ImpactAlpha, June 16 – Oil major BP lowered its long-term price assumptions for oil and gas by almost one-third, and hiked its estimate for the price it will have to pay for carbon dioxide emissions in 2030 to $100 a ton, from $40. The result: the company will write off assets of up to $17 billion in the second quarter – about 20% of its market value.

It is BP’s largest write-off since the $32 billion hit it took for the Deepwater Horizon disaster in 2010, and the latest in a string of write-downs by Chevron, Repsol and other oil companies.

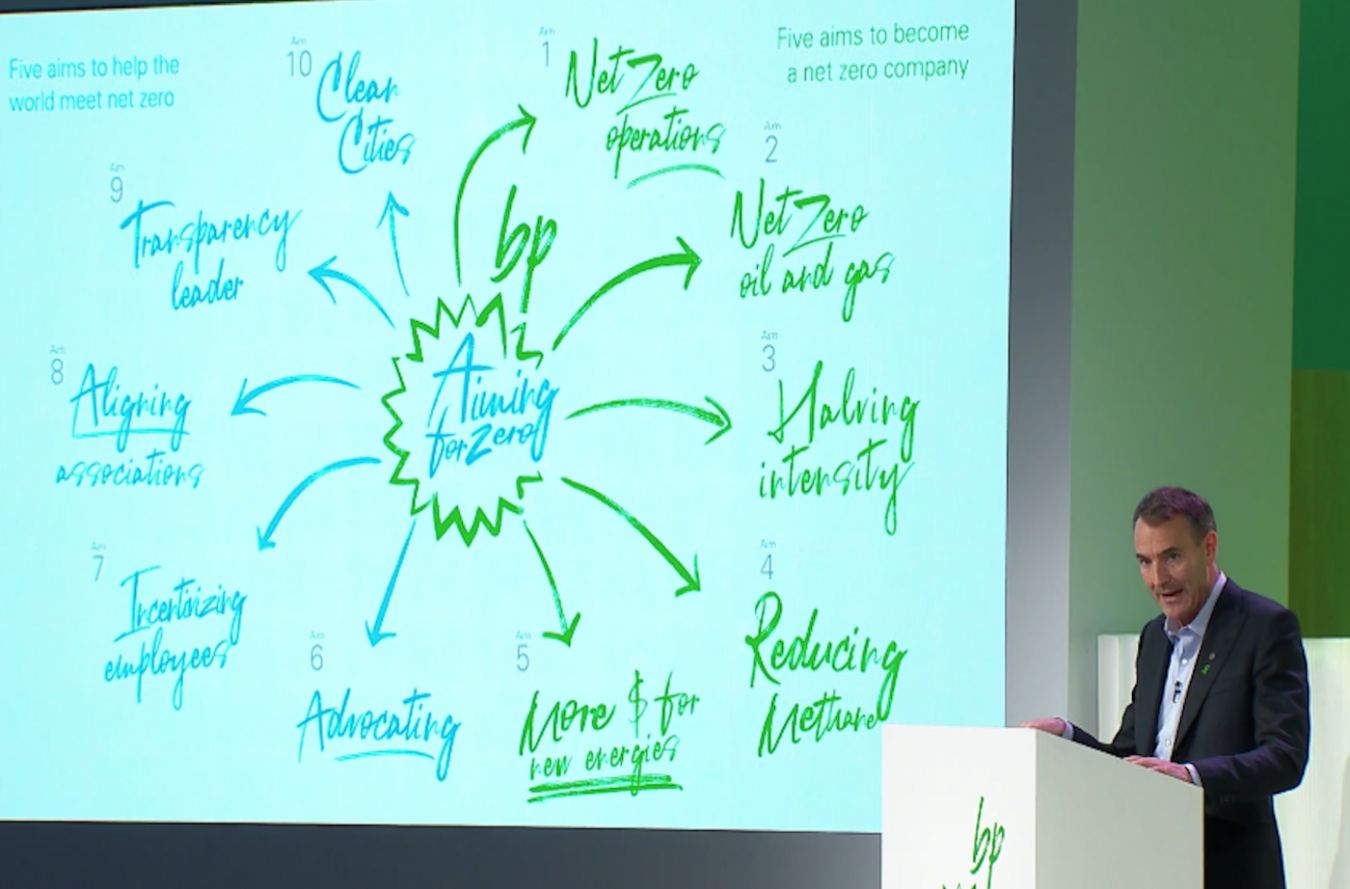

Driving the changes: the COVID pandemic’s “enduring impact” on energy demand and an accelerating transition to a lower carbon economy. The write-downs, said BP chief Bernard Looney, who in February charted a low-carbon strategy, “will better enable us to compete through the energy transition.”

Mispriced risk: The fossil fuel industry’s $100 trillion blindspot

Cascade of woes

In the relentless math of oil economics, falling price scenarios spell trouble for high-cost companies. Oil companies have tried to attract investors with lofty dividends that sometimes exceed earnings. Shell and Equinor have slashed dividends by two-thirds. BP and others may be forced to follow.

BP is cutting 14% of its workforce and Chevron up to 15%. More than three dozen US oil and gas companies have cut capital expenditures by $41 billion, or 36%, in 2020, according to S&P Global. Oil and gas companies will have to shrink production by more than a third to meet the goals of Paris climate agreement, according to Carbon Tracker.

https://impactalpha.com/the-carbon-bubble-has-burst-lets-not-re-inflate-it/

Transition or bust

Banks continue to fund oil companies despite the efforts of climate activists to “stop the money pipeline.” For oil companies that fail to plan for a transition, “their banks will lose faith in them and they will have no future,” wrote CarbonTacker in its recent “Decline and Fall” report (see chart).

https://impactalpha.com/fossil-fuel-wind-down/