By Nagaraju Bandaru

AI-Powered Intelligent Document Processing (IDP) is a fast-growing technology category that allows businesses to automatically capture relevant and valuable information previously trapped in complex documents and use it in important downstream business applications and processes.

These solutions leverage a variety of AI-related technologies such as Optical Character Recognition (OCR), natural language processing, computer vision and machine learning to convert unstructured data in digital documents into structured data that can be fed into downstream applications to automate business processes. This data can then be used to automate critical business applications like automated contract review and approval, milestone tracking and approval, contractor financial document review and numerous other use cases so common to the fintech industry.

![]() Major cloud service providers have created pre-built AI models that operate in the cloud, trained on millions of pieces of data and fintech applications that can use these pre-built AI models to develop custom applications. According to a recent article in the American Banker, Ally Financial says it has found a way to take much of the manual work out of processing auto loan applications. They use AI software that verifies documents and data in real time. The technology extracts data points from loan documents and compares them with numerous databases to confirm identity, employment, income and other vital information.

Major cloud service providers have created pre-built AI models that operate in the cloud, trained on millions of pieces of data and fintech applications that can use these pre-built AI models to develop custom applications. According to a recent article in the American Banker, Ally Financial says it has found a way to take much of the manual work out of processing auto loan applications. They use AI software that verifies documents and data in real time. The technology extracts data points from loan documents and compares them with numerous databases to confirm identity, employment, income and other vital information.

Mosaic is a 100% digital lender and completely paperless. However, we have numerous documents that are exchanged electronically as part of our contractor approval, homeowner funding approval, funding disbursement requests and approval, and many other business processes. These documents are a tremendous source of unstructured information. The opportunity to extract valuable attributes as well as meta-data is exciting and critical for business. On top of this use, machine learning models to emulate decision making becomes a strong case for operational efficiency and business scaling.

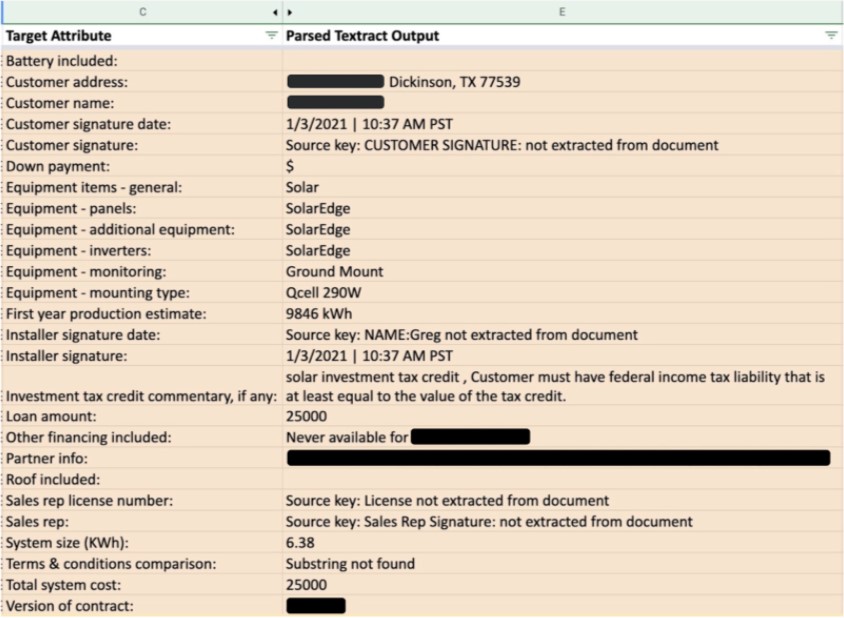

We evaluated use of different OCR technologies for document extraction and settled on AWS Textract mainly because of its ability to output documents as key-value pair format, capabilities around form recognition, and the ability to enhance with human input. It also goes beyond simple OCR by extracting relationships, structure and text from documents. We have been able to take 20 page or longer documents and extract valuable information from them. Below is a sample of output of relevant information for a home improvement contract for a solar project:

There have been a number of investments in technology companies that solve for fintech businesses, from helping them to scale to enhancing the customer experience. We are super excited about this trend and its use at Mosaic.

References:

https://bankingblog.accenture.com/new-document-ai-helps-mortgage-lenders

https://www.forbes.com/sites/forbestechcouncil/2021/09/08/ai-is-redefining-how-we-use-documents-in-a-digital-world/?sh=42fcea226d5a

https://www.americanbanker.com/news/how-ally-uses-ai-to-approve-auto-loans

https://towardsdatascience.com/compare-amazon-textract-with-tesseract-ocr-ocr-nlp-use-case-43ad7cd48748

https://aws.amazon.com/textract/