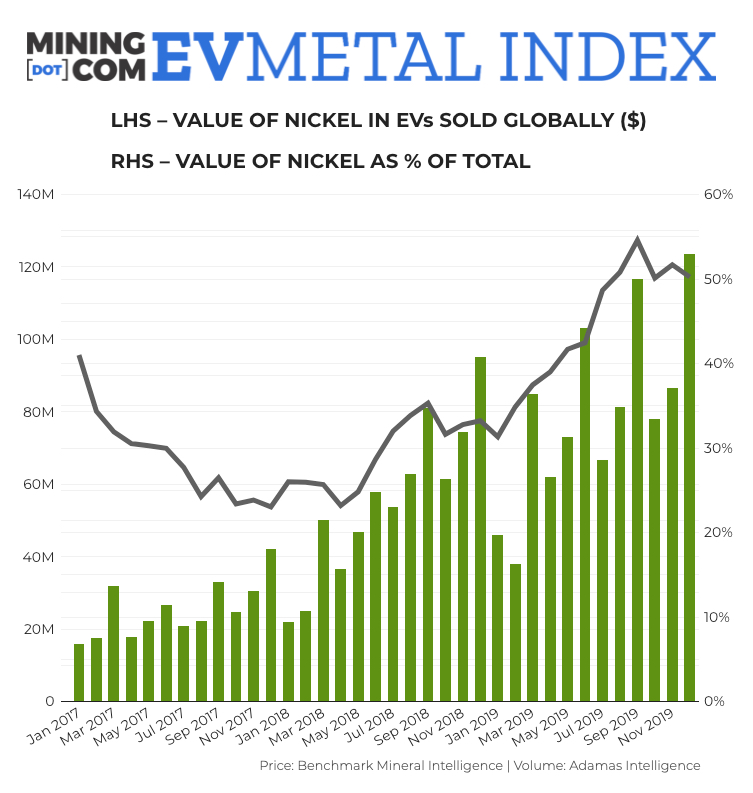

The average sales-weighted value of nickel on a per-vehicle basis is rising. This is due to the nickel-rich chemistries dominating the EV market and thus the increasing use of nickel, often to displace cobalt. It now accounts for more than 50% of the value of an average EV battery’s raw materials.

In Total

The combined values of lithium, cobalt, graphite, and nickel in EV batteries are based on sales-weighted averages per vehicle. The numbers were at $1,000 toward the end of last year. In 2018, those prices peaked and the costs of these raw materials were almost $1,900 per vehicle. That doesn’t include the rest of the battery.

Conclusion

An EV Metals Index is needed to not only judge the value of the raw materials used in creating the batteries, but as a tool that can help automakers see trends in the industry and how that might influence future availability and pricing. Knowing the costs and values of the key components that make up an EV battery is critical to anyone who is either working in the industry or even just buying an EV.

This helps one to understand why the cost is as it is. Mining.com believes that even though 2019 wasn’t the first annual fall in the new index, it will prove to be the last. The demand for EVs is here. That demand is creating jobs for those working in the auto industry, and also jobs for those working in the mining industry.

Today, there are more than 100 battery megafactories or larger planned around the world. In order to keep these factories powering their growing numbers of electric cars, increasing extraction of lithium, graphite, cobalt, and nickel is necessary.

Have a tip for CleanTechnica? Want to advertise? Want to suggest a guest for our CleanTech Talk podcast? Contact us here.

Latest CleanTechnica.TV Video

CleanTechnica uses affiliate links. See our policy here.